ES Daily Plan | June 5, 2025

Recap, Market Context & Key Levels for the Day Ahead

— For new subscribers

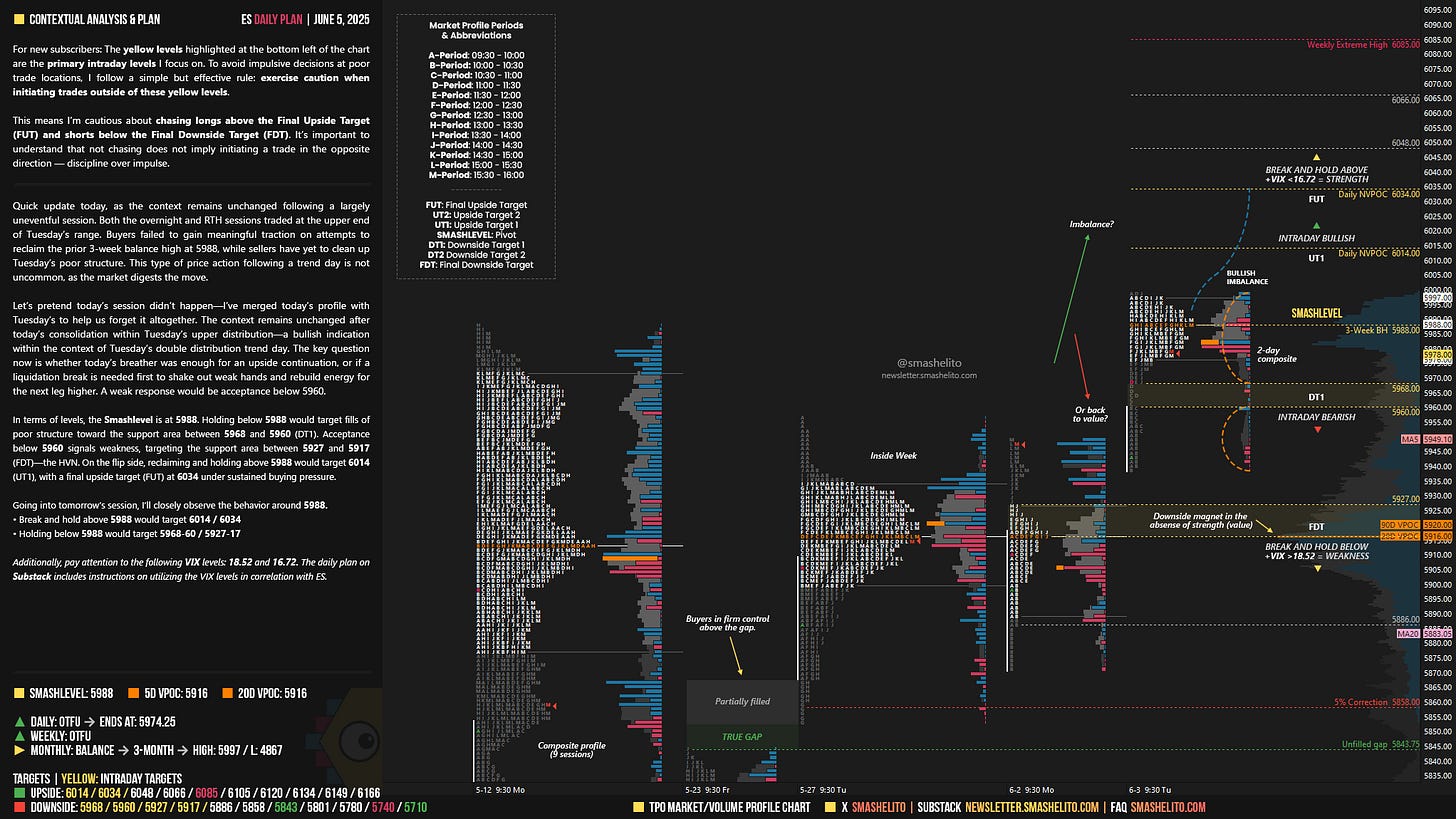

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | June 2-6, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Quick update today, as the context remains unchanged following a largely uneventful session. Both the overnight and RTH sessions traded at the upper end of Tuesday’s range. Buyers failed to gain meaningful traction on attempts to reclaim the prior 3-week balance high at 5988, while sellers have yet to clean up Tuesday’s poor structure. This type of price action following a trend day is not uncommon, as the market digests the move.

Let’s pretend today’s session didn’t happen—I’ve merged today’s profile with Tuesday’s to help us forget it altogether. The context remains unchanged after today’s consolidation within Tuesday’s upper distribution—a bullish indication within the context of Tuesday’s double distribution trend day. The key question now is whether today’s breather was enough for an upside continuation, or if a liquidation break is needed first to shake out weak hands and rebuild energy for the next leg higher. A weak response would be acceptance below 5960.

In terms of levels, the Smashlevel is at 5988. Holding below 5988 would target fills of poor structure toward the support area between 5968 and 5960 (DT1). Acceptance below 5960 signals weakness, targeting the support area between 5927 and 5917 (FDT)—the HVN.

On the flip side, reclaiming and holding above 5988 would target 6014 (UT1), with a final upside target (FUT) at 6034 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5988.

Break and hold above 5988 would target 6014 / 6034

Holding below 5988 would target 5968-60 / 5927-17

Additionally, pay attention to the following VIX levels: 18.52 and 16.72. These levels can provide confirmation of strength or weakness.

Break and hold above 6034 with VIX below 16.72 would confirm strength.

Break and hold below 5917 with VIX above 18.52 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you very much!

Thanks Smash!