ES Daily Plan | June 19/20, 2023

The market is one-time framing up across all time frames.

The short-term focus is on whether buyers can establish value at these higher prices or can sellers develop weakness by negating Thursday's trend day.

Contextual Analysis

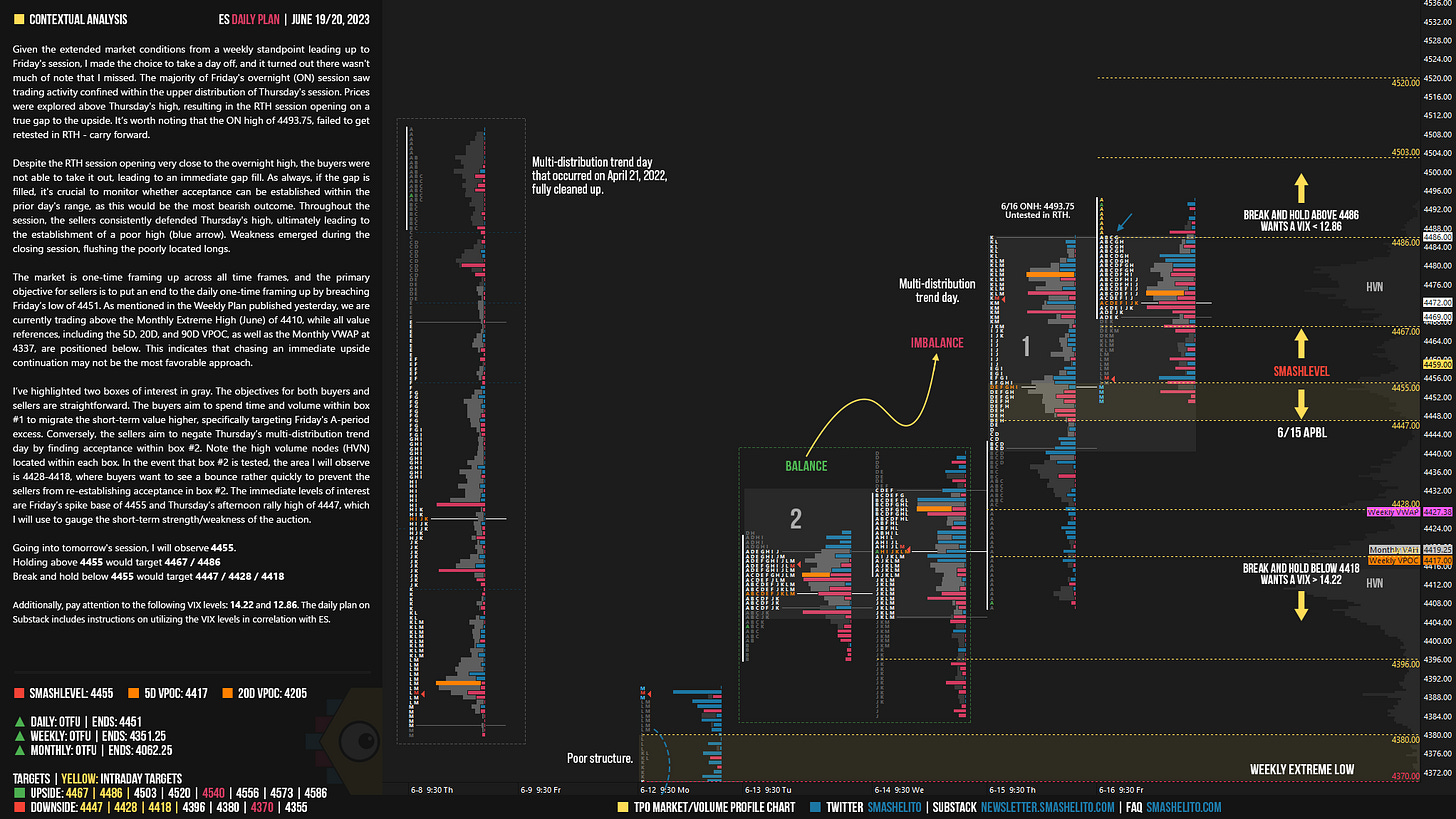

Given the extended market conditions from a weekly standpoint leading up to Friday's session, I made the choice to take a day off, and it turned out there wasn't much of note that I missed. The majority of Friday's overnight (ON) session saw trading activity confined within the upper distribution of Thursday's session. Prices were explored above Thursday's high, resulting in the RTH session opening on a true gap to the upside. It’s worth noting that the ON high of 4493.75, failed to get retested in RTH - carry forward.

Despite the RTH session opening very close to the overnight high, the buyers were not able to take it out, leading to an immediate gap fill. As always, if the gap is filled, it's crucial to monitor whether acceptance can be established within the prior day's range, as this would be the most bearish outcome. Throughout the session, the sellers consistently defended Thursday's high, ultimately leading to the establishment of a poor high (blue arrow). Weakness emerged during the closing session, flushing the poorly located longs.

The market is one-time framing up across all time frames, and the primary objective for sellers is to put an end to the daily one-time framing up by breaching Friday’s low of 4451. As mentioned in the Weekly Plan published yesterday, we are currently trading above the Monthly Extreme High (June) of 4410, while all value references, including the 5D, 20D, and 90D VPOC, as well as the Monthly VWAP at 4337, are positioned below. This indicates that chasing an immediate upside continuation may not be the most favorable approach.

I’ve highlighted two boxes of interest in gray. The objectives for both buyers and sellers are straightforward. The buyers aim to spend time and volume within box #1 to migrate the short-term value higher, specifically targeting Friday's A-period excess. Conversely, the sellers aim to negate Thursday’s multi-distribution trend day by finding acceptance within box #2. Note the high volume nodes (HVN) located within each box. In the event that box #2 is tested, the area I will observe is 4428-4418, where buyers want to see a bounce rather quickly to prevent the sellers from re-establishing acceptance in box #2. The immediate levels of interest are Friday’s spike base of 4455 and Thursday’s afternoon rally high of 4447, which I will use to gauge the short-term strength/weakness of the auction.

Going into tomorrow's session, I will observe 4455.

Holding above 4455 would target 4467 / 4486

Break and hold below 4455 would target 4447 / 4428 / 4418

Additionally, pay attention to the following VIX levels: 14.22 and 12.86. These levels can provide confirmation of strength or weakness.

Break and hold above 4486 with VIX below 12.86 would confirm strength.

Break and hold below 4418 with VIX above 14.22 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Great work as always Smash. Thank you.