ES Daily Plan | March 22, 2023

The weekly has returned to balance after today's true gap to the upside, which remained unfilled. The session ended with an upward spike that tagged the last upside target of 4040.

Tomorrow, we have FOMC!

Contextual Analysis

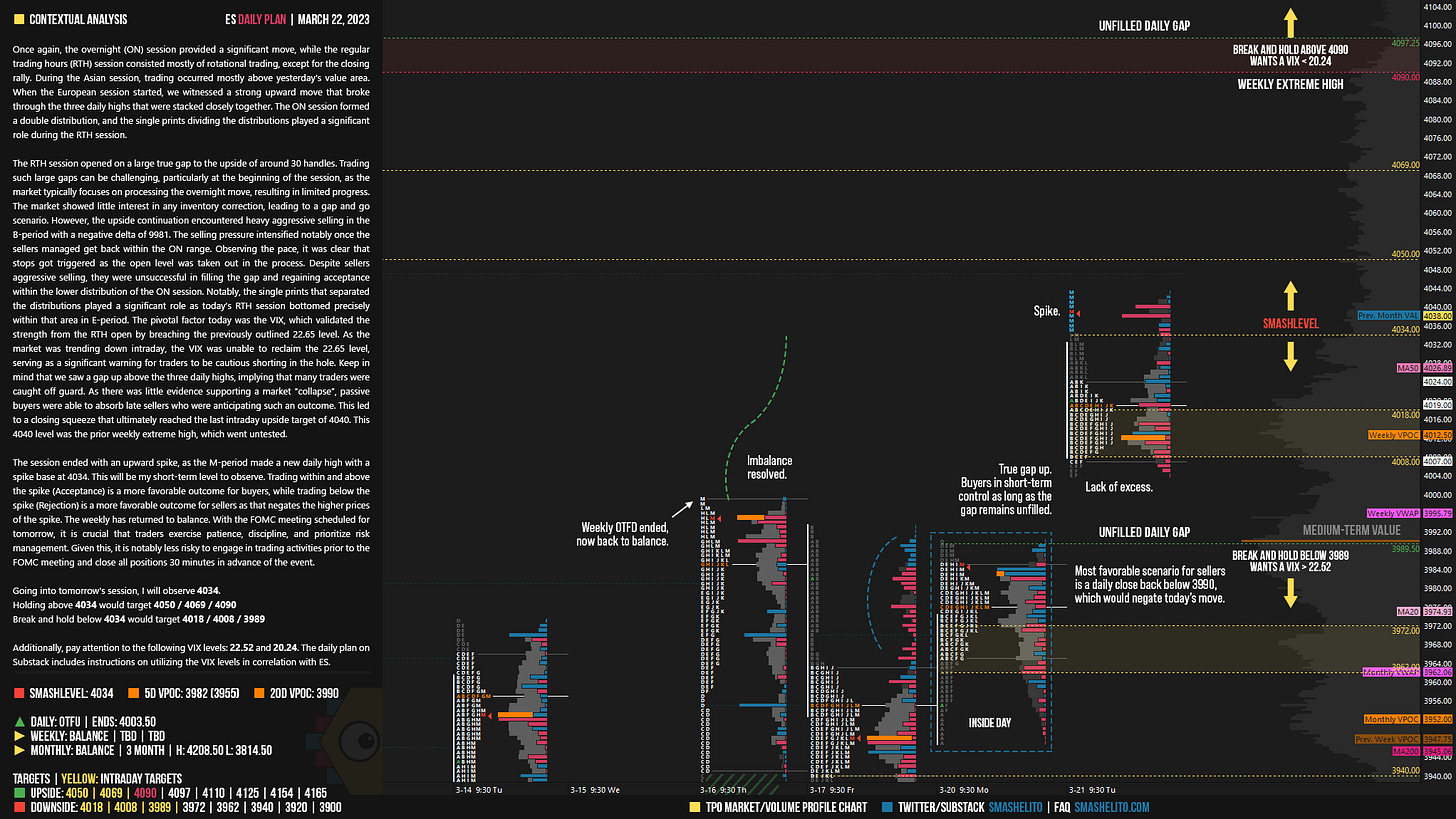

Once again, the overnight (ON) session provided a significant move, while the regular trading hours (RTH) session consisted mostly of rotational trading, except for the closing rally. During the Asian session, trading occurred mostly above yesterday's value area. When the European session started, we witnessed a strong upward move that broke through the three daily highs that were stacked closely together. The ON session formed a double distribution, and the single prints dividing the distributions played a significant role during the RTH session.

