ES Daily Plan | November 21, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

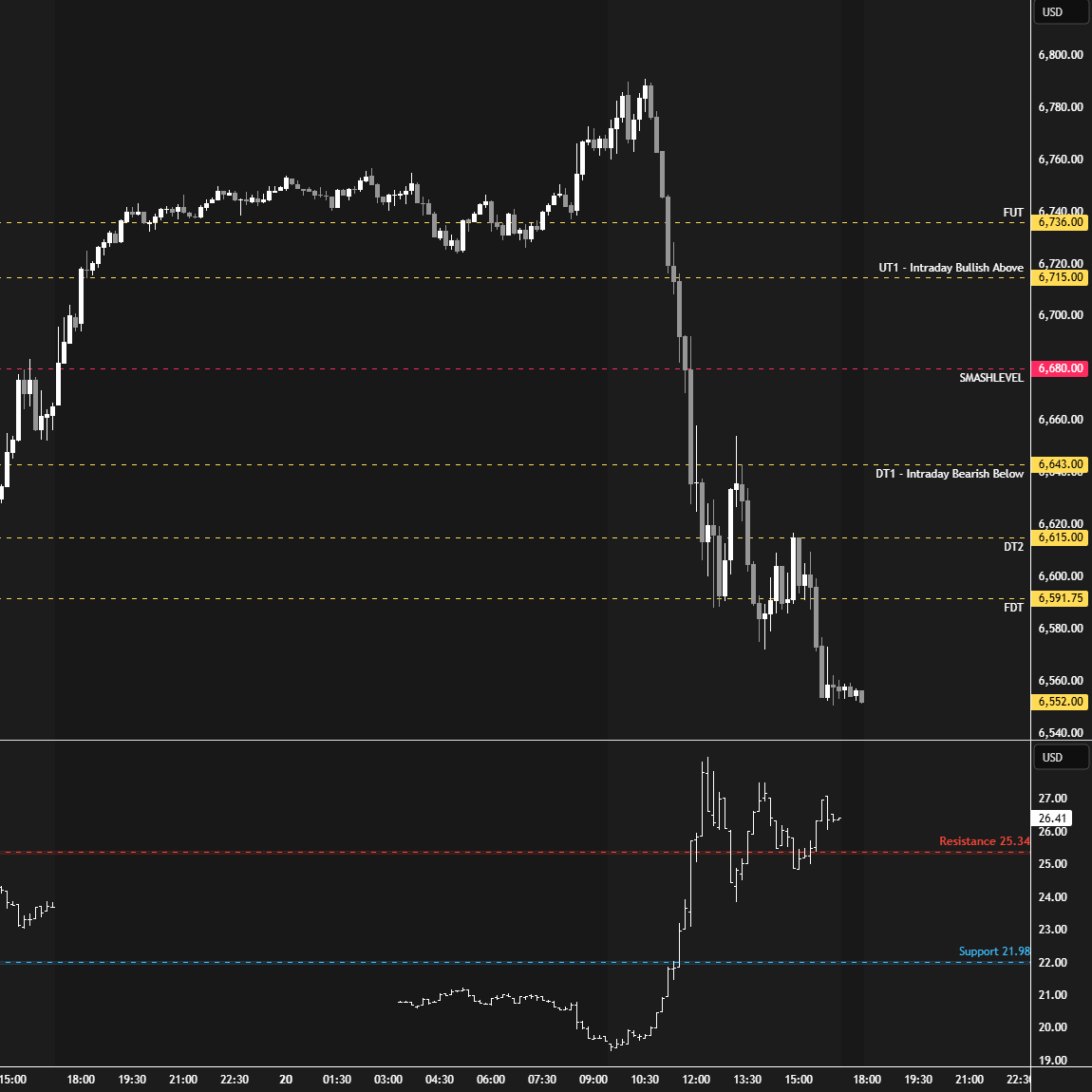

Today’s session was a wild ride. Hopefully you managed to stay out of trouble. Emotional markets tend to push traders into impulsive, irrational decisions—stepping aside until things settle is never a bad idea. Yesterday’s after-hours strength, driven by NVDA earnings, carried over into the overnight session, clearing all upside targets toward 6736 (FUT). A distribution was established around the 6736 level, from which the market saw a continuation higher prior the RTH session.

The RTH session opened on a true gap up, 65 handles above Wednesday’s range, which was significant. During the initial balance, the market tested 6790—a pivotal level that we have been discussing frequently over the past few weeks. The key question everyone should have asked themselves during the initial couple of periods was: how appealing was it to chase longs 65 handles above the FUT at 6736 in an environment where sellers have been in control recently? The market then reversed from 6790 in an incredible fashion, which, of course, no one could have predicted. However, being aware that short-covering rallies in a downtrend tend to weaken the market—as we’ve discussed—should have raised caution about chasing.

Despite a large true gap up, it was already filled in the D-period, and the absence of a gap-fill reversal resulted in a sharp decline. From being 65 handles above the FUT at 6736, price tagged and exceeded the FDT at 6592—a remarkable turnaround. The Monthly one-time framing up ended in the process.

