ES Daily Plan | November 11, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

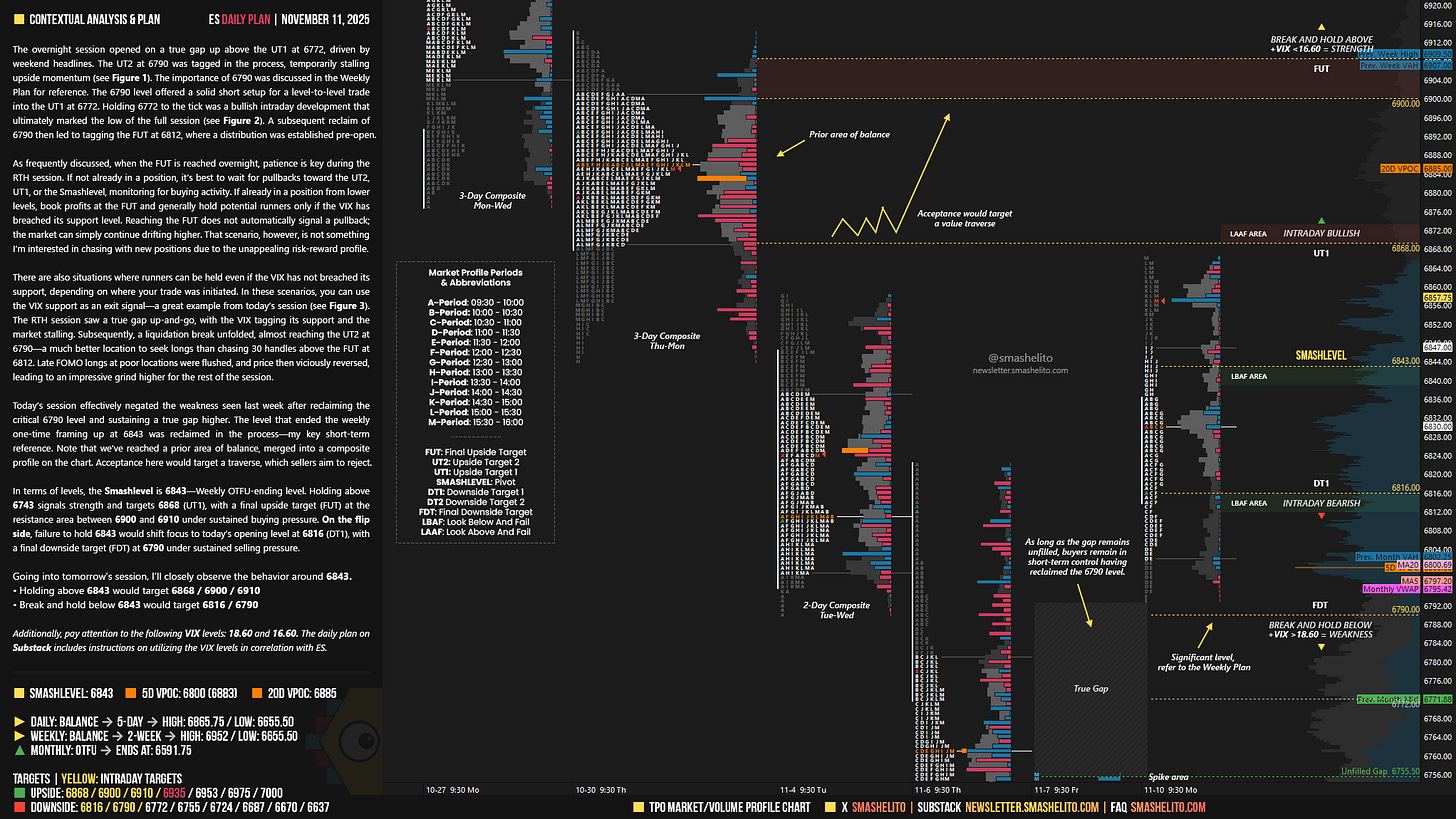

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

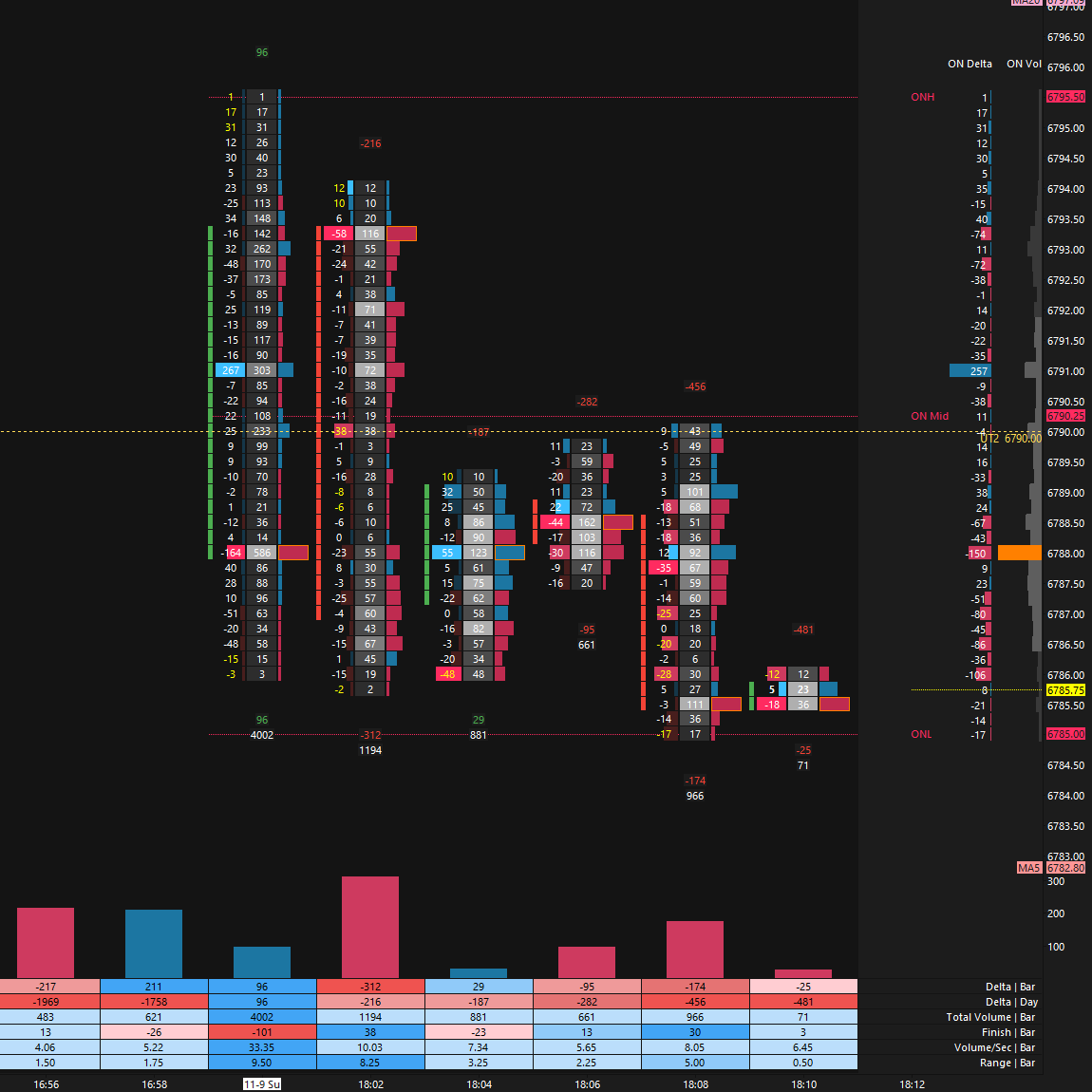

The overnight session opened on a true gap up above the UT1 at 6772, driven by weekend headlines. The UT2 at 6790 was tagged in the process, temporarily stalling upside momentum (see Figure 1). The importance of 6790 was discussed in the Weekly Plan for reference. The 6790 level offered a solid short setup for a level-to-level trade into the UT1 at 6772. Holding 6772 to the tick was a bullish intraday development that ultimately marked the low of the full session (see Figure 2). A subsequent reclaim of 6790 then led to tagging the FUT at 6812, where a distribution was established pre-open.

As frequently discussed, when the FUT is reached overnight, patience is key during the RTH session. If not already in a position, it’s best to wait for pullbacks toward the UT2, UT1, or the Smashlevel, monitoring for buying activity. If already in a position from lower levels, book profits at the FUT and generally hold potential runners only if the VIX has breached its support level. Reaching the FUT does not automatically signal a pullback; the market can simply continue drifting higher. That scenario, however, is not something I’m interested in chasing with new positions due to the unappealing risk-reward profile.

There are also situations where runners can be held even if the VIX has not breached its support, depending on where your trade was initiated. In these scenarios, you can use the VIX support as an exit signal—a great example from today’s session (see Figure 3). The RTH