ES Daily Plan | March 6, 2024

Today’s session saw a double distribution trend day to the downside, completing a full traverse of the previous week’s range.

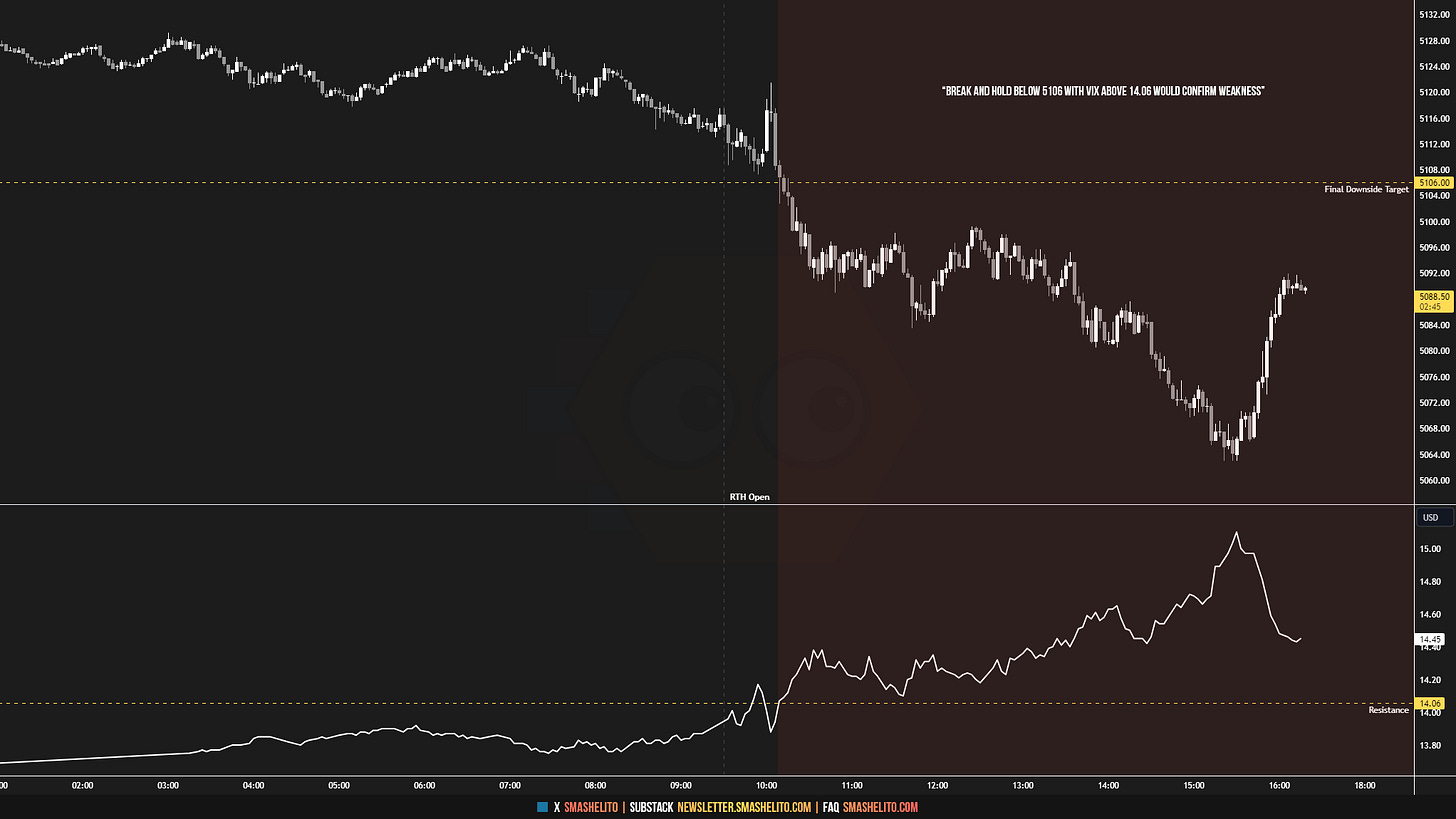

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

The main question ahead of today’s session was whether Monday’s look above the previous week’s high and fail would trigger weakness, or if buyers would continue to establish value at higher prices, aiming primarily to shift the short-term value (5D VPOC) higher. The level used as the gauge to assess the likelihood of either outcome was 5139, which was defended throughout the entire session on Monday, yet sellers managed to close below it during the last period. The overnight session was weak following the inability to reclaim 5139, leading to a retest of the previous ATH at 5123, where the downside momentum momentarily stalled for a couple of hours before resuming lower.

The overnight weakness led the RTH session to open on a true gap to the downside, within the previous month’s range and below Friday's breakout point. There was no interest in any corrective activity at the open, and sellers quickly breached the overnight low (ONL), signaling weakness. The caveat was that the final downside target was located at 5106, just 7 handles below the ONL, making it tricky for initiating new positions. The VIX was hovering around its resistance level of 14.06 during the A-period, adding complexity. A bounce unfolded during the B-period, triggered by a data release, which resulted in a retest of 4123, where sellers were reloading. The next break of the ONL was notably more decisive, resulting in reaching and breaking the final downside target of 5106. Simultaneously, the VIX breached its resistance level of 14.06, confirming weakness. Regular readers of this newsletter know that I typically avoid fading during such scenarios (ES below 5106 & VIX above 14.06), recognizing the potential for further weakness. It's a simple yet powerful concept that keeps me (and readers) out of trouble. Every attempt to bounce was met with selling activity, leading to an additional drop of 40 handles, speaking of further weakness. The closing session came within 8 handles from the Weekly Extreme Low of 5055, where a bounce followed, which is not hugely surprising since Powell is on deck tomorrow.

The main question ahead of today’s session was whether Monday’s look above the previous week’s high and fail would trigger weakness. Today’s session saw a double distribution trend day to the downside, completing a full traverse of the previous week’s range. Sellers have managed to break prior weekly lows a couple of times the past few months, but each attempt lacked follow-through—a pattern that they want to break. Remaining within today’s lower distribution holds the potential for further weakness, while buyers aim to negate today’s move, with the main objective of filling today’s gap. The daily and weekly have returned to balance, with both the short-term value (5D VPOC) and medium-term value (20D VPOC) situated at 5085.

For tomorrow, the Smashlevel (Pivot) is 5097, representing the upper end of today’s lower distribution. Break and hold above 5097 would target the B-period single prints at 5107. Acceptance above 5107 would target the previous months high at 5123, coinciding with the bottom of the gap. Holding below 5097 would target the Quarterly Extreme High at 5071, coinciding with the previous 2-week balance high. Acceptance below 5071 would target the support area from the Weekly Extreme Low at 5055 to the final downside target of 5045.

Levels of Interest

Going into tomorrow's session, I will observe 5097.

Break and hold above 5097 would target 5107 / 5123

Holding below 5097 would target 5071 / 5055 / 5045

Additionally, pay attention to the following VIX levels: 15.02 and 13.88. These levels can provide confirmation of strength or weakness.

Break and hold above 5123 with VIX below 13.88 would confirm strength.

Break and hold below 5045 with VIX above 15.02 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, buddy! I had a great day your levels are absolutely the best.

Thanks you so much 🙏🏻