ES Daily Plan | May 19, 2025

Key Levels & Market Context for the Upcoming Session.

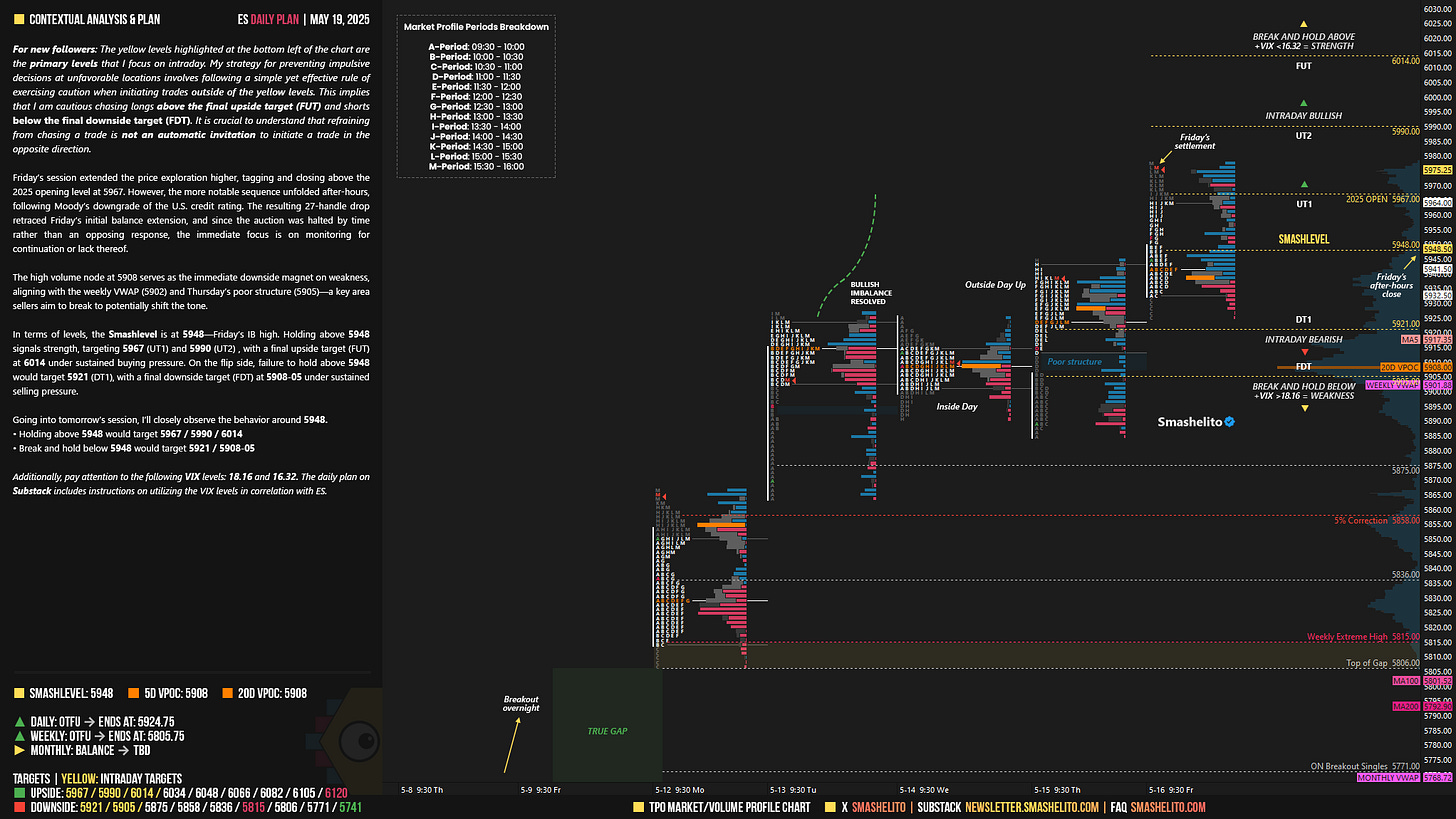

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final upside target (FUT) and shorts below the final downside target (FDT). It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

Friday’s session extended the price exploration higher, tagging and closing above the 2025 opening level at 5967. However, the more notable sequence unfolded after-hours, following Moody’s downgrade of the U.S. credit rating. The resulting 27-handle drop retraced Friday’s initial balance extension, and since the auction was halted by time rather than an opposing response, the immediate focus is on monitoring for continuation or lack thereof.

The high volume node at 5908 serves as the immediate downside magnet on weakness, aligning with the weekly VWAP (5902) and Thursday’s poor structure (5905)—a key area sellers aim to break to potentially shift the tone.

In terms of levels, the Smashlevel is at 5948—Friday’s IB high. Holding above 5948 signals strength, targeting 5967 (UT1) and 5990 (UT2) , with a final upside target (FUT) at 6014 under sustained buying pressure. On the flip side, failure to hold above 5948 would target 5921 (DT1), with a final downside target (FDT) at 5908-05 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5948.

Holding above 5948 would target 5967 / 5990 / 6014

Break and hold below 5948 would target 5921 / 5908-05

Additionally, pay attention to the following VIX levels: 18.16 and 16.32. These levels can provide confirmation of strength or weakness.

Break and hold above 6014 with VIX below 16.32 would confirm strength.

Break and hold below 5905 with VIX above 18.16 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you very much!

Thanks Smash! X promised me a limit down 😂