session saw a true gap up-and-go, with the VIX tagging its support and the market stalling. Subsequently, a liquidation break unfolded, almost reaching the UT2 at 6790—a much better location to seek longs than chasing 30 handles above the FUT at 6812. Late FOMO longs at poor locations were flushed, and price then viciously reversed, leading to an impressive grind higher for the rest of the session.

Today’s session effectively negated the weakness seen last week after reclaiming the critical 6790 level and sustaining a true gap higher. The level that ended the weekly one-time framing up at 6843 was reclaimed in the process—my key short-term reference. Note that we’ve reached a prior area of balance, merged into a composite profile on the chart. Acceptance here would target a traverse, which sellers aim to reject.

In terms of levels, the Smashlevel is 6843—Weekly OTFU-ending level. Holding above 6743 signals strength and targets 6868 (UT1), with a final upside target (FUT) at the resistance area between 6900 and 6910 under sustained buying pressure.

On the flip side, failure to hold 6843 would shift focus to today’s opening level at 6816 (DT1), with a final downside target (FDT) at 6790 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6843.

Holding above 6843 would target 6868 / 6900 / 6910

Break and hold below 6843 would target 6816 / 6790

Additionally, pay attention to the following VIX levels: 18.60 and 16.60. These levels can provide confirmation of strength or weakness.

Break and hold above 6910 with VIX below 16.60 would confirm strength.

Break and hold below 6790 with VIX above 18.60 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you very much!

Thank you Smash!