ES Daily Plan | May 24, 2023

Today’s session resulted in a double distribution, as the single prints in J-period remained unfilled.

My short-term level of interest will be the low volume node (LVN) that separates these distributions.

Contextual Analysis

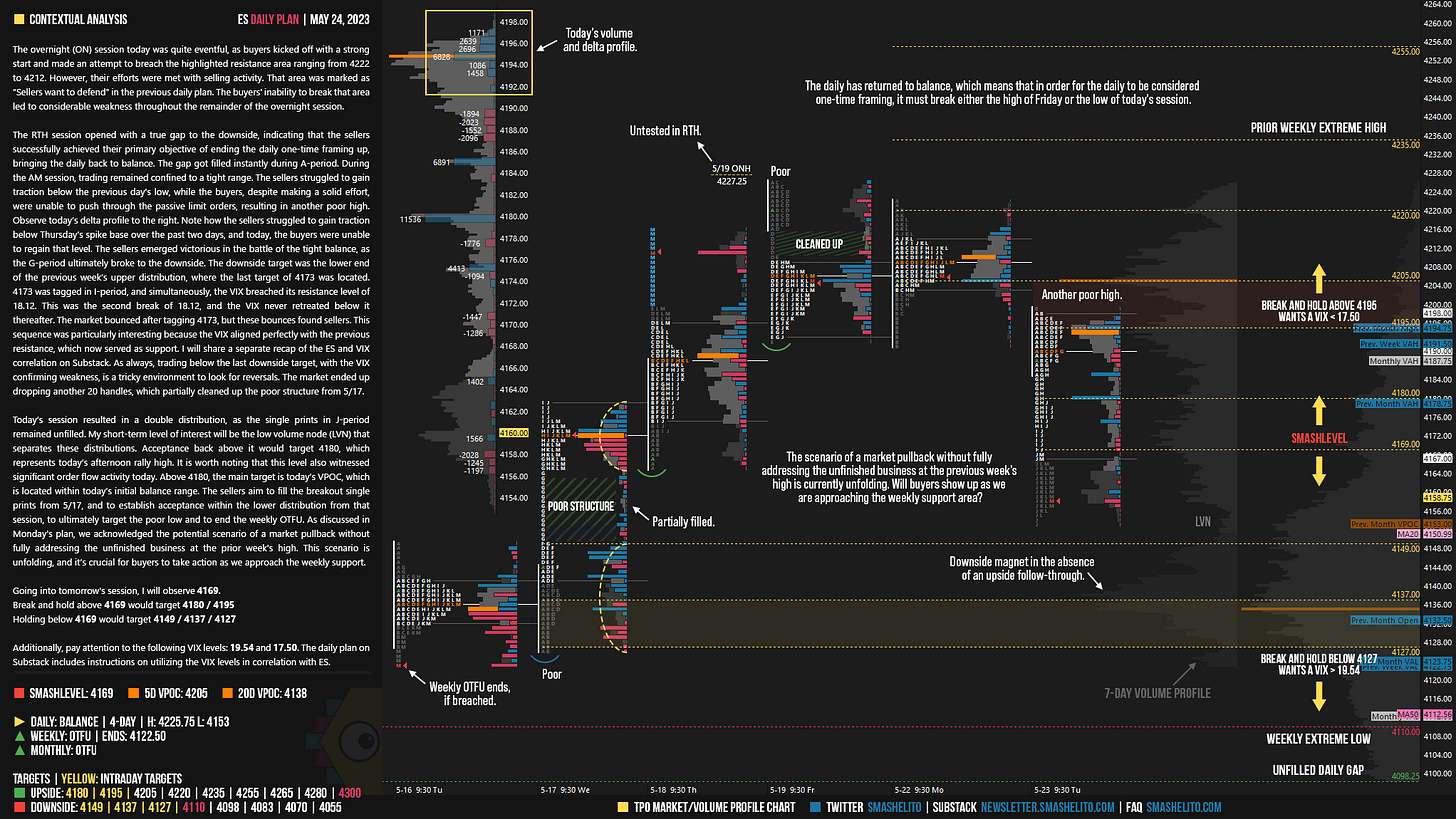

The overnight (ON) session today was quite eventful, as buyers kicked off with a strong start and made an attempt to breach the highlighted resistance area ranging from 4222 to 4212. However, their efforts were met with selling activity. That area was marked as “Sellers want to defend” in the previous daily plan. The buyers' inability to break that area led to considerable weakness throughout the remainder of the overnight session.

The RTH session opened with a true gap to the downside, indicating that the sellers successfully achieved their primary objective of ending the daily one-time framing up, bringing the daily back to balance. The gap got filled instantly during A-period. During the AM session, trading remained confined to a tight range. The sellers struggled to gain traction below the previous day's low, while the buyers, despite making a solid effort, were unable to push through the passive limit orders, resulting in another poor high. Observe today’s delta profile to the right. Note how the sellers struggled to gain traction below Thursday’s spike base over the past two days, and today, the buyers were unable to regain that level. The sellers emerged victorious in the battle of the tight balance, as the G-period ultimately broke to the downside. The downside target was the lower end of the previous week’s upper distribution, where the last target of 4173 was located. 4173 was tagged in I-period, and simultaneously, the VIX breached its resistance level of 18.12. This was the second break of 18.12, and the VIX never retreated below it thereafter. The market bounced after tagging 4173, but these bounces found sellers. This sequence was particularly interesting because the VIX aligned perfectly with the previous resistance, which now served as support. I will share a separate recap of the ES and VIX correlation on Substack. As always, trading below the last downside target, with the VIX confirming weakness, is a tricky environment to look for reversals. The market ended up dropping another 20 handles, which partially cleaned up the poor structure from 5/17.

Today’s session resulted in a double distribution, as the single prints in J-period remained unfilled. My short-term level of interest will be the low volume node (LVN) that separates these distributions. Acceptance back above it would target 4180, which represents today’s afternoon rally high. It is worth noting that this level also witnessed significant order flow activity today. Above 4180, the main target is today’s VPOC, which is located within today’s initial balance range. The sellers aim to fill the breakout single prints from 5/17, and to establish acceptance within the lower distribution from that session, to ultimately target the poor low and to end the weekly OTFU. As discussed in Monday's plan, we acknowledged the potential scenario of a market pullback without fully addressing the unfinished business at the prior week's high. This scenario is unfolding, and it’s crucial for buyers to take action as we approach the weekly support.

Going into tomorrow's session, I will observe 4169.

Break and hold above 4169 would target 4180 / 4195

Holding below 4169 would target 4149 / 4137 / 4127

Additionally, pay attention to the following VIX levels: 19.54 and 17.50. These levels can provide confirmation of strength or weakness.

Break and hold above 4195 with VIX below 17.50 would confirm strength.

Break and hold below 4127 with VIX above 19.54 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

ES Weekly Plan | May 22-26, 2023

🟩 Daily: OTFU | Ends: 4191.50 🟩 Weekly: OTFU | Ends: 4122.50 🟩 Monthly: OTFU Weekly Extreme High: 4300 Weekly Extreme Low: 4110 As usual, a detailed daily plan will be published tomorrow.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Me waiting for this plan everyday is like doggy waiting for owner back home lol. Nothing else matters.

Thanks Smashelito 💥

The VIX numbers are a great companion for the direction and confirmation. They always find a prominent place inside my sketchbook 😘 have great Wednesday.