ES Daily Plan | May 7, 2025

Key Levels & Market Context for the Upcoming Session.

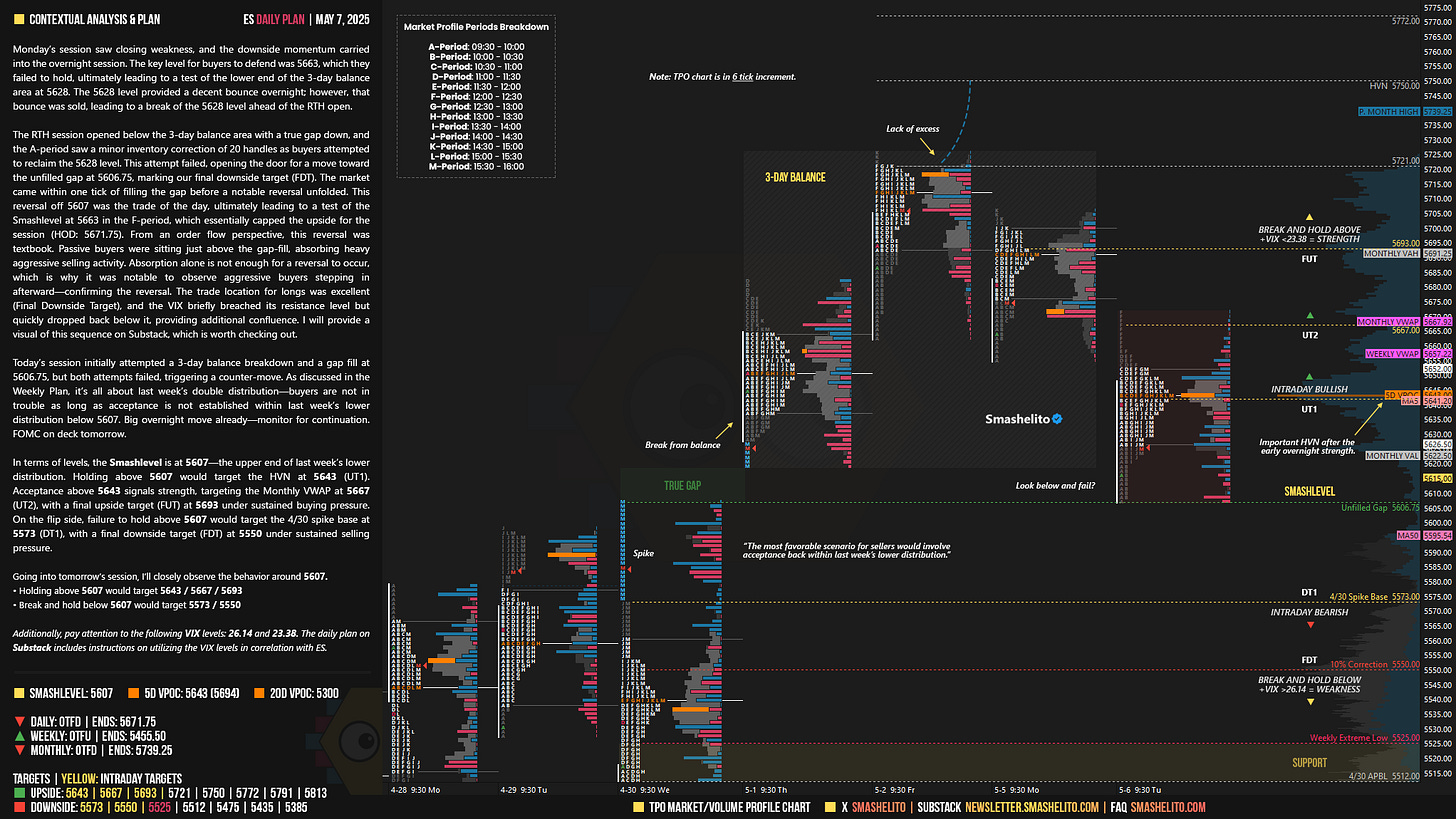

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

Monday’s session saw closing weakness, and the downside momentum carried into the overnight session. The key level for buyers to defend was 5663, which they failed to hold, ultimately leading to a test of the lower end of the 3-day balance area at 5628. The 5628 level provided a decent bounce overnight; however, that bounce was sold, leading to a break of the 5628 level ahead of the RTH open.

The RTH session opened below the 3-day balance area with a true gap down, and the A-period saw a minor inventory correction of 20 handles as buyers attempted to reclaim the 5628 level. This attempt failed, opening the door for a move toward the unfilled gap at 5606.75, marking our final downside target (FDT). The market came within one tick of filling the gap before a notable reversal unfolded. This reversal off 5607 was the trade of the day, ultimately leading to a test of the Smashlevel at 5663 in the F-period, which essentially capped the upside for the session (HOD: 5671.75). From an order flow perspective, this reversal was textbook. Passive buyers were sitting just above the gap-fill, absorbing heavy aggressive selling activity. Absorption alone is not enough for a reversal to occur, which is why it was notable to observe aggressive buyers stepping in afterward—confirming the reversal. The trade location for longs was excellent (Final Downside Target), and the VIX briefly breached its resistance level but quickly dropped back below it, providing additional confluence.

Today’s session initially attempted a 3-day balance breakdown and a gap fill at 5606.75, but both attempts failed, triggering a counter-move. As discussed in the Weekly Plan, it’s all about last week’s double distribution—buyers are not in trouble as long as acceptance is not established within last week’s lower distribution below 5607. Big overnight move already—monitor for continuation. FOMC on deck tomorrow.

In terms of levels, the Smashlevel is at 5607—the upper end of last week’s lower distribution. Holding above 5607 would target the HVN at 5643 (UT1). Acceptance above 5643 signals strength, targeting the Monthly VWAP at 5667 (UT2), with a final upside target (FUT) at 5693 under sustained buying pressure. On the flip side, failure to hold above 5607 would target the 4/30 spike base at 5573 (DT1), with a final downside target (FDT) at 5550 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5607.

Holding above 5607 would target 5643 / 5667 / 5693

Break and hold below 5607 would target 5573 / 5550

Additionally, pay attention to the following VIX levels: 26.14 and 23.38. These levels can provide confirmation of strength or weakness.

Break and hold above 5693 with VIX below 23.38 would confirm strength.

Break and hold below 5550 with VIX above 26.14 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks for the work smashie. Nearly all upside targets hit after hours.

Thank you Smashie!