ES Daily Plan | March 11, 2024

Starting tomorrow, I will transition to the ESM24 (June) contract. In terms of immediate focus, I’m keeping an eye on Friday’s ESM24 (June) settlement at 5192.50.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

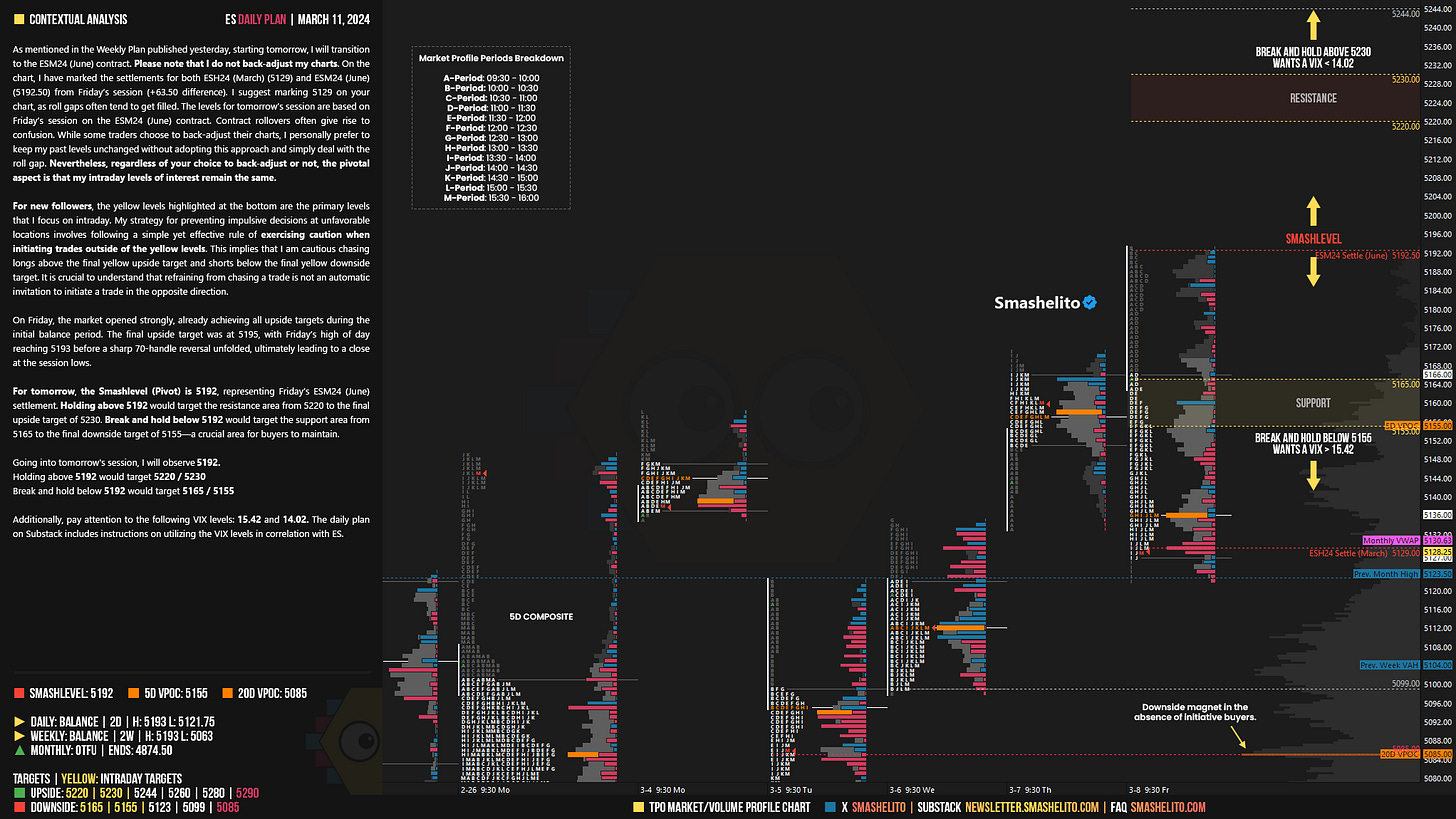

As mentioned in the Weekly Plan published yesterday, starting tomorrow, I will transition to the ESM24 (June) contract. Please note that I do not back-adjust my charts. On the chart, I have marked the settlements for both ESH24 (March) (5129) and ESM24 (June) (5192.50) from Friday’s session (+63.50 difference). I suggest marking 5129 on your chart, as roll gaps often tend to get filled. The levels for tomorrow’s session are based on Friday’s session on the ESM24 (June) contract. Contract rollovers often give rise to confusion. While some traders choose to back-adjust their charts, I personally prefer to keep my past levels unchanged without adopting this approach and simply deal with the roll gap. Nevertheless, regardless of your choice to back-adjust or not, the pivotal aspect is that my intraday levels of interest remain the same.

On Friday, the market opened strongly, already achieving all upside targets during the initial balance period. The final upside target was at 5195, with Friday’s high of day reaching 5193 before a sharp 70-handle reversal unfolded, ultimately leading to a close at the session lows.

For tomorrow, the Smashlevel (Pivot) is 5192, representing Friday’s ESM24 (June) settlement. Holding above 5192 would target the resistance area from 5220 to the final upside target of 5230. Break and hold below 5192 would target the support area from 5165 to the final downside target of 5155—a crucial area for buyers to maintain.

Levels of Interest

Going into tomorrow's session, I will observe 5192.

Holding above 5192 would target 5220 / 5230

Break and hold below 5192 would target 5165 / 5155

Additionally, pay attention to the following VIX levels: 15.42 and 14.02. These levels can provide confirmation of strength or weakness.

Break and hold above 5230 with VIX below 14.02 would confirm strength.

Break and hold below 5155 with VIX above 15.42 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you Smash. Have a good night

Thanks you so much 🙏🏻