ES Daily Plan | May 13, 2025

Key Levels & Market Context for the Upcoming Session.

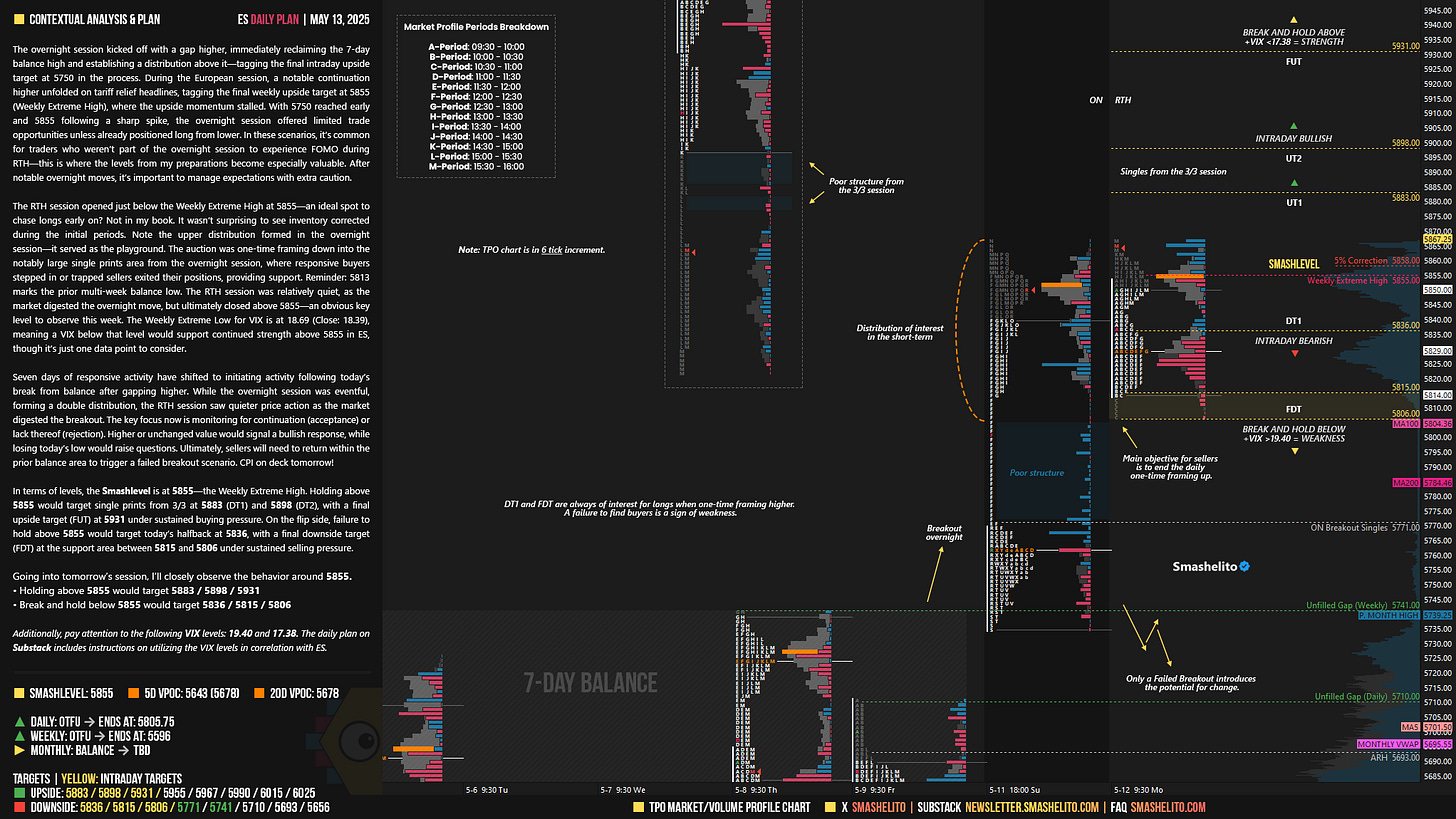

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final upside target (FUT) and shorts below the final downside target (FDT). It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

The overnight session kicked off with a gap higher, immediately reclaiming the 7-day balance high and establishing a distribution above it—tagging the final intraday upside target at 5750 in the process. During the European session, a notable continuation higher unfolded on tariff relief headlines, tagging the final weekly upside target at 5855 (Weekly Extreme High), where the upside momentum stalled. With 5750 reached early and 5855 following a sharp spike, the overnight session offered limited trade opportunities unless already positioned long from lower. In these scenarios, it’s common for traders who weren’t part of the overnight session to experience FOMO during RTH—this is where the levels from my preparations become especially valuable. After notable overnight moves, it’s important to manage expectations with extra caution.

The RTH session opened just below the Weekly Extreme High at 5855—an ideal spot to chase longs early on? Not in my book. It wasn’t surprising to see inventory corrected during the initial periods. Note the upper distribution formed in the overnight session—it served as the playground. The auction was one-time framing down into the notably large single prints area from the overnight session, where responsive buyers stepped in or trapped sellers exited their positions, providing support. Reminder: 5813 marks the prior multi-week balance low. The RTH session was relatively quiet, as the market digested the overnight move, but ultimately closed above 5855—an obvious key level to observe this week. The Weekly Extreme Low for VIX is at 18.69 (Close: 18.39), meaning a VIX below that level would support continued strength above 5855 in ES, though it’s just one data point to consider.

Seven days of responsive activity have shifted to initiating activity following today’s break from balance after gapping higher. While the overnight session was eventful, forming a double distribution, the RTH session saw quieter price action as the market digested the breakout. The key focus now is monitoring for continuation (acceptance) or lack thereof (rejection). Higher or unchanged value would signal a bullish response, while losing today’s low would raise questions. Ultimately, sellers will need to return within the prior balance area to trigger a failed breakout scenario. CPI on deck tomorrow!

In terms of levels, the Smashlevel is at 5855—the Weekly Extreme High. Holding above 5855 would target single prints from 3/3 at 5883 (DT1) and 5898 (DT2), with a final upside target (FUT) at 5931 under sustained buying pressure. On the flip side, failure to hold above 5855 would target today’s halfback at 5836, with a final downside target (FDT) at the support area between 5815 and 5806 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5855.

Holding above 5855 would target 5883 / 5898 / 5931

Break and hold below 5855 would target 5836 / 5815 / 5806

Additionally, pay attention to the following VIX levels: 19.40 and 17.38. These levels can provide confirmation of strength or weakness.

Break and hold above 5931 with VIX below 17.38 would confirm strength.

Break and hold below 5806 with VIX above 19.40 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Great level of detail, thank you!

"Not in my book" = "Not on my watch" - lol!

Totally cool that I can 100% follow - Thank you Smashie!

-M