ES Daily Plan | May 8, 2025

Key Levels & Market Context for the Upcoming Session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

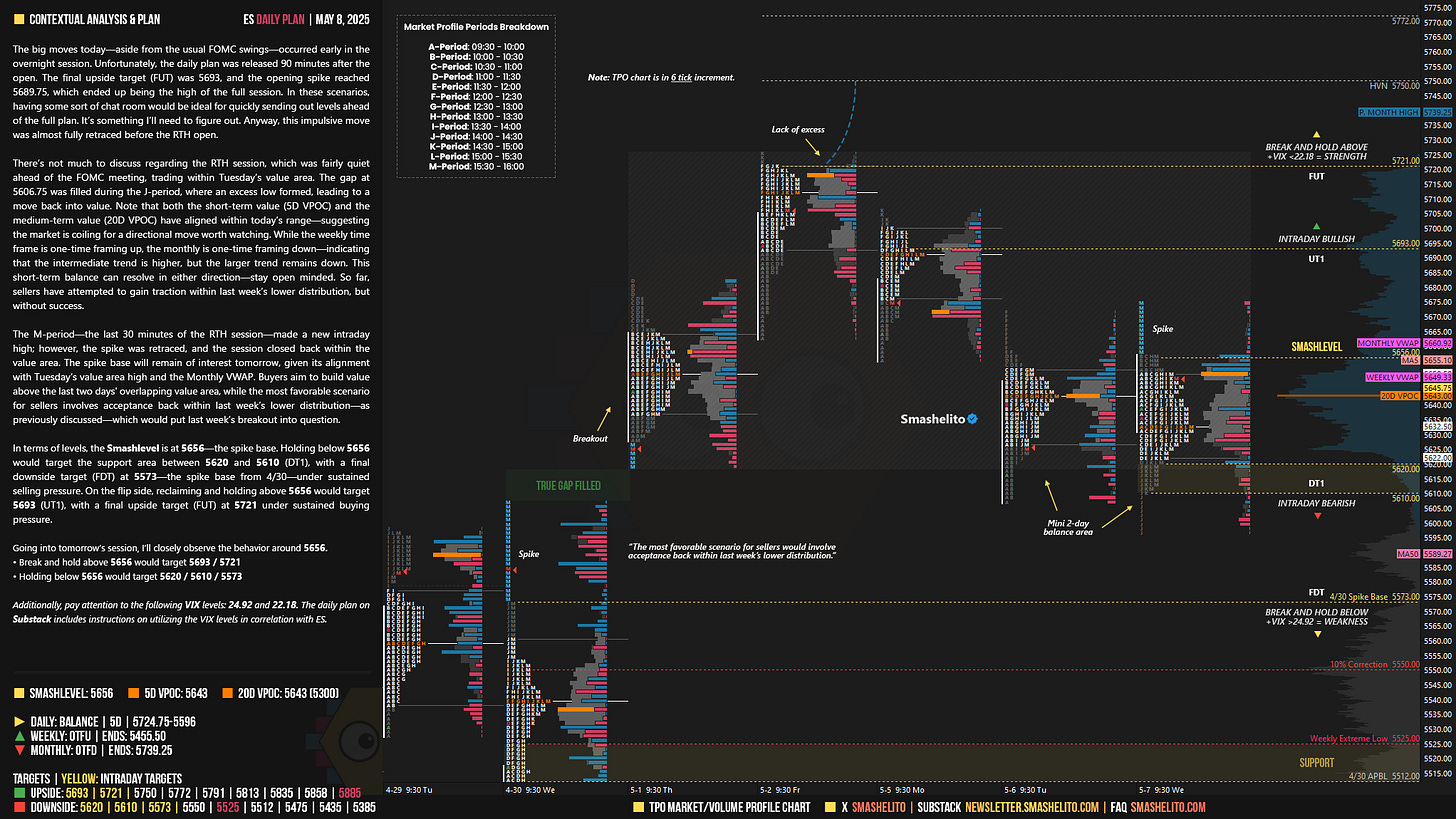

The big moves today—aside from the usual FOMC swings—occurred early in the overnight session. Unfortunately, the daily plan was released 90 minutes after the open. The final upside target (FUT) was 5693, and the opening spike reached 5689.75, which ended up being the high of the full session. In these scenarios, having some sort of chat room would be ideal for quickly sending out levels ahead of the full plan. It’s something I’ll need to figure out. Anyway, this impulsive move was almost fully retraced before the RTH open.

There’s not much to discuss regarding the RTH session, which was fairly quiet ahead of the FOMC meeting, trading within Tuesday’s value area. The gap at 5606.75 was filled during the J-period, where an excess low formed, leading to a move back into value. Note that both the short-term value (5D VPOC) and the medium-term value (20D VPOC) have aligned within today’s range—suggesting the market is coiling for a directional move worth watching. While the weekly time frame is one-time framing up, the monthly is one-time framing down—indicating that the intermediate trend is higher, but the larger trend remains down. This short-term balance can resolve in either direction—stay open minded. So far, sellers have attempted to gain traction within last week’s lower distribution, but without success.

The M-period—the last 30 minutes of the RTH session—made a new intraday high; however, the spike was retraced, and the session closed back within the value area. The spike base will remain of interest tomorrow, given its alignment with Tuesday’s value area high and the Monthly VWAP. Buyers aim to build value above the last two days' overlapping value area, while the most favorable scenario for sellers involves acceptance back within last week’s lower distribution—as previously discussed—which would put last week’s breakout into question.

In terms of levels, the Smashlevel is at 5656—the spike base. Holding below 5656 would target the support area between 5620 and 5610 (DT1), with a final downside target (FDT) at 5573—the spike base from 4/30—under sustained selling pressure. On the flip side, reclaiming and holding above 5656 would target 5693 (UT1), with a final upside target (FUT) at 5721 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5656.

Break and hold above 5656 would target 5693 / 5721

Holding below 5656 would target 5620 / 5610 / 5573

Additionally, pay attention to the following VIX levels: 24.92 and 22.18. These levels can provide confirmation of strength or weakness.

Break and hold above 5721 with VIX below 22.18 would confirm strength.

Break and hold below 5573 with VIX above 24.92 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Hi Smash,

Don't ever feel you have to apologize for not sending the newsletter out "late". This is volunteer charity work on your part. You owe no one anything. That aside, your comment about having some sort of chat room intrigued me. I thought I would share my thoughts on this with you, fwiw.

Easiest option is to use the chat functionality built in to Substack. (I personally hate it, as I don't always get notifications on posts there, and it's just one more place to go read stuff.)

Second easiest would be to post them on X.com and make it so that only people mentioned in the post can reply, so you don't get overwhelmed with follow up questions.

Last idea, which could be of interest if you ever wanted to do a Discord room, is set up a Discord room. It can have just one channel where you are the only person that can post. So it's basically read-only. Use it for any intraday updates. If you wanted to throw your readers a bone, you could make a second unmoderated open chat channel where we could chat amongst ourselves. You don't want to get sucked into the administrative side of having a Discord unless you are getting paid for it and or have someone to help moderate it.

Thank you for everything, Smash

Your newsletter has been invaluable in my day trading. The educational content is wonderful. I am eagerly waiting for your private chat room. I think invite-only Telegram (https://telegram.org/) channel will serve the purpose beautifully for real-time alerts/messages.