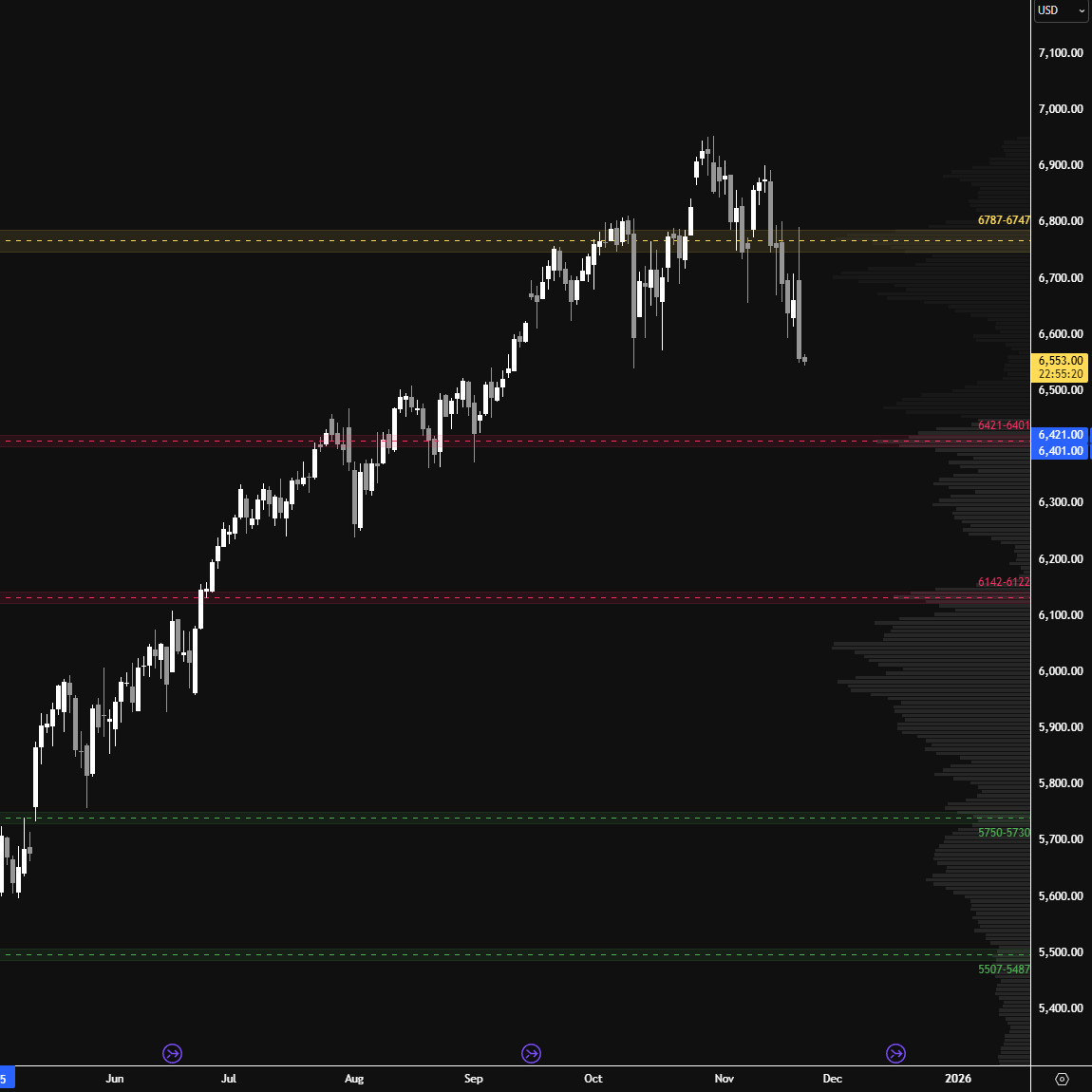

HTF Chart Update

Today’s session established an outside day down, following buyers’ failure to sustain the true gap up, resulting in a vicious reversal in line with the short-term trend. Another short-covering rally provided an excellent reload opportunity for sellers. In the process, the pattern of higher lows on the monthly timeframe was breached.

A downward spike formed in the closing session—our short-term reference point to gauge price. Generally, buyers need to negate the closing weakness and reclaim last month’s low, which also is the prior multi-week balance low. Failure to do so leaves the door open for continued downside pressure.

In terms of levels, the Smashlevel is 6573—the spike base. Holding below 6573 signals weakness, targeting the Monthly Extreme Low at 6542 (DT1). Acceptance below 6542 would indicate further weakness, targeting 6494 (DT2), with a final downside target (FDT) at 6470—the HVN—under sustained selling pressure.

On the flip side, reclaiming and holding above 6573 would shift focus to the TPOC at 6609 (UT1), with a final upside target (FUT) at 6652—the afternoon rally high—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6573.

Break and hold above 6573 would target 6609 / 6652

Holding below 6573 would target 6542 / 6494 / 6470

Additionally, pay attention to the following VIX levels: 28.26 and 24.58. These levels can provide confirmation of strength or weakness.

Break and hold above 6652 with VIX below 24.58 would confirm strength.

Break and hold below 6470 with VIX above 28.26 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

How freaking spot on was that 6790 level! Thanks for everything you do!

Weekly Smash at 6790. What else did we needed today?