ES Daily Plan | March 12, 2025

Key Levels & Market Context for the Upcoming Session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

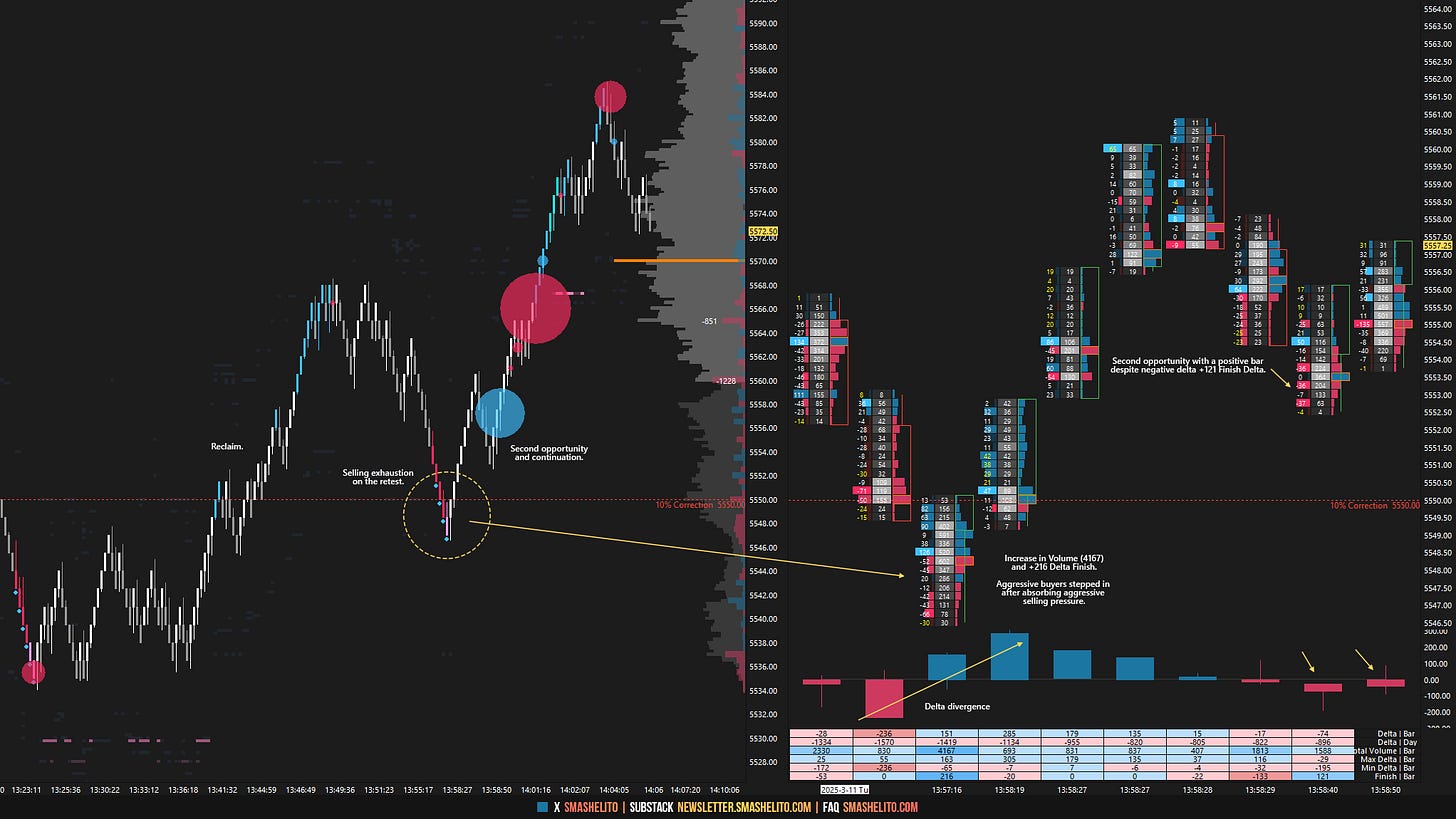

Immediate weakness overnight breached Monday’s excess low and came within a few handles of testing the 10% correction level at 5550, which has been the main downside risk and today’s final downside target. After reclaiming Monday’s low, the market reclaimed the Weekly Extreme Low at 5600 and tested the Monthly Extreme Low at 5642 during the European session, where sellers were waiting. The VIX held the 27.18 level, as noted in the prior plan, maintaining downside pressure. Notably, the VIX closed below this level today, which is a positive takeaway for buyers in an environment where not much is going their way.

There’s not much to discuss about the RTH session, which was characterized by two-sided activity, with sellers maintaining overall control of the auction. The 10% correction level for ES at 5550 and SPX at 5532 (~ES 5537) was successfully reached. The most interesting sequence today unfolded when sellers attempted to gain traction below the 5550 level, our final downside target. This attempt was made with a VIX that held below its resistance level of 29.84, meaning it lacked confirmation—potentially opening the door for reversal setups. We’ve previously discussed the risk-reward profile for chasing shorts (which still stands), and the lack of confirmation from the VIX made chasing even riskier. The market formed a poor low, reclaimed 5550, and rallied back to the 5642 level. Buyers failed to reclaim 5642, resulting in closing weakness.

The pattern of lower highs on the daily remains intact after today’s session, keeping sellers in firm control. Both the 10% correction level for ES at 5550 and SPX at 5532 were reached today—our key downside targets. The big event tomorrow is, of course, the CPI data release. Stay nimble.

In terms of levels, the Smashlevel is at 5550, the 10% correction level. Holding above this level would target 5600, with a final target at 5642 under sustained buying pressure—squeeze potential above (5670-80). Conversely, failure to hold above 5550 would target 5520, with a final target at 5506 under sustained selling pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5550.

Holding above 5550 would target 5600 / 5642 / (5670-80)

Break and hold below 5550 would target 5520 / 5506

Additionally, pay attention to the following VIX levels: 29.18 and 24.64. These levels can provide confirmation of strength or weakness.

Break and hold above 5642 with VIX below 24.64 would confirm strength.

Break and hold below 5506 with VIX above 29.18 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Thank you! Love that visual!

Thank you very much!