ES Daily Plan | March 10, 2025

Key Levels & Market Context for the Upcoming Session.

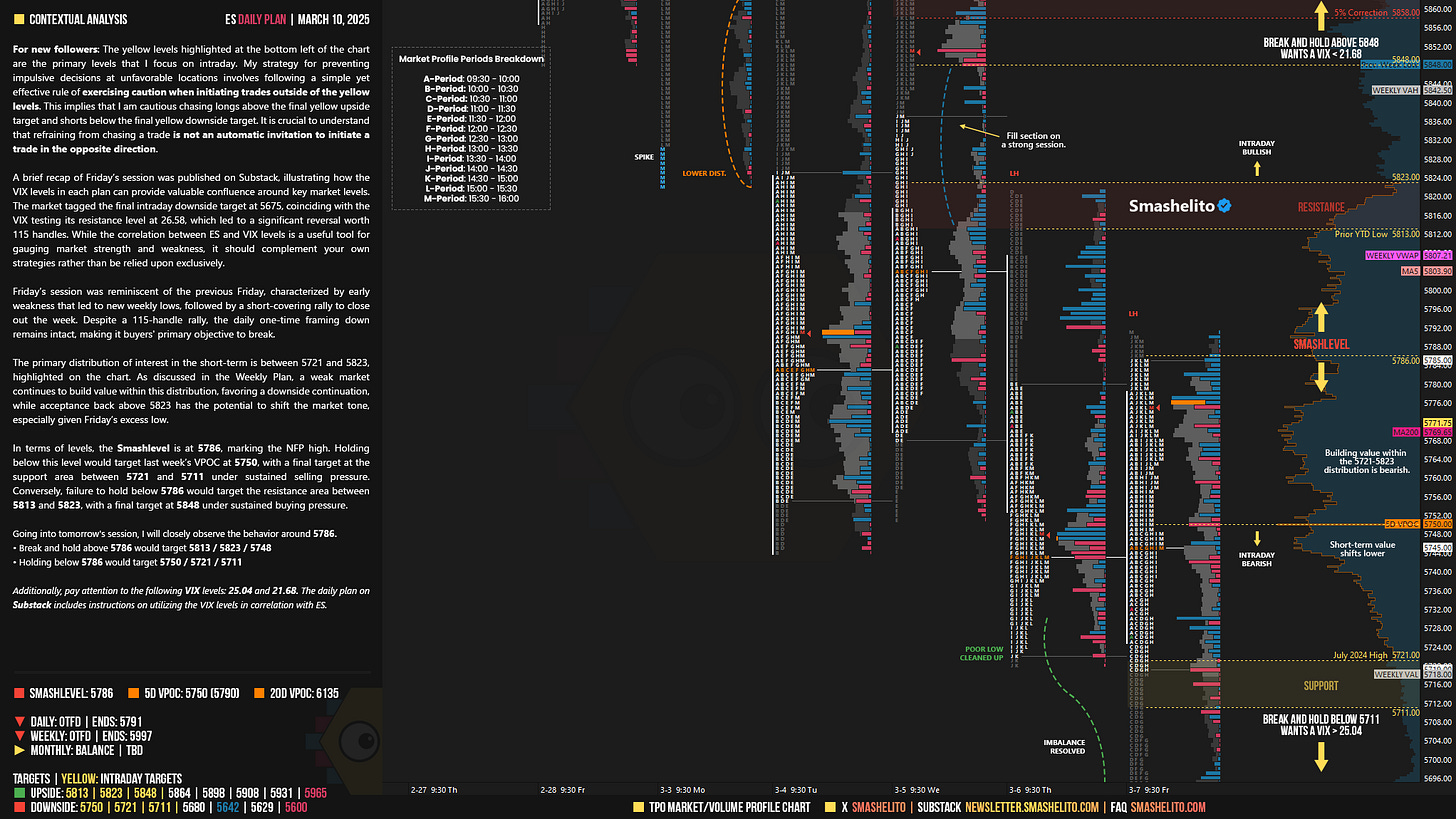

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

A brief recap of Friday’s session was published on Substack (link), illustrating how the VIX levels in each plan can provide valuable confluence around key market levels. The market tagged the final intraday downside target at 5675, coinciding with the VIX testing its resistance level at 26.58, which led to a significant reversal worth 115 handles. While the correlation between ES and VIX levels is a useful tool for gauging market strength and weakness, it should complement your own strategies rather than be relied upon exclusively.

Friday’s session was reminiscent of the previous Friday, characterized by early weakness that led to new weekly lows, followed by a short-covering rally to close out the week. Despite a 115-handle rally, the daily one-time framing down remains intact, making it buyers' primary objective to break.

The primary distribution of interest in the short-term is between 5721 and 5823, highlighted on the chart. As discussed in the Weekly Plan, a weak market continues to build value within this distribution, favoring a downside continuation, while acceptance back above 5823 has the potential to shift the market tone, especially given Friday’s excess low.

In terms of levels, the Smashlevel is at 5786, marking the NFP high. Holding below this level would target last week’s VPOC at 5750, with a final target at the support area between 5721 and 5711 under sustained selling pressure. Conversely, failure to hold below 5786 would target the resistance area between 5813 and 5823, with a final target at 5848 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5786.

Break and hold above 5786 would target 5813 / 5823 / 5848

Holding below 5786 would target 5750 / 5721 / 5711

Additionally, pay attention to the following VIX levels: 25.04 and 21.68. These levels can provide confirmation of strength or weakness.

Break and hold above 5848 with VIX below 21.68 would confirm strength.

Break and hold below 5711 with VIX above 25.04 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

What a reaction off 5711! 👏

Thank you very much!