ES Daily Plan | November 3, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

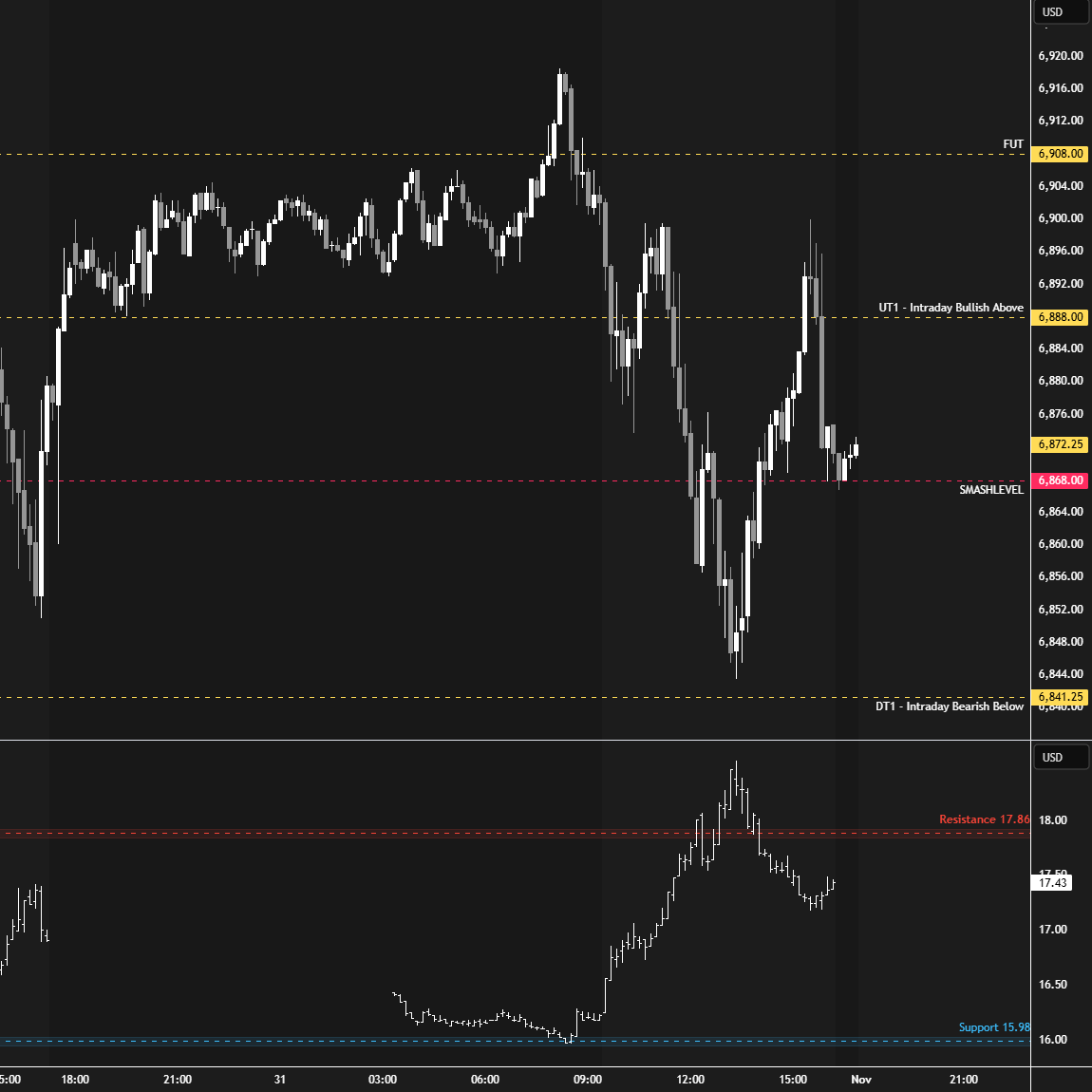

Thursday’s closing weakness was immediately retraced after-hours following the AAPL and AMZN earnings, resulting in Friday’s overnight session opening above its initial upside target at 6888 (UT1). The final upside target at 6908 (FUT) was already tagged pre-open. Note the confluence of sellers stepping in as the VIX tagged its support level at 15.98 (LOD: 15.96) (see Figure 1). Sellers were in control of the auction during the RTH session, continuing to fill Monday’s gap. Despite the weakness seen on both Thursday and Friday, the 6841.25 gap remains unfilled, suggesting we’re not quite yet dealing with stronger sellers.

While the monthly and weekly time frames remain one-time framing up, the daily is currently one-time framing down, forming lower highs and lower lows. The key moving forward is to monitor whether this short-term weakness develops into something more meaningful, or if last week’s selling effort will instead serve as fuel for an upside continuation. The main objective for sellers is to fill last week’s gap at 6841.25, which would simultaneously end the weekly one-time framing up. Failure to do so removes the potential for change.

In terms of levels, the Smashlevel is 6890—where notable order flow activity was observed on Friday before the closing drop. Holding below 6890 would target 6860 (DT1), where Friday’s intraday one-time framing down ended. Acceptance below 6860 would signal weakness, targeting the unfilled weekly gap at 6841 (DT2), with a final downside target (FDT) at 6812—the top of the daily gap—under sustained selling pressure.

On the flip side, reclaiming and holding above 6890 would shift focus to 6908 (UT1), with a final upside target (FUT) at 6936 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6890.

Break and hold above 6890 would target 6908 / 6936

Holding below 6890 would target 6860 / 6841 / 6812

Additionally, pay attention to the following VIX levels: 18.52 and 16.36. These levels can provide confirmation of strength or weakness.

Break and hold above 6936 with VIX below 16.36 would confirm strength.

Break and hold below 6812 with VIX above 18.52 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Smash, I truly admire your discipline and consistency with your posts, don't go! Impeccable as always, have a great week!

Mille grazie, Smashelito. Que pases una buena semana... Comprendo il spagnolo ma non poso scrivere correttamente. Cordiali saluti da Helsinki.