ES Daily Plan | June 29, 2023

Four out of the six sets of single prints from yesterday were filled before sellers got a bit ahead of themselves.

Buyers aiming for today's excess, targeting the resistance area. Sellers aiming for the poor low.

Contextual Analysis

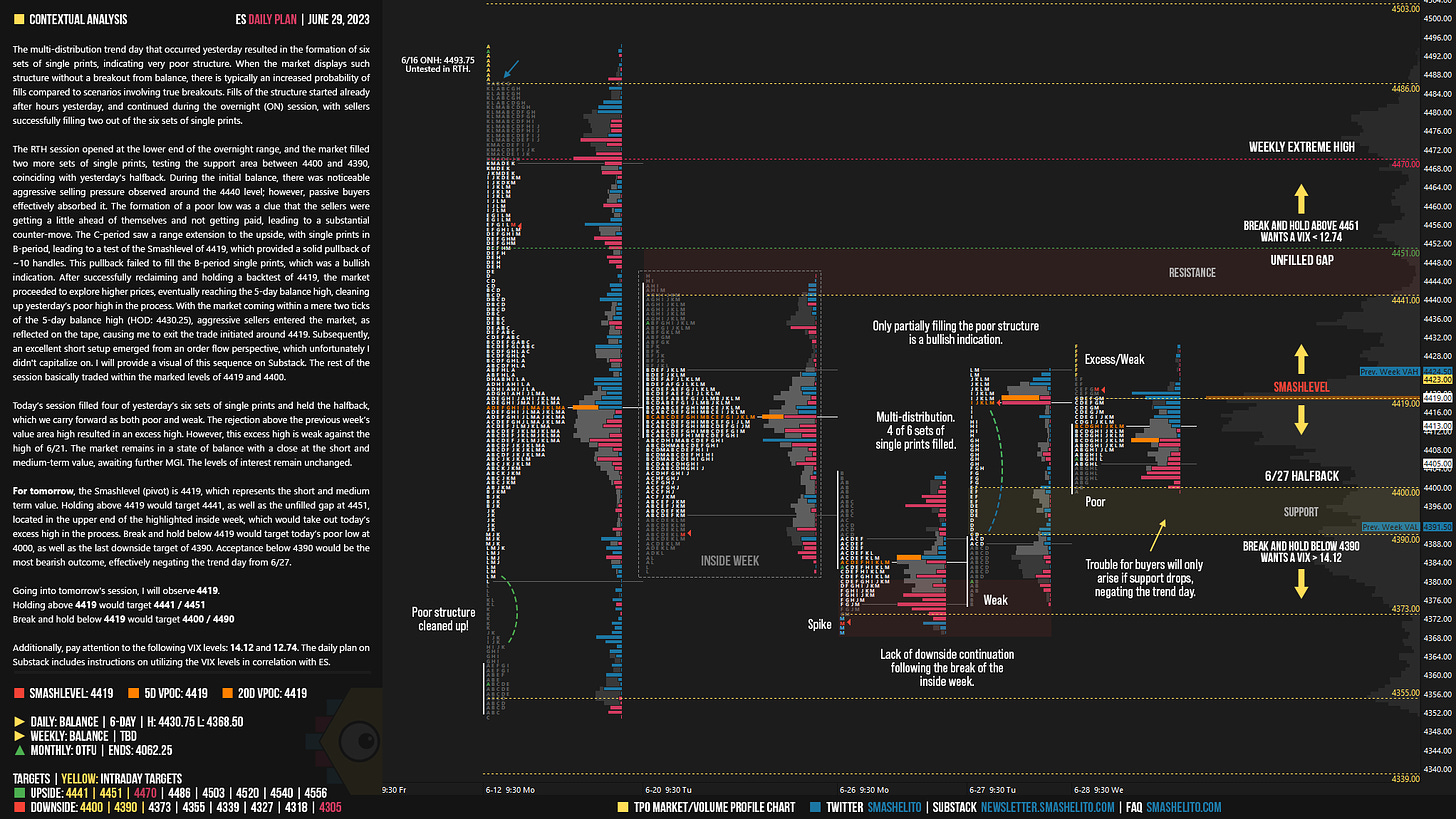

The multi-distribution trend day that occurred yesterday resulted in the formation of six sets of single prints, indicating very poor structure. When the market displays such structure without a breakout from balance, there is typically an increased probability of fills compared to scenarios involving true breakouts. Fills of the structure started already after hours yesterday, and continued during the overnight (ON) session, with sellers successfully filling two out of the six sets of single prints.

The RTH session opened at the lower end of the overnight range, and the market filled two more sets of single prints, testing the support area between 4400 and 4390, coinciding with yesterday's halfback. During the initial balance, there was noticeable aggressive selling pressure observed around the 4440 level; however, passive buyers effectively absorbed it. The formation of a poor low was a clue that the sellers were getting a little ahead of themselves and not getting paid, leading to a substantial counter-move. The C-period saw a range extension to the upside, with single prints in B-period, leading to a test of the Smashlevel of 4419, which provided a solid pullback of ~10 handles. This pullback failed to fill the B-period single prints, which was a bullish indication. After successfully reclaiming and holding a backtest of 4419, the market proceeded to explore higher prices, eventually reaching the 5-day balance high, cleaning up yesterday’s poor high in the process. With the market coming within a mere two ticks of the 5-day balance high (HOD: 4430.25), aggressive sellers entered the market, as reflected on the tape, causing me to exit the trade initiated around 4419. Subsequently, an excellent short setup emerged from an order flow perspective, which unfortunately I didn't capitalize on. I will provide a visual of this sequence on Substack. The rest of the session basically traded within the marked levels of 4419 and 4400.

Today’s session filled four of yesterday’s six sets of single prints and held the halfback, which we carry forward as both poor and weak. The rejection above the previous week’s value area high resulted in an excess high. However, this excess high is weak against the high of 6/21. The market remains in a state of balance with a close at the short and medium-term value, awaiting further MGI. The levels of interest remain unchanged.

For tomorrow, the Smashlevel (pivot) is 4419, which represents the short and medium term value. Holding above 4419 would target 4441, as well as the unfilled gap at 4451, located in the upper end of the highlighted inside week, which would take out today’s excess high in the process. Break and hold below 4419 would target today’s poor low at 4000, as well as the last downside target of 4390. Acceptance below 4390 would be the most bearish outcome, effectively negating the trend day from 6/27.

Going into tomorrow's session, I will observe 4419.

Holding above 4419 would target 4441 / 4451

Break and hold below 4419 would target 4400 / 4390

Additionally, pay attention to the following VIX levels: 14.12 and 12.74. These levels can provide confirmation of strength or weakness.

Break and hold above 4451 with VIX below 12.74 would confirm strength.

Break and hold below 4390 with VIX above 14.12 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Very interesting how much passive buying was there just above 4400. Sellers tried to break that so many times, and it was absorbed every single time.

We've seen the classic picture of a state of balance. "the top of the balance acts as resistance until it is proven false."