ES Daily Plan | May 14, 2025

Key Levels & Market Context for the Upcoming Session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final upside target (FUT) and shorts below the final downside target (FDT). It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

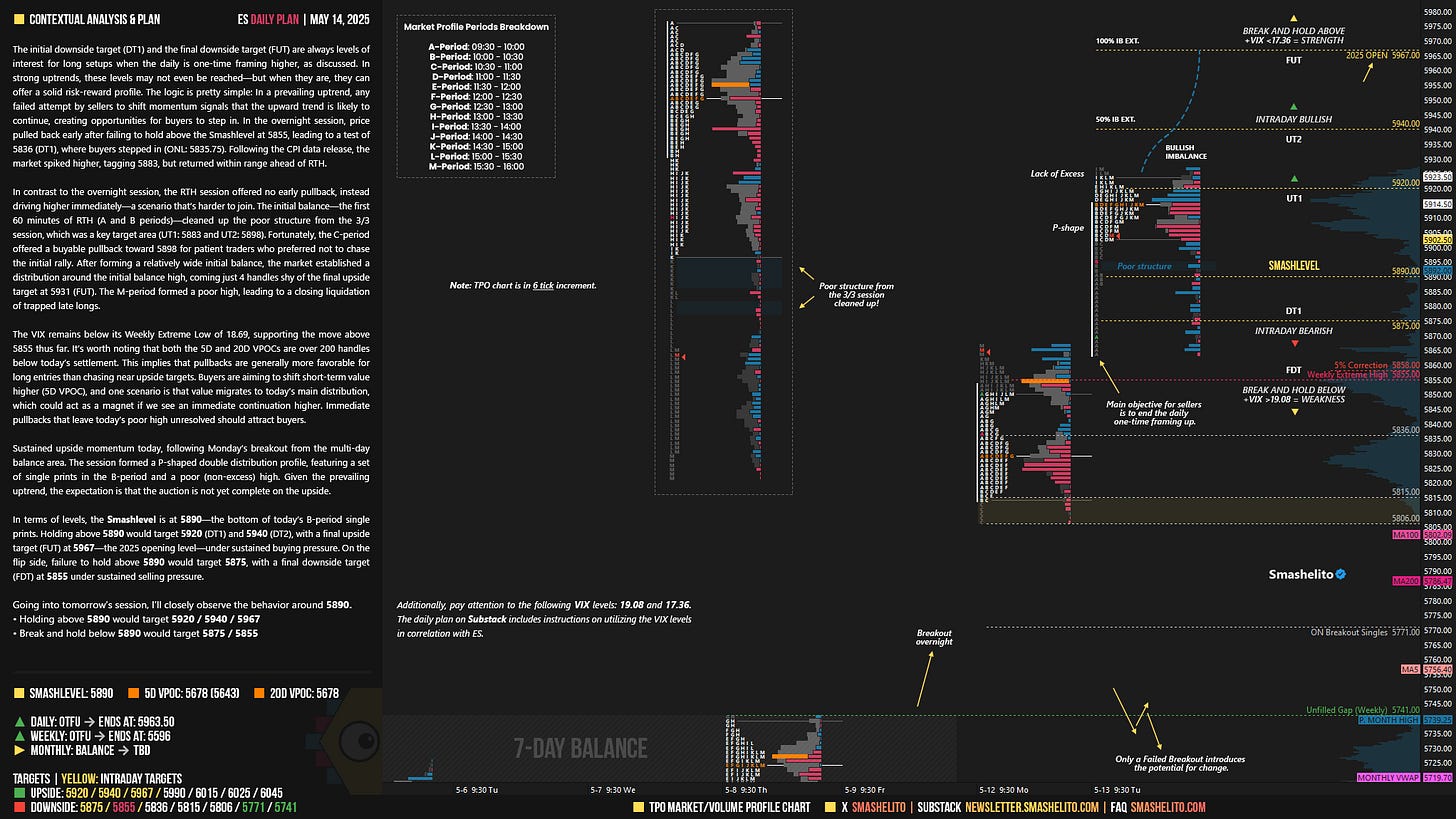

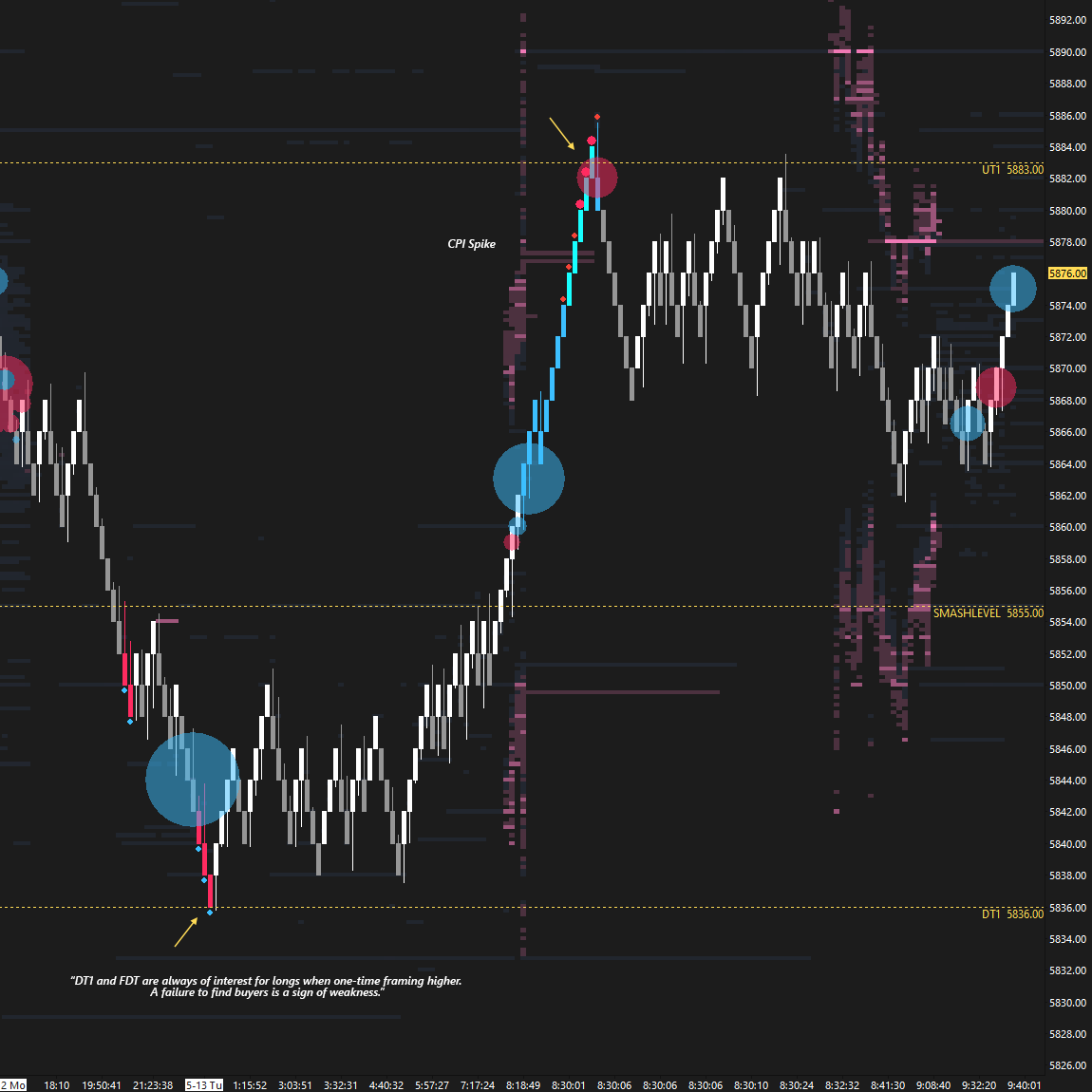

The initial downside target (DT1) and the final downside target (FUT) are always levels of interest for long setups when the daily is one-time framing higher, as discussed. In strong uptrends, these levels may not even be reached—but when they are, they can offer a solid risk-reward profile. The logic is pretty simple: In a prevailing uptrend, any failed attempt by sellers to shift momentum signals that the upward trend is likely to continue, creating opportunities for buyers to step in. In the overnight session, price pulled back early after failing to hold above the Smashlevel at 5855, leading to a test of 5836 (DT1), where buyers stepped in (ONL: 5835.75). Following the CPI data release, the market spiked higher, tagging 5883, but returned within range ahead of RTH.

In contrast to the overnight session, the RTH session offered no early pullback, instead driving higher immediately—a scenario that’s harder to join. The initial balance—the first 60 minutes of RTH (A and B periods)—cleaned up the poor structure from the 3/3 session, which was a key target area (UT1: 5883 and UT2: 5898). Fortunately, the C-period offered a buyable pullback toward 5898 for patient traders who preferred not to chase the initial rally. After forming a relatively wide initial balance, the market established a distribution around the initial balance high, coming just 4 handles shy of the final upside target at 5931 (FUT). The M-period formed a poor high, leading to a closing liquidation of trapped late longs.

