ES Daily Plan | May 16, 2025

Key Levels & Market Context for the Upcoming Session.

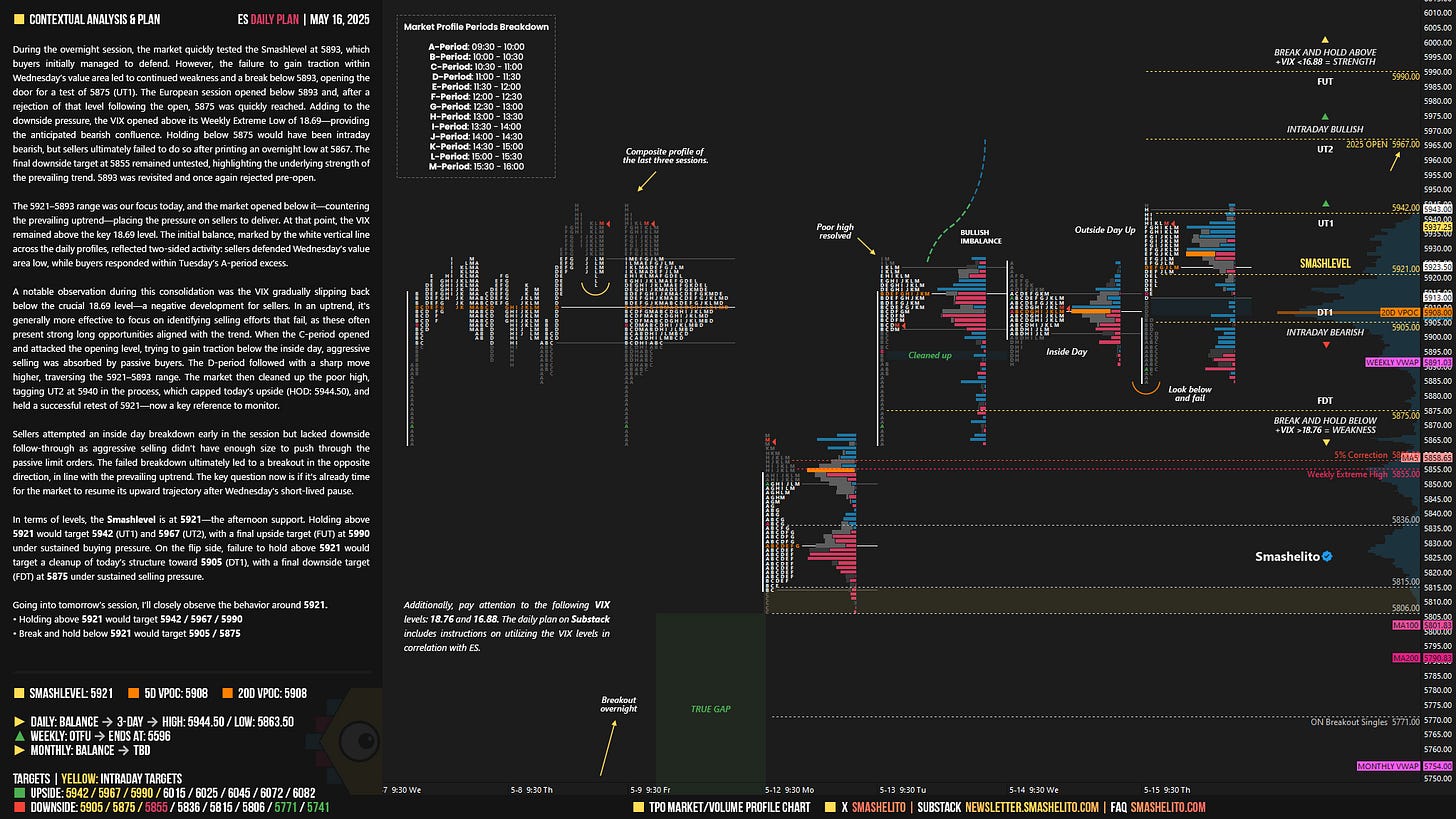

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final upside target (FUT) and shorts below the final downside target (FDT). It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

During the overnight session, the market quickly tested the Smashlevel at 5893, which buyers initially managed to defend. However, the failure to gain traction within Wednesday’s value area led to continued weakness and a break below 5893, opening the door for a test of 5875 (UT1). The European session opened below 5893 and, after a rejection of that level following the open, 5875 was quickly reached. Adding to the downside pressure, the VIX opened above its Weekly Extreme Low of 18.69—providing the anticipated bearish confluence. Holding below 5875 would have been intraday bearish, but sellers ultimately failed to do so after printing an overnight low at 5867. The final downside target at 5855 remained untested, highlighting the underlying strength of the prevailing trend. 5893 was revisited and once again rejected pre-open.

The 5921–5893 range was our focus today, and the market opened below it—countering the prevailing uptrend—placing the pressure on sellers to deliver. At that point, the VIX remained above the key 18.69 level. The initial balance, marked by the white vertical line across the daily profiles, reflected two-sided activity: sellers defended Wednesday’s value area low, while buyers responded within Tuesday’s A-period excess.

A notable observation during this consolidation was the VIX gradually slipping back below the crucial 18.69 level—a negative development for sellers (see Figure 1). In an uptrend, it's generally more effective to focus on identifying selling efforts that fail, as these often present strong long opportunities aligned with the trend. When the C-period opened and attacked the opening level, trying to gain traction below the inside day, aggressive selling was absorbed by passive buyers. The D-period followed with a sharp move higher, traversing the 5921–5893 range. The market then cleaned up the poor high, tagging UT2 at 5940 in the process, which capped today’s upside (HOD: 5944.50), and held a successful retest of 5921—now a key reference.

Sellers attempted an inside day breakdown early in the session but lacked downside follow-through as aggressive selling didn’t have enough size to push through the passive limit orders. The failed breakdown ultimately led to a breakout in the opposite direction, in line with the prevailing uptrend. The key question now is if it's already time for the market to resume its upward trajectory after Wednesday's short-lived pause.

In terms of levels, the Smashlevel is at 5921—the afternoon support. Holding above 5921 would target 5942 (UT1) and 5967 (UT2), with a final upside target (FUT) at 5990 under sustained buying pressure. On the flip side, failure to hold above 5921 would target a cleanup of today’s structure toward 5905 (DT1), with a final downside target (FDT) at 5875 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5921.

Holding above 5921 would target 5942 / 5967 / 5990

Break and hold below 5921 would target 5905 / 5875

Additionally, pay attention to the following VIX levels: 18.76 and 16.88. These levels can provide confirmation of strength or weakness.

Break and hold above 5990 with VIX below 16.88 would confirm strength.

Break and hold below 5875 with VIX above 18.76 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks again Smash for the phenomenal educational content. Unbelievable, but every day something new can be learned from your newsletter.

Thank you as always!!