ES Daily Plan | November 26, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

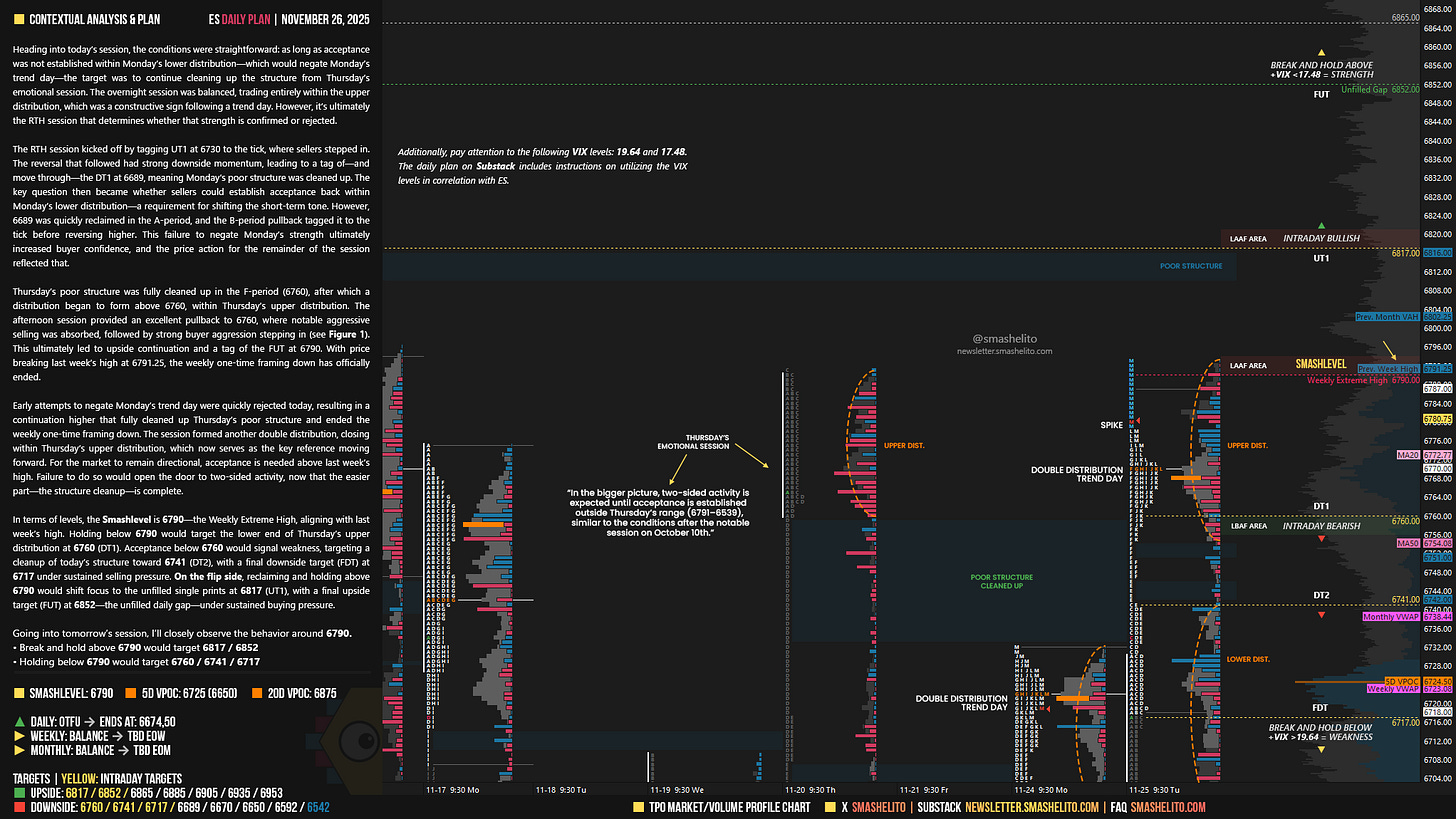

Heading into today’s session, the conditions were straightforward: as long as acceptance was not established within Monday’s lower distribution—which would negate Monday’s trend day—the target was to continue cleaning up the structure from Thursday’s emotional session. The overnight session was balanced, trading entirely within the upper distribution, which was a constructive sign following a trend day. However, it’s ultimately the RTH session that determines whether that strength is confirmed or rejected.

The RTH session kicked off by tagging UT1 at 6730 to the tick, where sellers stepped in. The reversal that followed had strong downside momentum, leading to a tag of—and move through—the DT1 at 6689, meaning Monday‘s poor structure was cleaned up. The key question then became whether sellers could establish acceptance back within Monday’s lower distribution—a requirement for shifting the short-term tone. However, 6689 was quickly reclaimed in the A-period, and the B-period pullback tagged it to the tick before reversing higher. This failure to negate Monday’s strength ultimately increased buyer confidence, and the price action for the remainder of the session reflected that.

