ES Daily Plan | May 26-27, 2025

Key Levels & Market Context for the Upcoming Session.

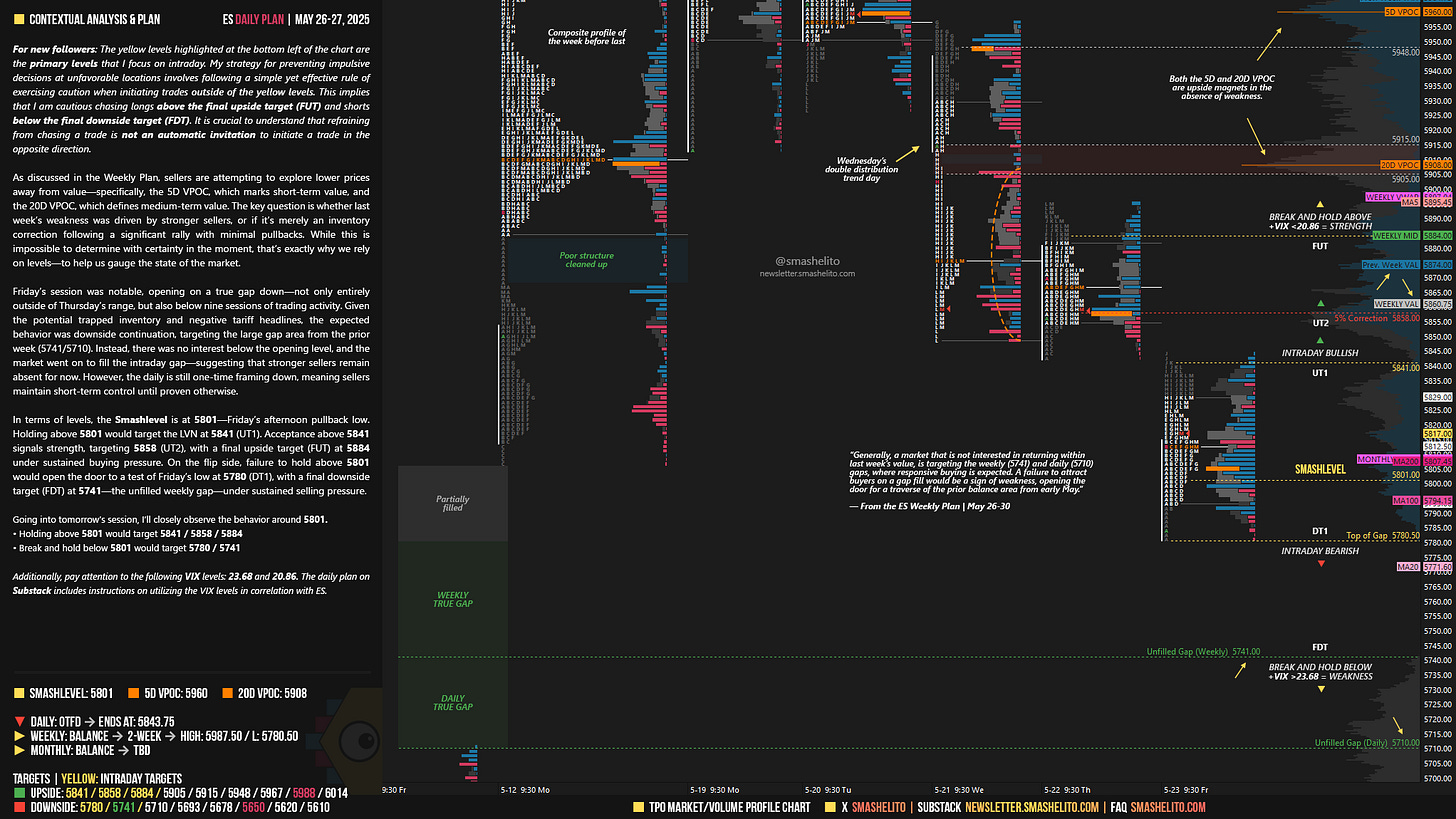

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final upside target (FUT) and shorts below the final downside target (FDT). It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

As discussed in the Weekly Plan, sellers are attempting to explore lower prices away from value—specifically, the 5D VPOC, which marks short-term value, and the 20D VPOC, which defines medium-term value. The key question is whether last week’s weakness was driven by stronger sellers, or if it’s merely an inventory correction following a significant rally with minimal pullbacks. While this is impossible to determine with certainty in the moment, that’s exactly why we rely on levels—to help us gauge the state of the market.

Friday’s session was notable, opening on a true gap down—not only entirely outside of Thursday’s range, but also below nine sessions of trading activity. Given the potential trapped inventory and negative tariff headlines, the expected behavior was downside continuation, targeting the large gap area from the prior week (5741/5710). Instead, there was no interest below the opening level, and the market went on to fill the intraday gap—suggesting that stronger sellers remain absent for now. However, the daily is still one-time framing down, meaning sellers maintain short-term control until proven otherwise.

In terms of levels, the Smashlevel is at 5801—Friday’s afternoon pullback low. Holding above 5801 would target the LVN at 5841 (UT1). Acceptance above 5841 signals strength, targeting 5858 (UT2), with a final upside target (FUT) at 5884 under sustained buying pressure. On the flip side, failure to hold above 5801 would open the door to a test of Friday’s low at 5780 (DT1), with a final downside target (FDT) at 5741—the unfilled weekly gap—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5801.

Holding above 5801 would target 5841 / 5858 / 5884

Break and hold below 5801 would target 5780 / 5741

Additionally, pay attention to the following VIX levels: 23.68 and 20.86. These levels can provide confirmation of strength or weakness.

Break and hold above 5884 with VIX below 20.86 would confirm strength.

Break and hold below 5741 with VIX above 23.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you Smash! Extra thanks for the days I missed!

Thank you!