ES Daily Plan | March 26, 2024

Today’s session saw a breakdown from the 2-day balance area after opening with a gap lower. The conditions are straightforward moving forward.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

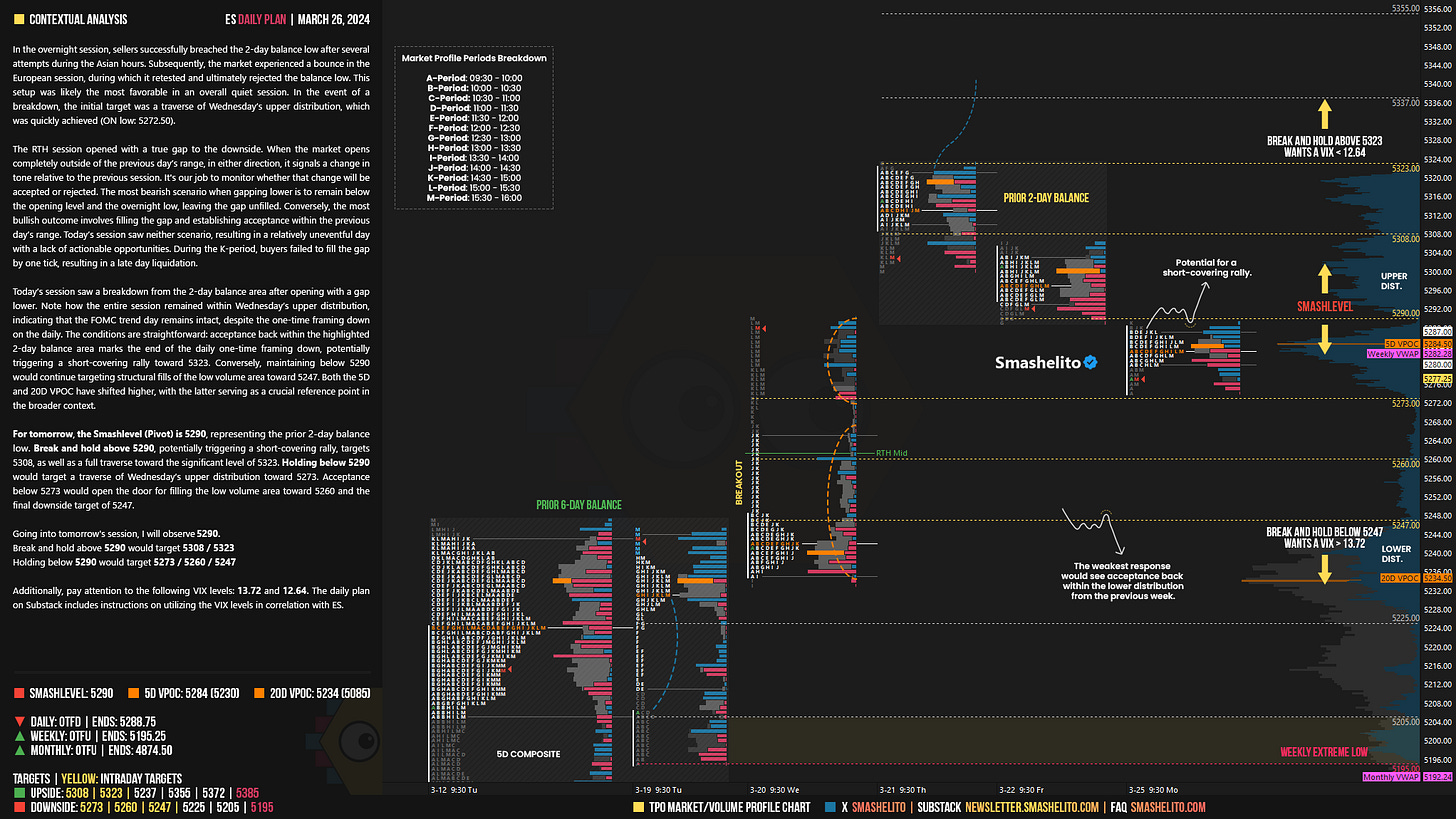

In the overnight session, sellers successfully breached the 2-day balance low after several attempts during the Asian hours. Subsequently, the market experienced a bounce in the European session, during which it retested and ultimately rejected the balance low. This setup was likely the most favorable in an overall quiet session. In the event of a breakdown, the initial target was a traverse of Wednesday’s upper distribution, which was quickly achieved (ON low: 5272.50).

The RTH session opened with a true gap to the downside. When the market opens completely outside of the previous day’s range, in either direction, it signals a change in tone relative to the previous session. It's our job to monitor whether that change will be accepted or rejected. The most bearish scenario when gapping lower is to remain below the opening level and the overnight low, leaving the gap unfilled. Conversely, the most bullish outcome involves filling the gap and establishing acceptance within the previous day’s range. Today’s session saw neither scenario, resulting in a relatively uneventful day with a lack of actionable opportunities. During the K-period, buyers failed to fill the gap by one tick, resulting in a late day liquidation.

Today’s session saw a breakdown from the 2-day balance area after opening with a gap lower. Note how the entire session remained within Wednesday’s upper distribution, indicating that the FOMC trend day remains intact, despite the one-time framing down on the daily. The conditions are straightforward: acceptance back within the highlighted 2-day balance area marks the end of the daily one-time framing down, potentially triggering a short-covering rally toward 5323. Conversely, maintaining below 5290 would continue targeting structural fills of the low volume area toward 5247. Both the 5D and 20D VPOC have shifted higher, with the latter serving as a crucial reference point in the broader context.

For tomorrow, the Smashlevel (Pivot) is 5290, representing the prior 2-day balance low. Break and hold above 5290, potentially triggering a short-covering rally, targets 5308, as well as a full traverse toward the significant level of 5323. Holding below 5290 would target a traverse of Wednesday’s upper distribution toward 5273. Acceptance below 5273 would open the door for filling the low volume area toward 5260 and the final downside target of 5247.

Levels of Interest

Going into tomorrow's session, I will observe 5290.

Break and hold above 5290 would target 5308 / 5323

Holding below 5290 would target 5273 / 5260 / 5247

Additionally, pay attention to the following VIX levels: 13.72 and 12.64. These levels can provide confirmation of strength or weakness.

Break and hold above 5323 with VIX below 12.64 would confirm strength.

Break and hold below 5247 with VIX above 13.72 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

thank you

Thank you, buddy! Another great session.