ES Daily Plan | May 23, 2025

Key Levels & Market Context for the Upcoming Session.

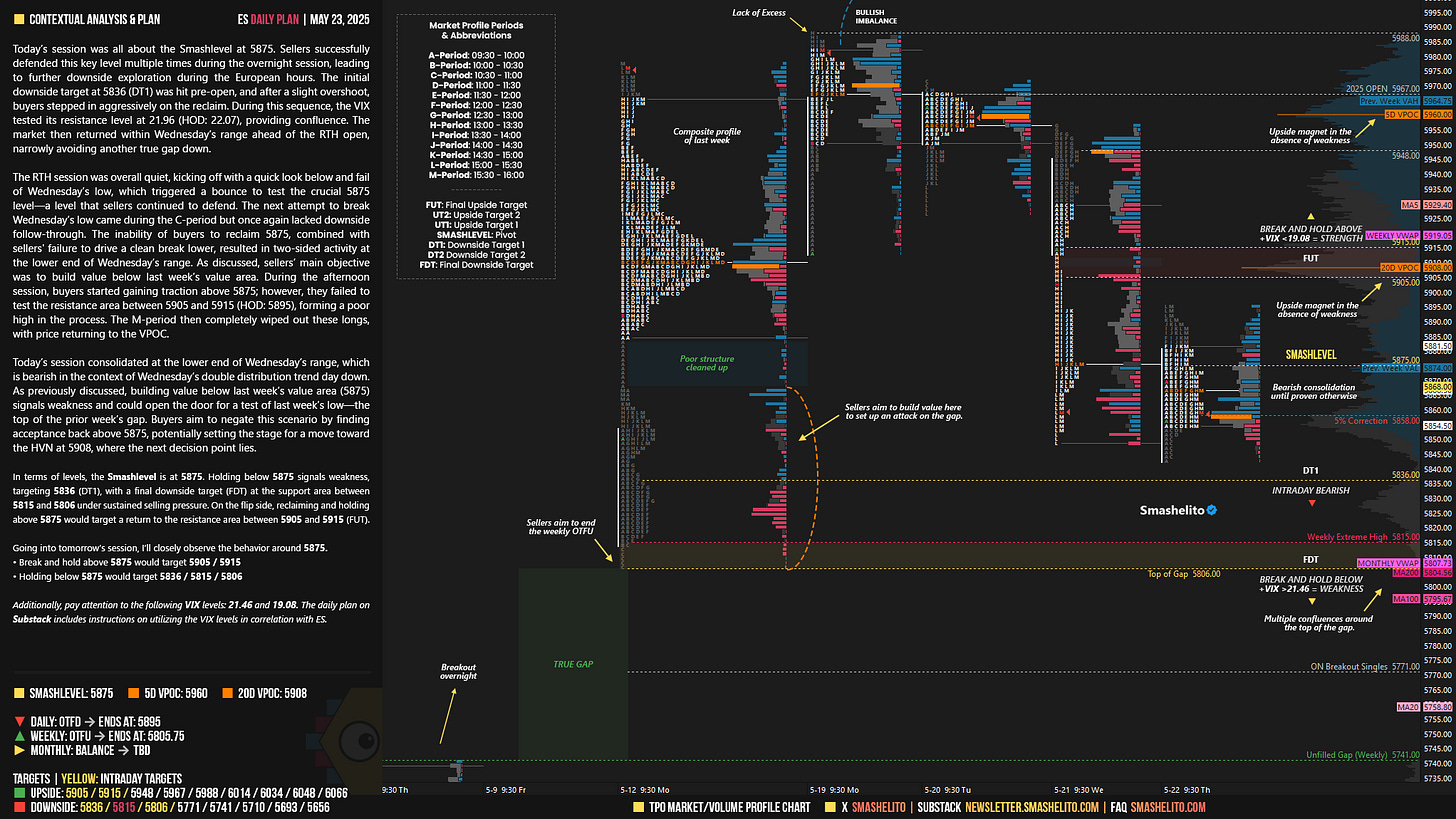

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final upside target (FUT) and shorts below the final downside target (FDT). It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

Today’s session was all about the Smashlevel at 5875. Sellers successfully defended this key level multiple times during the overnight session, leading to further downside exploration during the European hours. The initial downside target at 5836 (DT1) was hit pre-open, and after a slight overshoot, buyers stepped in aggressively on the reclaim. During this sequence, the VIX tested its resistance level at 21.96 (HOD: 22.07), providing confluence (see Figure 1). The market then returned within Wednesday’s range ahead of the RTH open, narrowly avoiding another true gap down.

The RTH session was overall quiet, kicking off with a quick look below and fail of Wednesday’s low, which triggered a bounce to test the crucial 5875 level—a level that sellers continued to defend. The next attempt to break Wednesday’s low came during the C-period but once again lacked downside follow-through. The inability of buyers to reclaim 5875, combined with sellers' failure to drive a clean break lower, resulted in two-sided activity at the lower end of Wednesday’s range. As discussed, sellers’ main objective was to build value below last week’s value area. During the afternoon session, buyers started gaining traction above 5875; however, they failed to test the resistance area between 5905 and 5915 (HOD: 5895), forming a poor high in the process. The M-period then completely wiped out these longs, with price returning to the VPOC.

Today’s session consolidated at the lower end of Wednesday’s range, which is bearish in the context of Wednesday’s double distribution trend day down. As previously discussed, building value below last week’s value area (5875) signals weakness and could open the door for a test of last week’s low—the top of the prior week’s gap. Buyers aim to negate this scenario by finding acceptance back above 5875, potentially setting the stage for a move toward the HVN at 5908, where the next decision point lies.

In terms of levels, the Smashlevel is at 5875. Holding below 5875 signals weakness, targeting 5836 (DT1), with a final downside target (FDT) at the support area between 5815 and 5806 under sustained selling pressure. On the flip side, reclaiming and holding above 5875 would target a return to the resistance area between 5905 and 5915 (FUT).

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5875.

Break and hold above 5875 would target 5905 / 5915

Holding below 5875 would target 5836 / 5815 / 5806

Additionally, pay attention to the following VIX levels: 21.46 and 19.08. These levels can provide confirmation of strength or weakness.

Break and hold above 5915 with VIX below 19.08 would confirm strength.

Break and hold below 5806 with VIX above 21.46 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Correction: VIX levels 21.46 / 19.08.

Thanks Smash! 5875 was a monster!