ES Daily Plan | June 6, 2025

Recap, Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | June 2-6, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

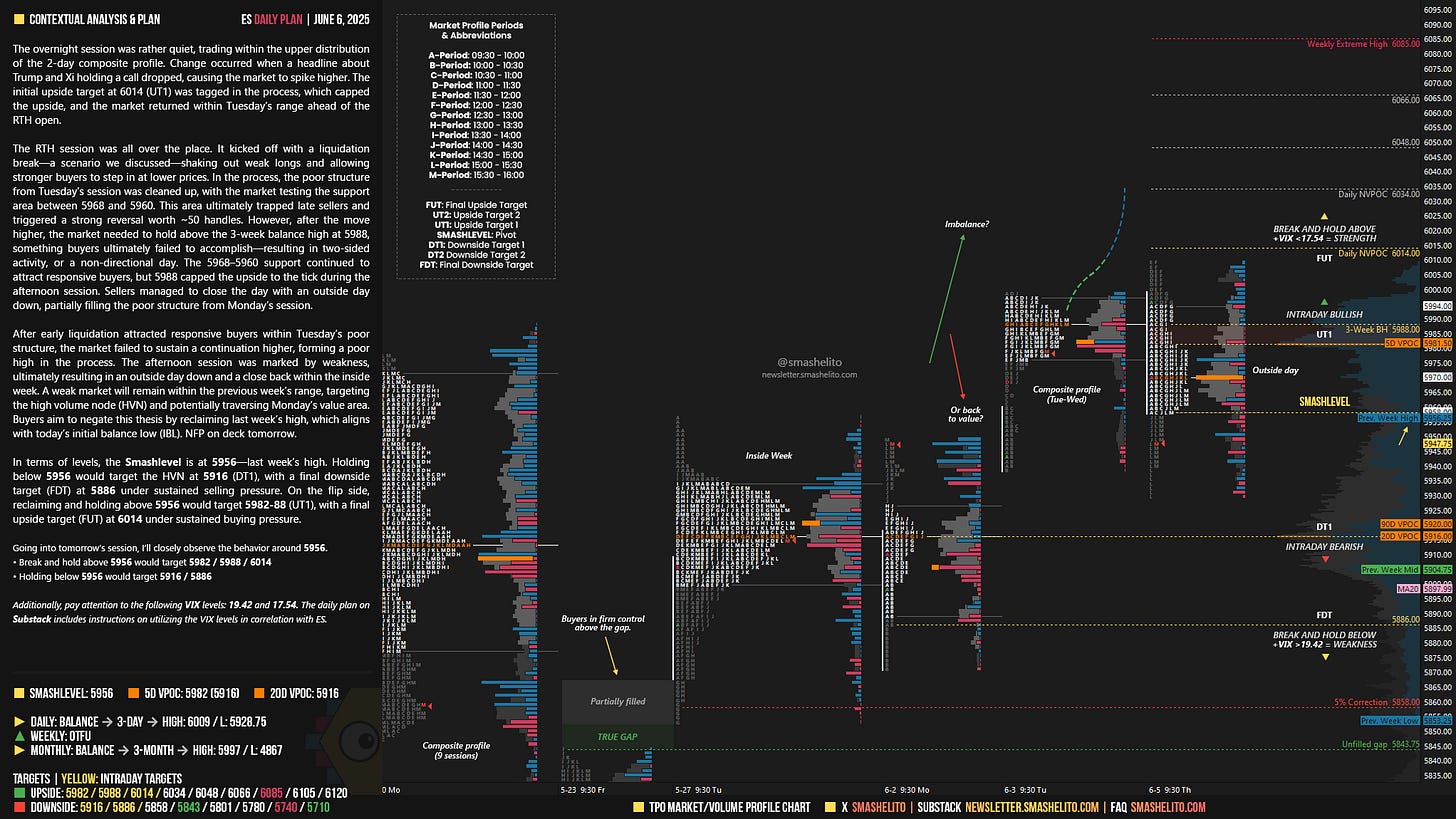

The overnight session was rather quiet, trading within the upper distribution of the 2-day composite profile. Change occurred when a headline about Trump and Xi holding a call dropped, causing the market to spike higher. The initial upside target at 6014 (UT1) was tagged in the process, which capped the upside, and the market returned within Tuesday’s range ahead of the RTH open.

The RTH session was all over the place. It kicked off with a liquidation break—a scenario we discussed—shaking out weak longs and allowing stronger buyers to step in at lower prices. In the process, the poor structure from Tuesday’s session was cleaned up, with the market testing the support area between 5968 and 5960. This area ultimately trapped late sellers and triggered a strong reversal worth ~50 handles. However, after the move higher, the market needed to hold above the 3-week balance high at 5988, something buyers ultimately failed to accomplish—resulting in two-sided activity, or a non-directional day. The 5968–5960 support continued to attract responsive buyers, but 5988 capped the upside to the tick during the afternoon session. Sellers managed to close the day with an outside day down, partially filling the poor structure from Monday’s session.

After early liquidation attracted responsive buyers within Tuesday’s poor structure, the market failed to sustain a continuation higher, forming a poor high in the process. The afternoon session was marked by weakness, ultimately resulting in an outside day down and a close back within the inside week. A weak market will remain within the previous week’s range, targeting the high volume node (HVN) and potentially traversing Monday’s value area. Buyers aim to negate this thesis by reclaiming last week’s high, which aligns with today’s initial balance low (IBL). NFP on deck tomorrow.

In terms of levels, the Smashlevel is at 5956—last week’s high. Holding below 5956 would target the HVN at 5916 (DT1), with a final downside target (FDT) at 5886 under sustained selling pressure.

On the flip side, reclaiming and holding above 5956 would target 5982-88 (UT1), with a final upside target (FUT) at 6014 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5956.

Break and hold above 5956 would target 5982 / 5988 / 6014

Holding below 5956 would target 5916 / 5886

Additionally, pay attention to the following VIX levels: 19.42 and 17.54. These levels can provide confirmation of strength or weakness.

Break and hold above 6014 with VIX below 17.54 would confirm strength.

Break and hold below 5886 with VIX above 19.42 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you as always mr. Smashelito🙌

Thank you!