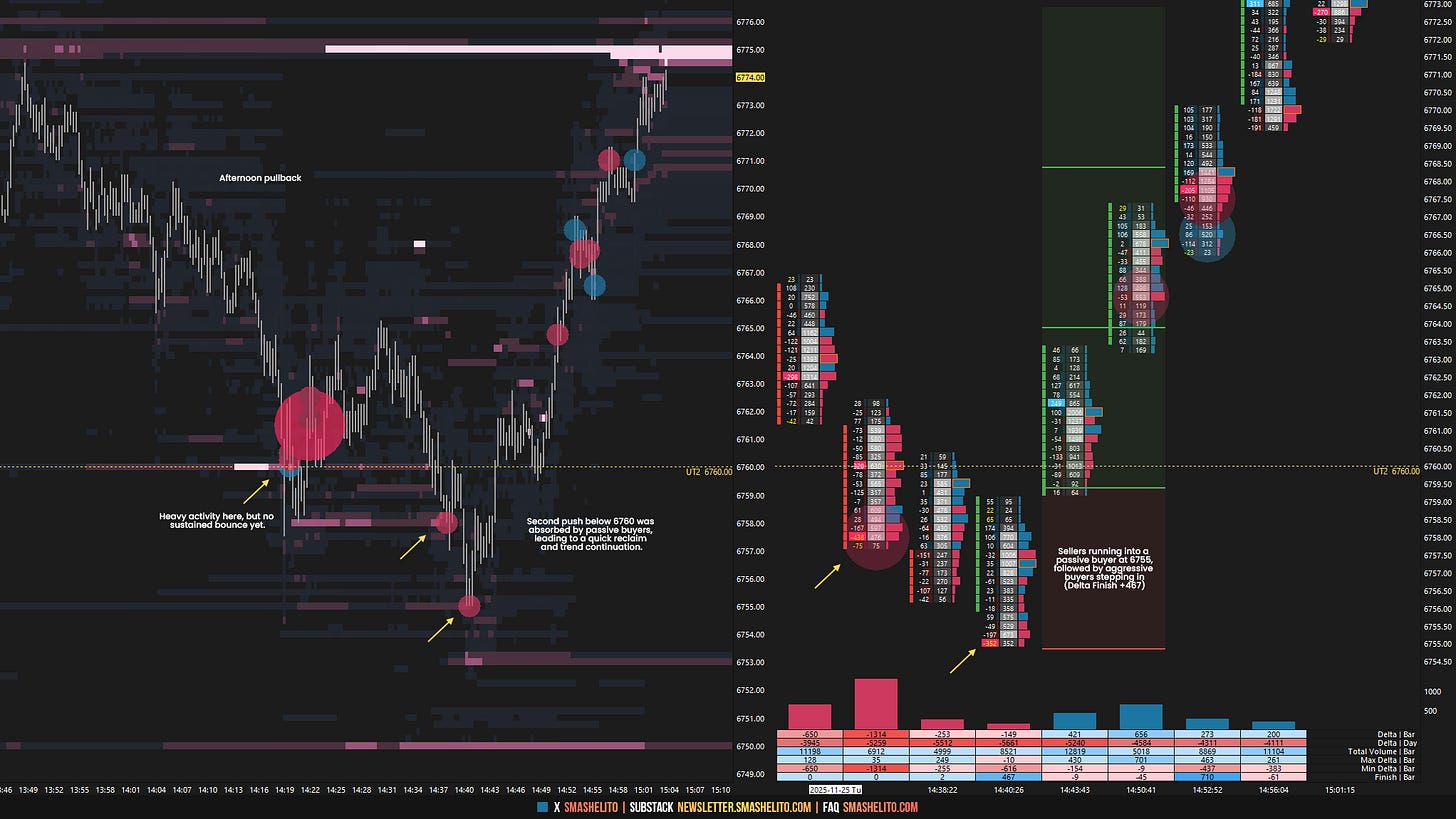

Thursday’s poor structure was fully cleaned up in the F-period (6760), after which a distribution began to form above 6760, within Thursday’s upper distribution. The afternoon session provided an excellent pullback to 6760, where notable aggressive selling was absorbed, followed by strong buyer aggression stepping in (see Figure 1). This ultimately led to upside continuation and a tag of the FUT at 6790. With price breaking last week’s high at 6791.25, the weekly one-time framing down has officially ended.

Early attempts to negate Monday’s trend day were quickly rejected today, resulting in a continuation higher that fully cleaned up Thursday’s poor structure and ended the weekly one-time framing down. The session formed another double distribution, closing within Thursday’s upper distribution, which now serves as the key reference moving forward.

For the market to remain directional, acceptance is needed above last week’s high. Failure to do so would open the door to two-sided activity, now that the easier part—the structure cleanup—is complete.

In terms of levels, the Smashlevel is 6790—the Weekly Extreme High, aligning with last week’s high. Holding below 6790 would target the lower end of Thursday’s upper distribution at 6760 (DT1). Acceptance below 6760 would signal weakness, targeting a cleanup of today’s structure toward 6741 (DT2), with a final downside target (FDT) at 6717 under sustained selling pressure.

On the flip side, reclaiming and holding above 6790 would shift focus to the unfilled single prints at 6817 (UT1), with a final upside target (FUT) at 6852—the unfilled daily gap—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6790.

Break and hold above 6790 would target 6817 / 6852

Holding below 6790 would target 6760 / 6741 / 6717

Additionally, pay attention to the following VIX levels: 19.64 and 17.48. These levels can provide confirmation of strength or weakness.

Break and hold above 6852 with VIX below 17.48 would confirm strength.

Break and hold below 6717 with VIX above 19.64 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Caught the move off the intraday bullish at the 30s for a whole traversal down to the single prints. Insane as always smash

Levels were nuts today! Thank you as always!