ES Weekly Plan | March 10-14, 2025

Key Levels & Market Context for the Upcoming Week.

Economic Calendar

Earnings Calendar

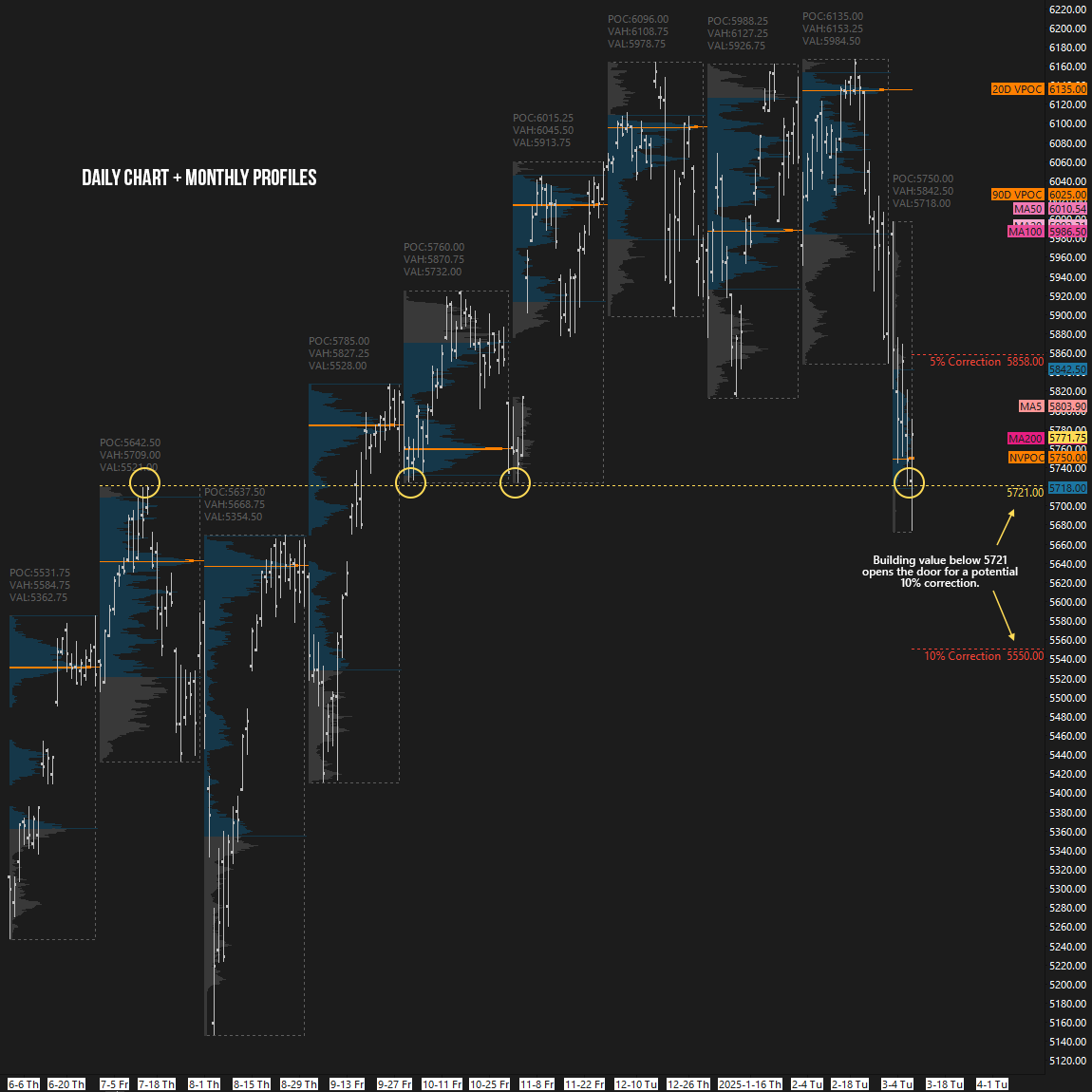

Visual Representation

Market Structure

🟥 DAILY: OTFD | Ends: 5791

🟥 WEEKLY: OTFD | Ends: 5997

🟨 MONTHLY: BALANCE | TBD

Contextual Analysis

Last week, the early focus was on whether the market would accept or reject Friday’s vicious short-covering rally. Monday’s session looked above Friday’s high and failed miserably, as not only was Friday’s closing strength erased, but the entire range was retraced. This confirmed that Friday’s strength failed to attract additional buyers once shorts had covered. The weekly support area was already hit on Monday, and Tuesday’s session tagged and closed below the Weekly Extreme Low of 5815, breaking the January low in the process. Breaking 5815 so early in the week was tricky, with price action reflecting this through big ranges. Still, the daily one-time framing down remained intact. On Friday, the market attempted another downside leg; but sellers failed to follow through, ultimately resulting in a 115-handle reversal, almost returning to the 5815 level. The potential for a reversal was discussed in Friday’s daily plan. You can check out a brief recap of Friday’s session here.

For this week, the main focus will be on whether sellers can sustain downside pressure following the break of the January low at 5813 and the establishment of new yearly lows. Similar to the previous week, Friday’s session saw a short-covering rally, forming an excess low after testing the significant July 2024 high at 5721. Yet, the pattern of lower highs on the daily remained intact throughout the entire week, making it buyers' primary objective to break. A weak market would continue to build value below 5813, aiming to negate Friday’s excess low, which could open the door for a potential 10% correction (5550). Failure to do so—meaning the market finds acceptance back above 5813 after either defending or failing to test the excess low—would signal short-term strength. CPI data is scheduled for release on Wednesday, followed by PPI on Thursday.

The weekly Smashlevel is 5813, representing both the prior YTD low and prior multi-week balance low, breached last week. Break and hold above 5813 would target the pivotal area between 5858 and 5864. Acceptance above 5864 signals strength, targeting the resistance area from 5935 to the Weekly Extreme High of 5965, where selling activity can be expected. Note the added volume profile from the all-time high (ATH), highlighting the most traded price by volume located within this resistance area—a crucial level for sellers to defend. Additionally, the 2025 opening level at 5967 adds confluence to this area.

Holding below 5813 maintains downside pressure, targeting the July 2024 high at 5721—a significant level. Acceptance below 5721 signals weakness, targeting the support area from 5630 to the Weekly Extreme Low of 5600, where buying activity can be expected. Note the Monthly Extreme Low slightly above at 5642, indicating that the risk-reward profile for chasing shorts within the 5642–5600 area is unfavorable should an immediate downside continuation unfold.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will closely observe the behavior around 5813.

Break and hold above 5813 would target 5864 / 5935 / 5965* / 6025 / 6075

Holding below 5813 would target 5721 / 5630 / 5600* / 5550 / 5520

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Levels of interest updated!*

Break and hold below 5920? Do u mean 5720? We are already below 5920.

Thanks for the updates!