ES Daily Plan | May 29, 2025

Key Levels & Market Context for the Upcoming Session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final upside target (FUT) and shorts below the final downside target (FDT). It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

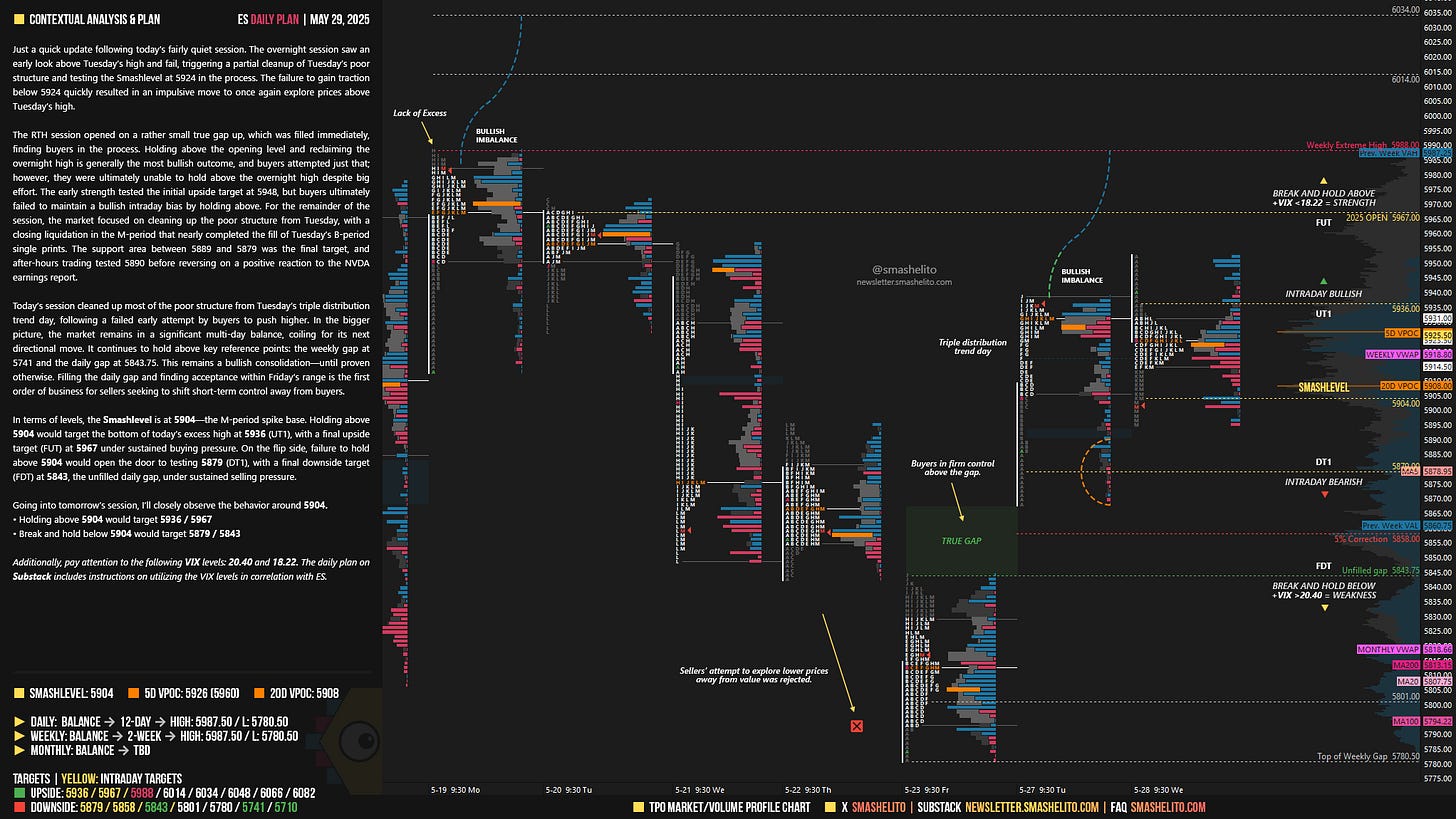

Just a quick update following today’s fairly quiet session. The overnight session saw an early look above Tuesday’s high and fail, triggering a partial cleanup of Tuesday’s poor structure and testing the Smashlevel at 5924 in the process. The failure to gain traction below 5924 quickly resulted in an impulsive move to once again explore prices above Tuesday’s high.

