ES Daily Plan | March 28, 2023

The daily has returned to balance after putting an end to the pattern of lower highs and lower lows.

The market is currently in balance across all time frames, awaiting more market-generated information.

Contextual Analysis

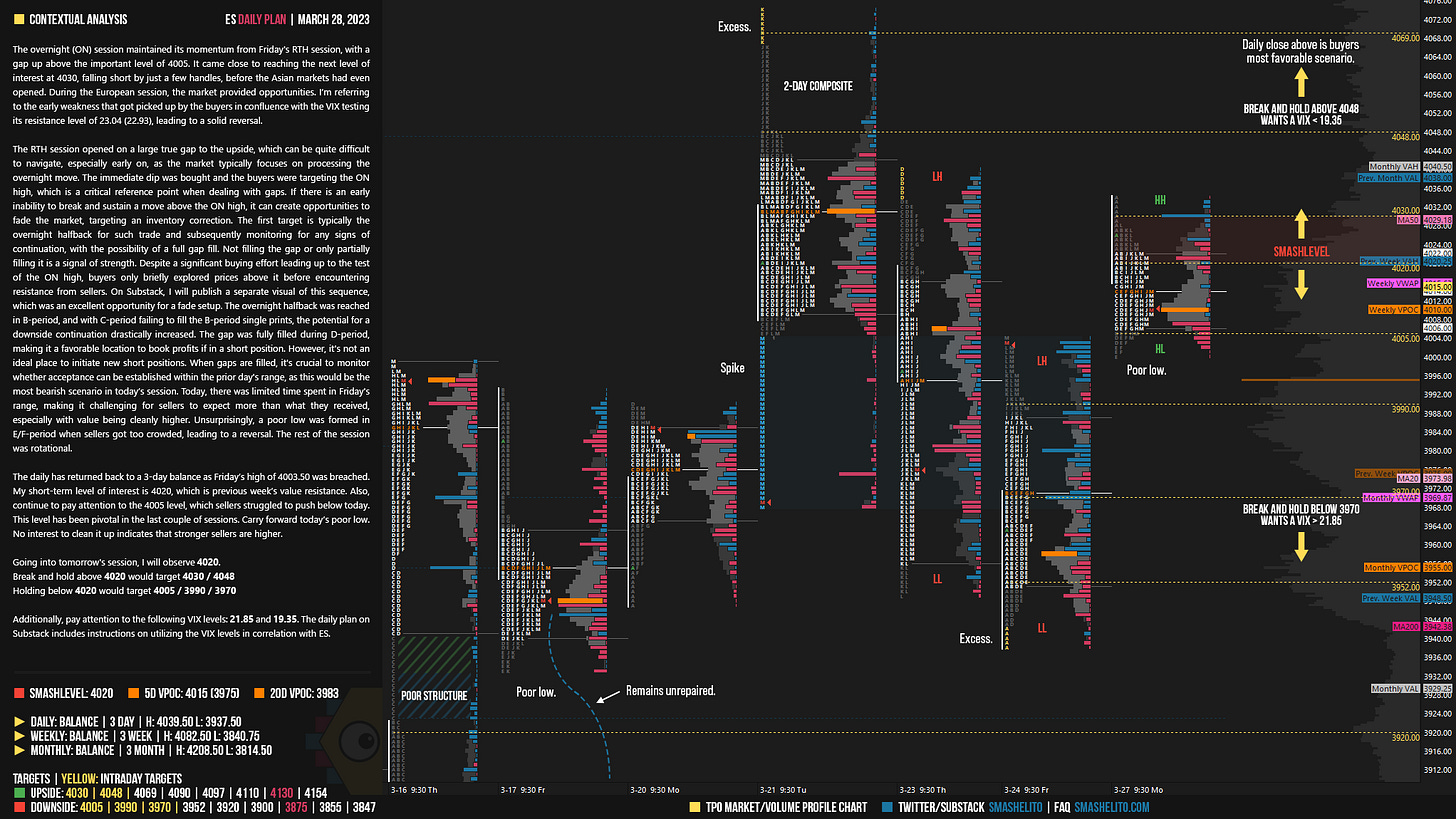

The overnight (ON) session maintained its momentum from Friday's RTH session, with a gap up above the important level of 4005. It came close to reaching the next level of interest at 4030, falling short by just a few handles, before the Asian markets had even opened. During the European session, the market provided opportunities. I’m referring to the early weakness that got picked up by the buyers in confluence with the VIX testing its resistance level of 23.04 (22.93), leading to a solid reversal.

The RTH session opened on a large true gap to the upside, which can be quite difficult to navigate, especially early on, as the market typically focuses on processing the overnight move. The immediate dip was bought and the buyers were targeting the ON high, which is a critical reference point when dealing with gaps. If there is an early inability to break and sustain a move above the ON high, it can create opportunities to fade the market, targeting an inventory correction. The first target is typically the overnight halfback for such trade and subsequently monitoring for any signs of continuation, with the possibility of a full gap fill. Not filling the gap or only partially filling it is a signal of strength. Despite a significant buying effort leading up to the test of the ON high, buyers only briefly explored prices above it before encountering resistance from sellers. On Substack, I will publish a separate visual of this sequence, which was an excellent opportunity for a fade setup.

The overnight halfback was reached in B-period, and with C-period failing to fill the B-period single prints, the potential for a downside continuation drastically increased. The gap was fully filled during D-period, making it a favorable location to book profits if in a short position. However, it's not an ideal place to initiate new short positions. When gaps are filled, it's crucial to monitor whether acceptance can be established within the prior day's range, as this would be the most bearish scenario in today’s session. Today, there was limited time spent in Friday's range, making it challenging for sellers to expect more than what they received, especially with value being cleanly higher. Unsurprisingly, a poor low was formed in E/F-period when sellers got too crowded, leading to a reversal. The rest of the session was rotational.

The daily has returned back to a 3-day balance as Friday’s high of 4003.50 was breached. My short-term level of interest is 4020, which is previous week’s value resistance. Also, continue to pay attention to the 4005 level, which sellers struggled to push below today. This level has been pivotal in the last couple of sessions. Carry forward today’s poor low. No interest to clean it up indicates that stronger sellers are higher.

Going into tomorrow's session, I will observe 4020.

Break and hold above 4020 would target 4030 / 4048

Holding below 4020 would target 4005 / 3990 / 3970

Additionally, pay attention to the following VIX levels: 21.85 and 19.35. These levels can provide confirmation of strength or weakness.

Break and hold above 4048 with VIX below 19.35 would confirm strength.

Break and hold below 3952 with VIX above 21.85 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. Twitter: @smashelito | FAQ: smashelito.com

Thank you! VIX was surgical!

"Carry forward today's poor low. No interest to clean it up indicates that stronger sellers are higher."

The above sentence doesn't make sense to me. The pool low is where the poor sellers are crowded. Is this because stronger sellers want to react from higher positional energy?