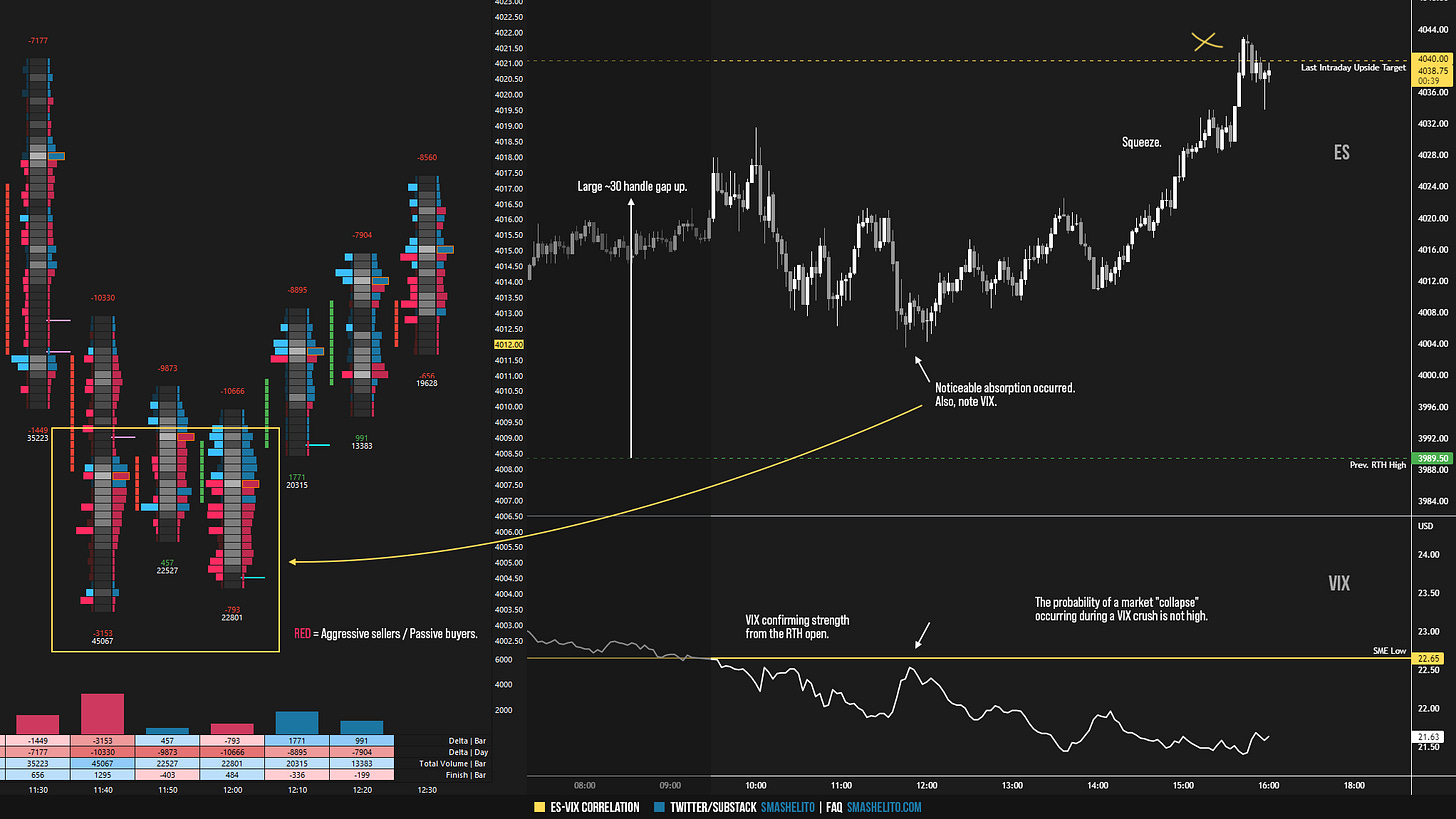

The RTH session opened on a large true gap to the upside of around 30 handles. Trading such large gaps can be challenging, particularly at the beginning of the session, as the market typically focuses on processing the overnight move, resulting in limited progress. The market showed little interest in any inventory correction, leading to a gap and go scenario. However, the upside continuation encountered heavy aggressive selling in the B-period with a negative delta of 9981. The selling pressure intensified notably once the sellers managed get back within the ON range. Observing the pace, it was clear that stops got triggered as the open level was taken out in the process. Despite sellers aggressive selling, they were unsuccessful in filling the gap and regaining acceptance within the lower distribution of the ON session. Notably, the single prints that separated the distributions played a significant role as today’s RTH session bottomed precisely within that area in E-period. The pivotal factor today was the VIX, which validated the strength from the RTH open by breaching the previously outlined 22.65 level. As the market was trending down intraday, the VIX was unable to reclaim the 22.65 level, serving as a significant warning for traders to be cautious shorting in the hole. Keep in mind that we saw a gap up above the three daily highs, implying that many traders were caught off guard. As there was little evidence supporting a market “collapse”, passive buyers were able to absorb late sellers who were anticipating such an outcome. This led to a closing squeeze that ultimately reached the last intraday upside target of 4040. This 4040 level was the prior weekly extreme high, which went untested.

The session ended with an upward spike, as the M-period made a new daily high with a spike base at 4034. This will be my short-term level to observe. Trading within and above the spike (Acceptance) is a more favorable outcome for buyers, while trading below the spike (Rejection) is a more favorable outcome for sellers as that negates the higher prices of the spike. The weekly has returned to balance. With the FOMC meeting scheduled for tomorrow, it is crucial that traders exercise patience, discipline, and prioritize risk management. With that said, it is notably less risky to engage in trading activities prior to the FOMC meeting and close all positions 30 minutes in advance of the event.

Going into tomorrow's session, I will observe 4034.

Holding above 4034 would target 4050 / 4069 / 4090

Break and hold below 4034 would target 4018 / 4008 / 3989

Additionally, pay attention to the following VIX levels: 22.52 and 20.24. These levels can provide confirmation of strength or weakness.

Break and hold above 4090 with VIX below 20.24 would confirm strength.

Break and hold below 3989 with VIX above 22.52 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. Twitter: @smashelito | FAQ: smashelito.com

Very astute observation of RTH vs. ON behavior. VIX sold nonstop and we did not even touch 1 STD in VWAP, which means the selling was weak. Once ORH was taken out at 4028.5, stop run galore