ES Daily Plan | May 5, 2025

Key Levels & Market Context for the Upcoming Session.

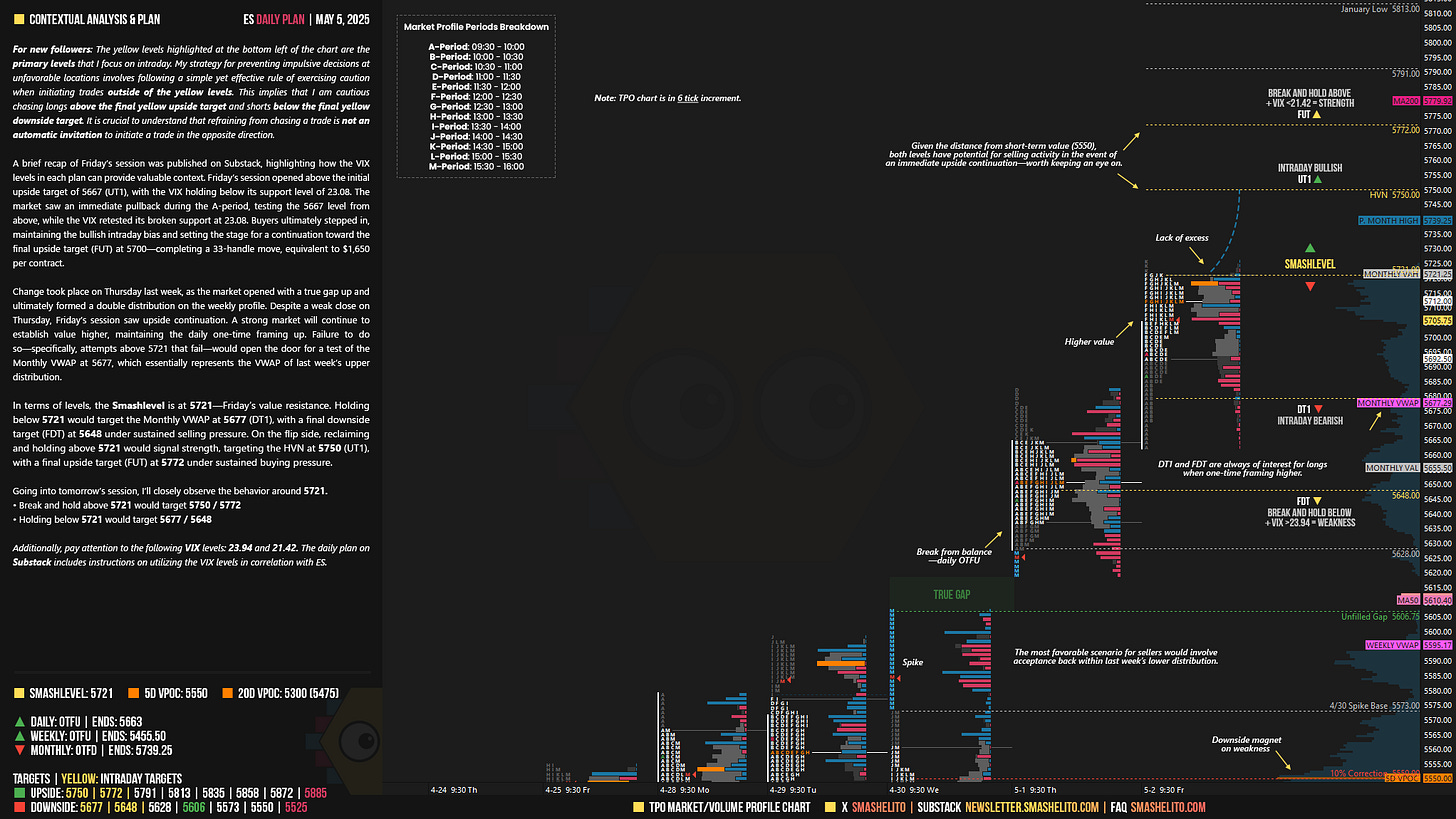

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

A brief recap of Friday’s session was published on Substack (link), highlighting how the VIX levels in each plan can provide valuable context. Friday’s session opened above the initial upside target of 5667 (UT1), with the VIX holding below its support level of 23.08. The market saw an immediate pullback during the A-period, testing the 5667 level from above, while the VIX retested its broken support at 23.08. Buyers ultimately stepped in, maintaining the bullish intraday bias and setting the stage for a continuation toward the final upside target (FUT) at 5700—completing a 33-handle move, equivalent to $1,650 per contract.

Change took place on Thursday last week, as the market opened with a true gap up and ultimately formed a double distribution on the weekly profile. Despite a weak close on Thursday, Friday’s session saw upside continuation. A strong market will continue to establish value higher, maintaining the daily one-time framing up. Failure to do so—specifically, attempts above 5721 that fail—would open the door for a test of the Monthly VWAP at 5677, which essentially represents the VWAP of last week’s upper distribution.

In terms of levels, the Smashlevel is at 5721—Friday’s value resistance. Holding below 5721 would target the Monthly VWAP at 5677 (DT1), with a final downside target (FDT) at 5648 under sustained selling pressure. On the flip side, reclaiming and holding above 5721 would signal strength, targeting the HVN at 5750 (UT1), with a final upside target (FUT) at 5772 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5721.

Break and hold above 5721 would target 5750 / 5772

Holding below 5721 would target 5677 / 5648

Additionally, pay attention to the following VIX levels: 23.94 and 21.42. These levels can provide confirmation of strength or weakness.

Break and hold above 5772 with VIX below 21.42 would confirm strength.

Break and hold below 5648 with VIX above 23.94 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash!

Thanks for all the hard work smashie.