ES Daily Plan | June 13, 2025

Recap, Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | June 9-13, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

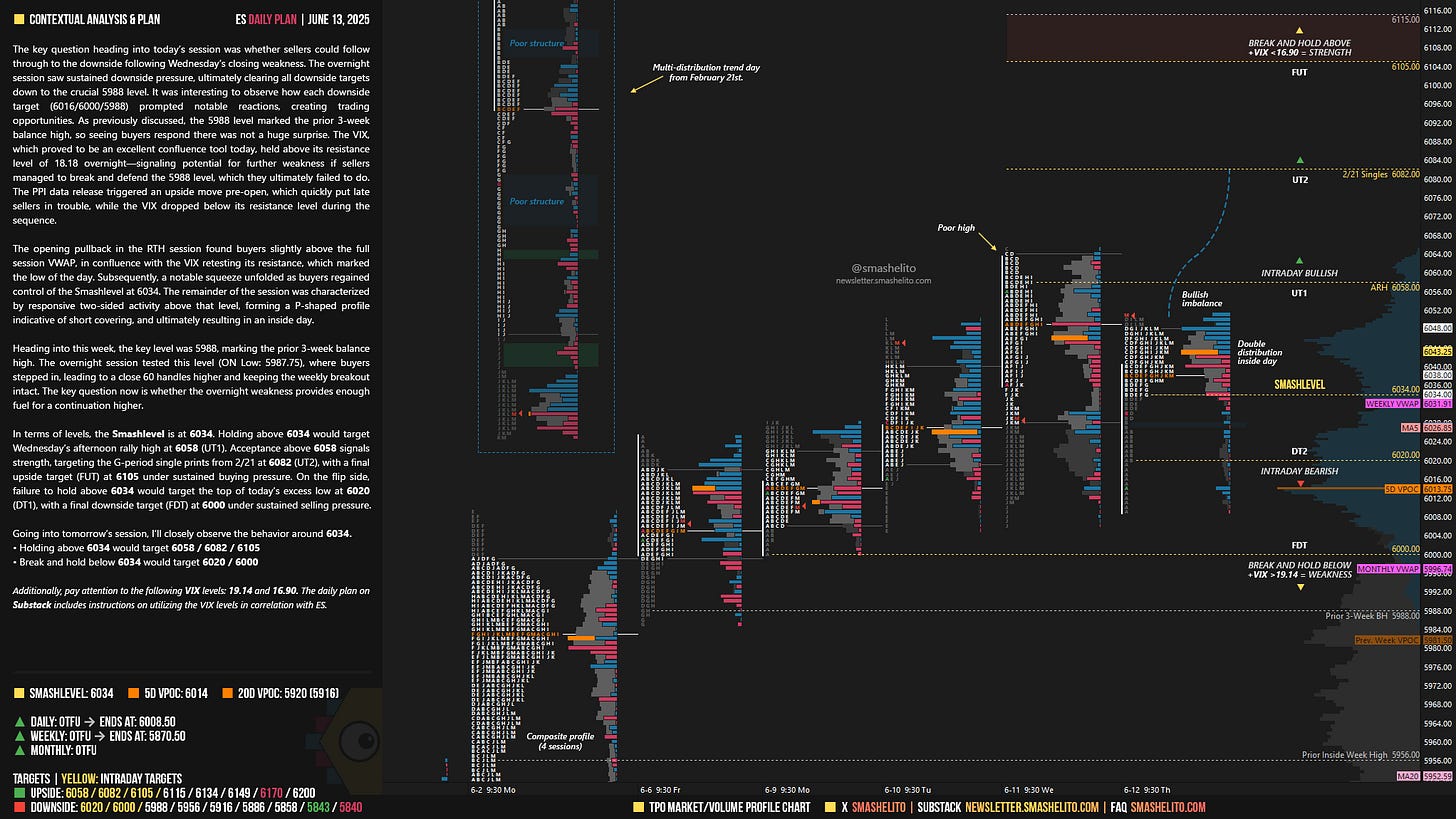

The key question heading into today’s session was whether sellers could follow through to the downside following Wednesday’s closing weakness. The overnight session saw sustained downside pressure, ultimately clearing all downside targets down to the crucial 5988 level. It was interesting to observe how each downside target (6016/6000/5988) prompted notable reactions, creating trading opportunities. As previously discussed, the 5988 level marked the prior 3-week balance high, so seeing buyers respond there was not a huge surprise. The VIX, which proved to be an excellent confluence tool today, held above its resistance level of 18.18 overnight—signaling potential for further weakness if sellers managed to break and defend the 5988 level, which they ultimately failed to do. The PPI data release triggered an upside move pre-open, which quickly put late sellers in trouble, while the VIX dropped below its resistance level during the sequence.

The opening pullback in the RTH session found buyers slightly above the full session VWAP, in confluence with the VIX retesting its resistance, which marked the low of the day. Subsequently, a notable squeeze unfolded as buyers regained control of the Smashlevel at 6034. The remainder of the session was characterized by responsive two-sided activity above that level, forming a P-shaped profile indicative of short covering, and ultimately resulting in an inside day.

Heading into this week, the key level was 5988, marking the prior 3-week balance high. The overnight session tested this level (ON Low: 5987.75), where buyers stepped in, leading to a close 60 handles higher and keeping the weekly breakout intact. The key question now is whether the overnight weakness provides enough fuel for a continuation higher.

In terms of levels, the Smashlevel is at 6034. Holding above 6034 would target Wednesday’s afternoon rally high at 6058 (UT1). Acceptance above 6058 signals strength, targeting the G-period single prints from 2/21 at 6082 (UT2), with a final upside target (FUT) at 6105 under sustained buying pressure.

On the flip side, failure to hold above 6034 would target the top of today’s excess low at 6020 (DT1), with a final downside target (FDT) at 6000 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6034.

Holding above 6034 would target 6058 / 6082 / 6105

Break and hold below 6034 would target 6020 / 6000

Additionally, pay attention to the following VIX levels: 19.14 and 16.90. These levels can provide confirmation of strength or weakness.

Break and hold above 6105 with VIX below 16.90 would confirm strength.

Break and hold below 6000 with VIX above 19.14 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks for all you do.

When are you rolling to September? Good stuff today, set up some nice wins