ES Daily Plan | November 24, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

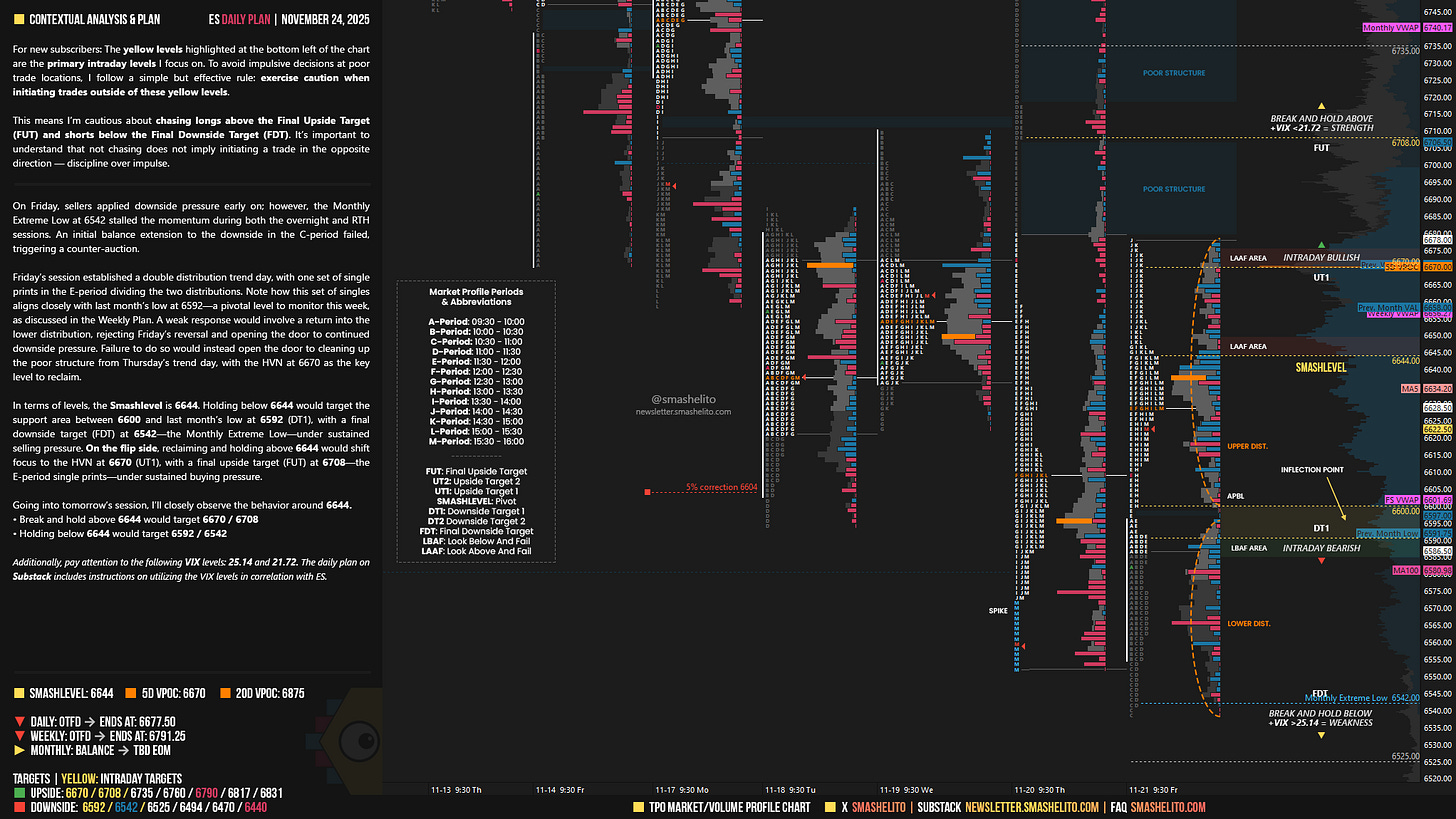

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

On Friday, sellers applied downside pressure early on; however, the Monthly Extreme Low at 6542 stalled the momentum during both the overnight and RTH sessions. An initial balance extension to the downside in the C-period failed, triggering a counter-auction.

Friday’s session established a double distribution trend day, with one set of single prints in the E-period dividing the two distributions. Note how this set of singles aligns closely with last month’s low at 6592—a pivotal level to monitor this week, as discussed in the Weekly Plan.

A weak response would involve a return into the lower distribution, rejecting Friday’s reversal and opening the door to continued downside pressure. Failure to do so would instead open the door to cleaning up the poor structure from Thursday’s trend day, with the HVN at 6670 as the key level to reclaim.

In terms of levels, the Smashlevel is 6644. Holding below 6644 would target the support area between 6600 and last month’s low at 6592 (DT1), with a final downside target (FDT) at 6542—the Monthly Extreme Low—under sustained selling pressure.

On the flip side, reclaiming and holding above 6644 would shift focus to the HVN at 6670 (UT1), with a final upside target (FUT) at 6708—the E-period single prints—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6644.

Break and hold above 6644 would target 6670 / 6708

Holding below 6644 would target 6592 / 6542

Additionally, pay attention to the following VIX levels: 25.14 and 21.72. These levels can provide confirmation of strength or weakness.

Break and hold above 6708 with VIX below 21.72 would confirm strength.

Break and hold below 6542 with VIX above 25.14 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Hola Smashelito. Thank you very much for all your work and all your posts. Feliz domingo por la tarde y que tengas una buena semana. Cordiali saluti da Helsinki.

Thanks Smash!