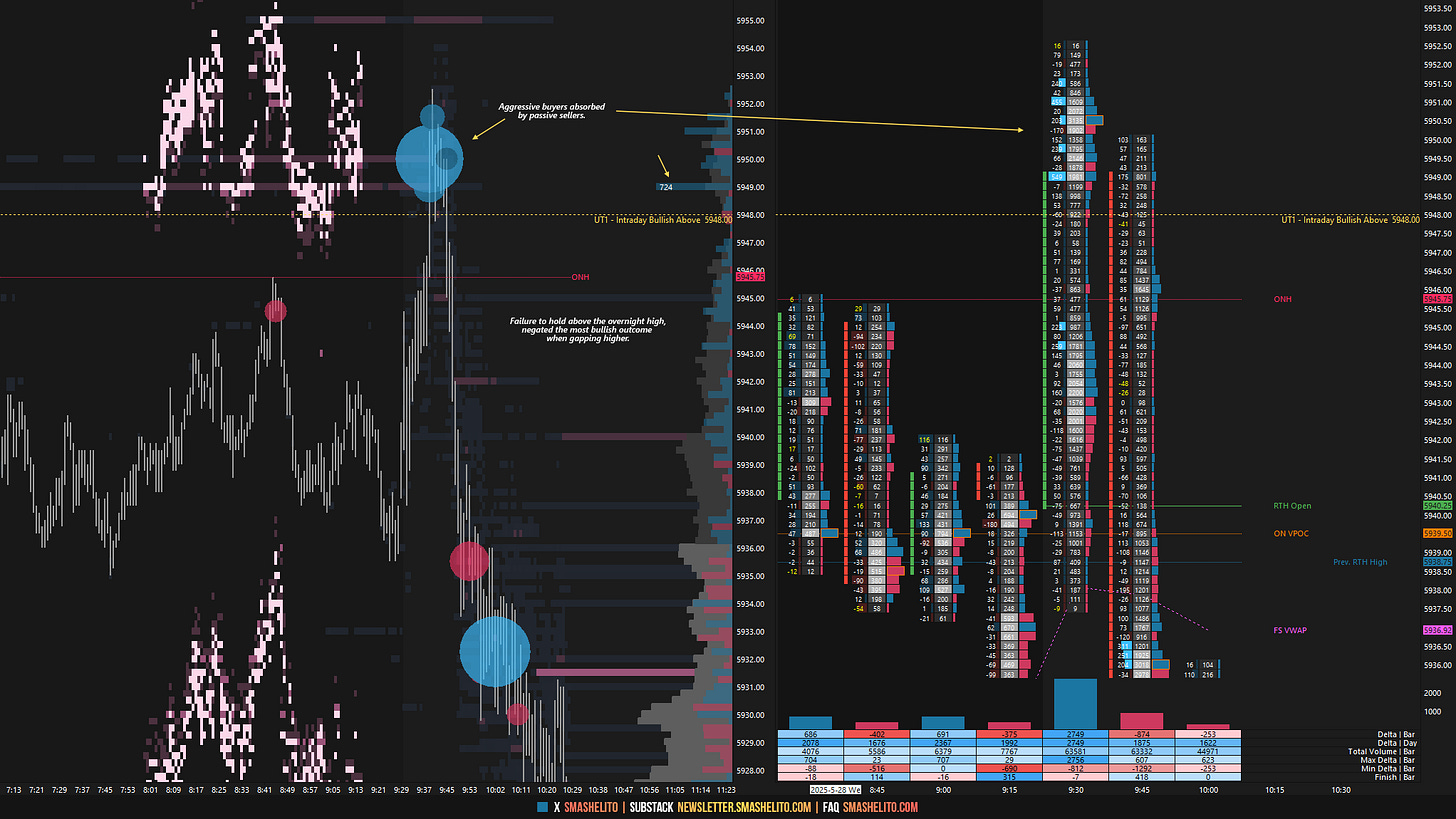

The RTH session opened on a rather small true gap up, which was filled immediately, finding buyers in the process. Holding above the opening level and reclaiming the overnight high is generally the most bullish outcome, and buyers attempted just that; however, they were ultimately unable to hold above the overnight high despite big effort (see Figure 1). The early strength tested the initial upside target at 5948, but buyers ultimately failed to maintain a bullish intraday bias by holding above. For the remainder of the session, the market focused on cleaning up the poor structure from Tuesday, with a closing liquidation in the M-period that nearly completed the fill of Tuesday’s B-period single prints. The support area between 5889 and 5879 was the final target, and after-hours trading tested 5890 before reversing on a positive reaction to the NVDA earnings report.

Today’s session cleaned up most of the poor structure from Tuesday’s triple distribution trend day, following a failed early attempt by buyers to push higher. In the bigger picture, the market remains in a significant multi-day balance, coiling for its next directional move. It continues to hold above key reference points: the weekly gap at 5741 and the daily gap at 5843.75. This remains a bullish consolidation—until proven otherwise. Filling the daily gap and finding acceptance within Friday’s range is the first order of business for sellers seeking to shift short-term control away from buyers.

In terms of levels, the Smashlevel is at 5904—the M-period spike base. Holding above 5904 would target the bottom of today’s excess high at 5936 (UT1), with a final upside target (FUT) at 5967 under sustained buying pressure. On the flip side, failure to hold above 5904 would open the door to testing 5879 (DT1), with a final downside target (FDT) at 5843, the unfilled daily gap, under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5904.

Holding above 5904 would target 5936 / 5967

Break and hold below 5904 would target 5879 / 5843

Additionally, pay attention to the following VIX levels: 20.40 and 18.22. These levels can provide confirmation of strength or weakness.

Break and hold above 5967 with VIX below 18.22 would confirm strength.

Break and hold below 5843 with VIX above 20.40 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you!

Beautiful trap! Thanks Smash!