ES Daily Plan | May 26, 2023

The daily has returned to balance after breaching the previous day’s high. The buyers need to establish acceptance within Tuesday's upper distribution. All levels remain the same.

Contextual Analysis

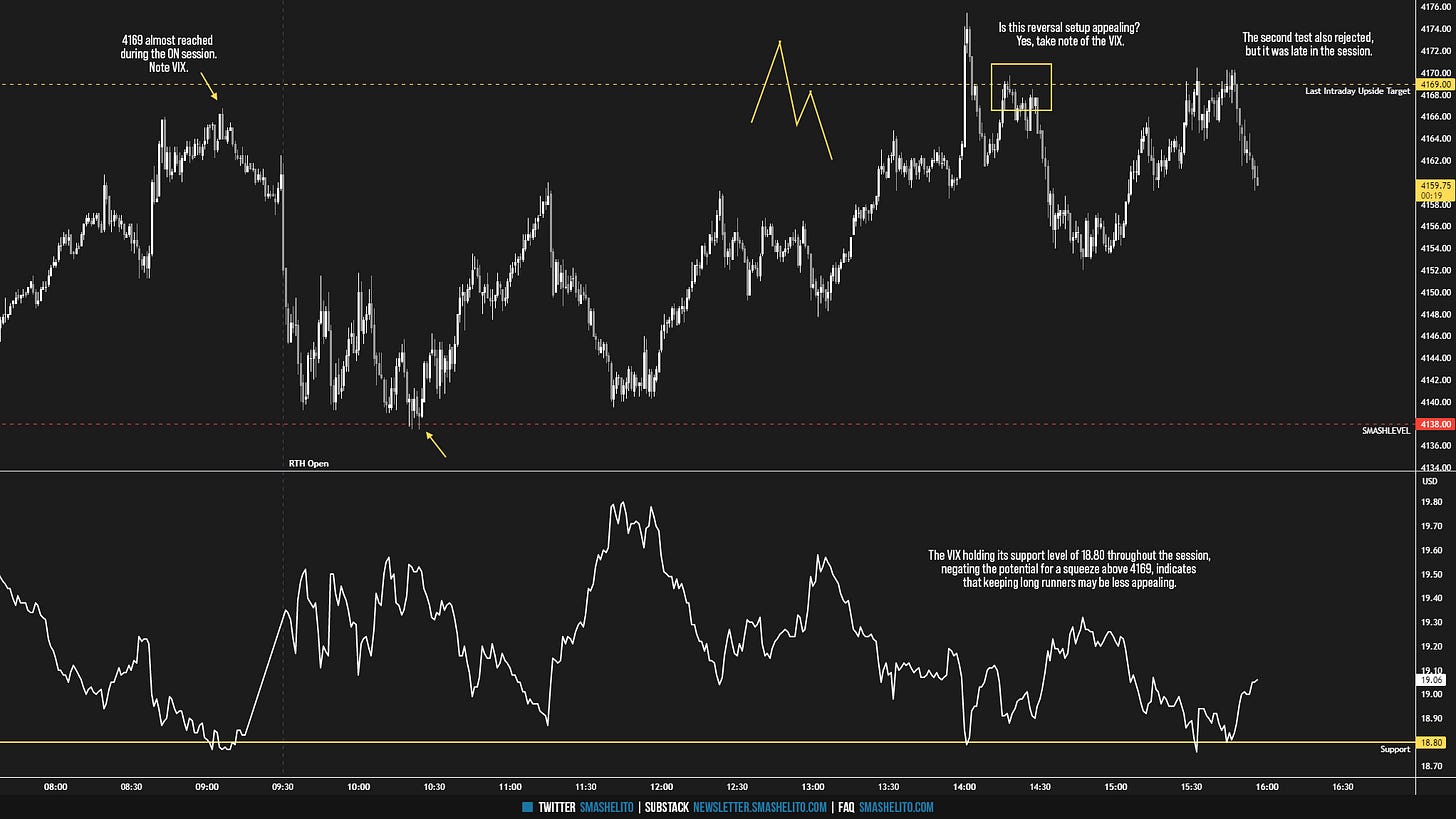

After yesterday's settlement, NVDA earnings triggered a positive response from the market, resulting in reaching the unfilled gap at 4153. It is important to mention that I only consider gap fills that occur during regular trading hours. Early in the overnight (ON) session, the after-hours move was essentially retraced. However, sellers faced difficulty in gaining traction below the Smashlevel of 4138, which proved to be highly significant throughout the session. The last upside target of 4169 was nearly reached already during the overnight session, with an ON high of 4166.75. This was a good location to book profits and avoid the potential volatility at the opening of RTH, especially with the VIX testing its support level of 18.80 during that sequence.

The RTH session opened with a fairly large true gap to the upside, and the market witness an immediate inventory correction, resulting in a test of 4138, filling the gap in the process. There was a notable amount of aggressive selling at 4138, but ultimately, the sellers didn’t have size enough to push price through the passive limit orders, leading to a reversal. I posted a tweet containing a visual representation of this sequence, which is worth checking out.

The AM session basically filled the low volume node (LVN) that was highlighted in the previous plan. I have now replaced it with a 5-day volume profile to highlight that the short-term value (5-day VPOC) remains at 4205. This is a potential upside magnet if buyers are able to follow-through tomorrow. In the H-period, the market observed an upward range extension that eventually reached the last upside target of 4169, triggering some stops. During this sequence, the VIX once again tested its support level of 18.80 but failed to break through. As a result, it is my usual practice to secure profits when in a long position, as reversals can occur due to the absence of confirmed strength from the VIX. In a separate recap, I will outline the correlation between the ES and VIX levels from the previous plan, highlighting an exceptional opportunity for a reversal setup that occurred today. The market returned within the initial balance range, where the RTH session closed.

The daily has returned to a 3-day balance after breaching the previous day’s high. In the previous plan, I mentioned that the buyers want the VIX to drop 19.18 to confirm that the low of the week was in. Today, the VIX closed at 19.14. I suggest continuing to monitor the level of 19.18 tomorrow. All ES levels remain the same. The buyers aim to establish acceptance above 4169 to target the 3-day balance high (poor), and the upside magnet of 4205. Conversely, the sellers aim to negate today’s action by breaching 4138 to target the 3 day balance low (poor). Stay nimble.

Going into tomorrow's session, I will observe 4169.

Break and hold above 4169 would target 4180 / 4195 / 4205

Holding below 4169 would target 4153 / 4138 / 4120

Additionally, pay attention to the following VIX levels: 20.32 and 17.94. These levels can provide confirmation of strength or weakness.

Break and hold above 4205 with VIX below 17.94 would confirm strength.

Break and hold below 4120 with VIX above 20.32 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Back in the range from hell!

Negative delta & positive candles -> When you see these, do you immediately open a position or wait for the next candle?