ES Daily Plan | November 17, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

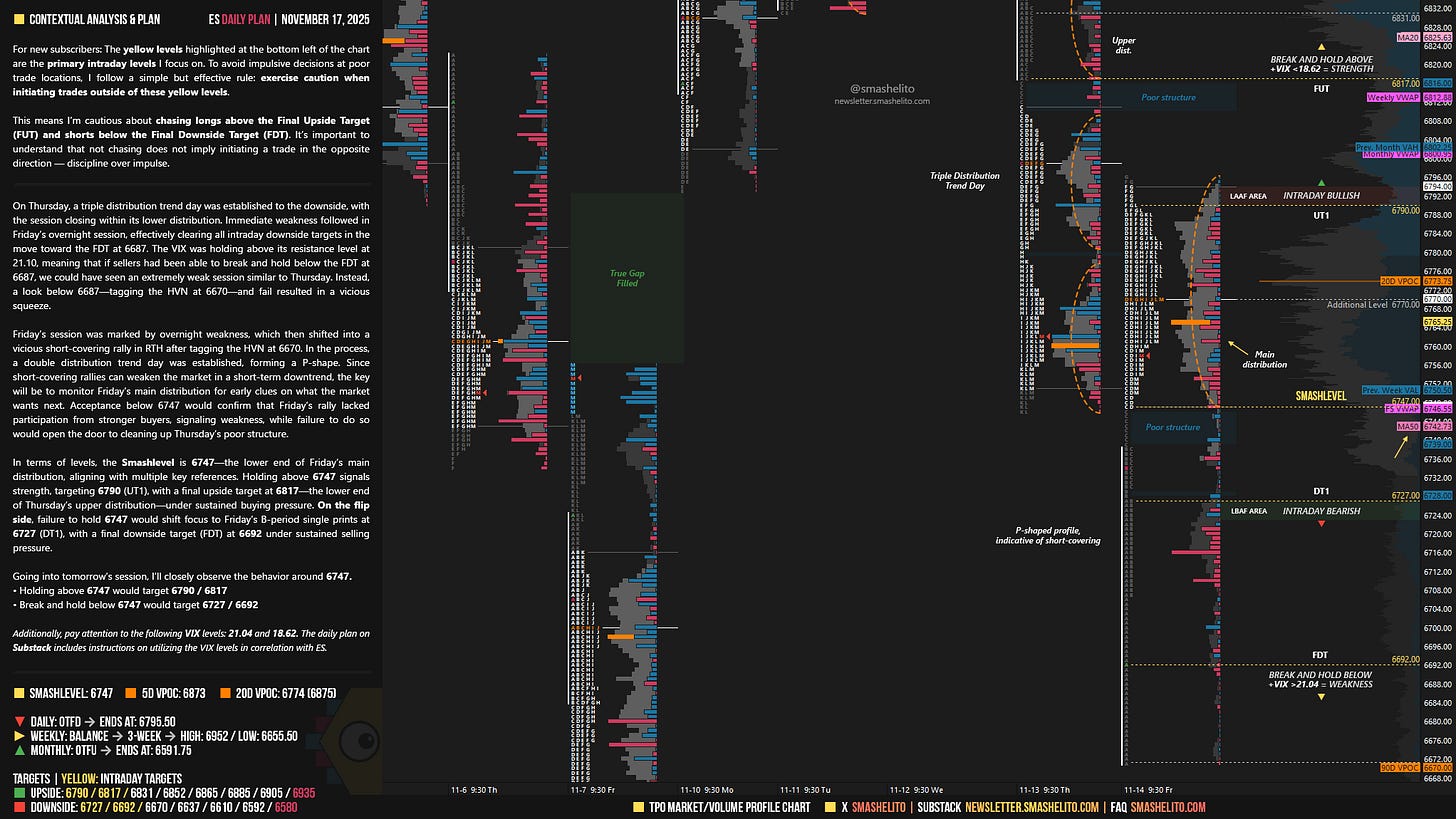

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

On Thursday, a triple distribution trend day was established to the downside, with the session closing within its lower distribution. Immediate weakness followed in Friday’s overnight session, effectively clearing all intraday downside targets in the move toward the FDT at 6687. The VIX was holding above its resistance level at 21.10, meaning that if sellers had been able to break and hold below the FDT at 6687, we could have seen an extremely weak session similar to Thursday. Instead, a look below 6687—tagging the HVN at 6670—and fail resulted in a vicious squeeze.

Friday’s session was marked by overnight weakness, which then shifted into a vicious short-covering rally in RTH after tagging the HVN at 6670. In the process, a double distribution trend day was established, forming a P-shape.

Since short-covering rallies can weaken the market in a short-term downtrend, the key will be to monitor Friday’s main distribution for early clues on what the market wants next.

Acceptance below 6747 would confirm that Friday’s rally lacked participation from stronger buyers, signaling weakness, while failure to do so would open the door to cleaning up Thursday’s poor structure.

In terms of levels, the Smashlevel is 6747—the lower end of Friday’s main distribution, aligning with multiple key references. Holding above 6747 signals strength, targeting 6790 (UT1), with a final upside target at 6817—the lower end of Thursday’s upper distribution—under sustained buying pressure.

On the flip side, failure to hold 6747 would shift focus to Friday’s B-period single prints at 6727 (DT1), with a final downside target (FDT) at 6692 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6747.

Holding above 6747 would target 6790 / 6817

Break and hold below 6747 would target 6727 / 6692

Additionally, pay attention to the following VIX levels: 21.04 and 18.62. These levels can provide confirmation of strength or weakness.

Break and hold above 6817 with VIX below 18.62 would confirm strength.

Break and hold below 6692 with VIX above 21.04 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you very much!

Thank you Smash! Let's get it!