The VIX remains below its Weekly Extreme Low of 18.69, supporting the move above 5855 thus far. It’s worth noting that both the 5D and 20D VPOCs are over 200 handles below today’s settlement. This implies that pullbacks are generally more favorable for long entries than chasing near upside targets. Buyers are aiming to shift short-term value higher (5D VPOC), and one scenario is that value migrates to today’s main distribution, which could act as a magnet if we see an immediate continuation higher. Immediate pullbacks that leave today’s poor high unresolved should attract buyers.

Sustained upside momentum today, following Monday’s breakout from the multi-day balance area. The session formed a P-shaped double distribution profile, featuring a set of single prints in the B-period and a poor (non-excess) high. Given the prevailing uptrend, the expectation is that the auction is not yet complete on the upside.

In terms of levels, the Smashlevel is at 5890—the bottom of today’s B-period single prints. Holding above 5890 would target 5920 (DT1) and 5940 (DT2), with a final upside target (FUT) at 5967—the 2025 opening level—under sustained buying pressure. On the flip side, failure to hold above 5890 would target 5875, with a final downside target (FDT) at 5855 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5890.

Holding above 5890 would target 5920 / 5940 / 5967

Break and hold below 5890 would target 5875 / 5855

Additionally, pay attention to the following VIX levels: 19.08 and 17.36. These levels can provide confirmation of strength or weakness.

Break and hold above 5967 with VIX below 17.36 would confirm strength.

Break and hold below 5855 with VIX above 19.08 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash! Bulls keep going.

Thank you Smashie!