ES Daily Plan | June 12, 2025

Recap, Market Context & Key Levels for the Day Ahead

— For new subscribers

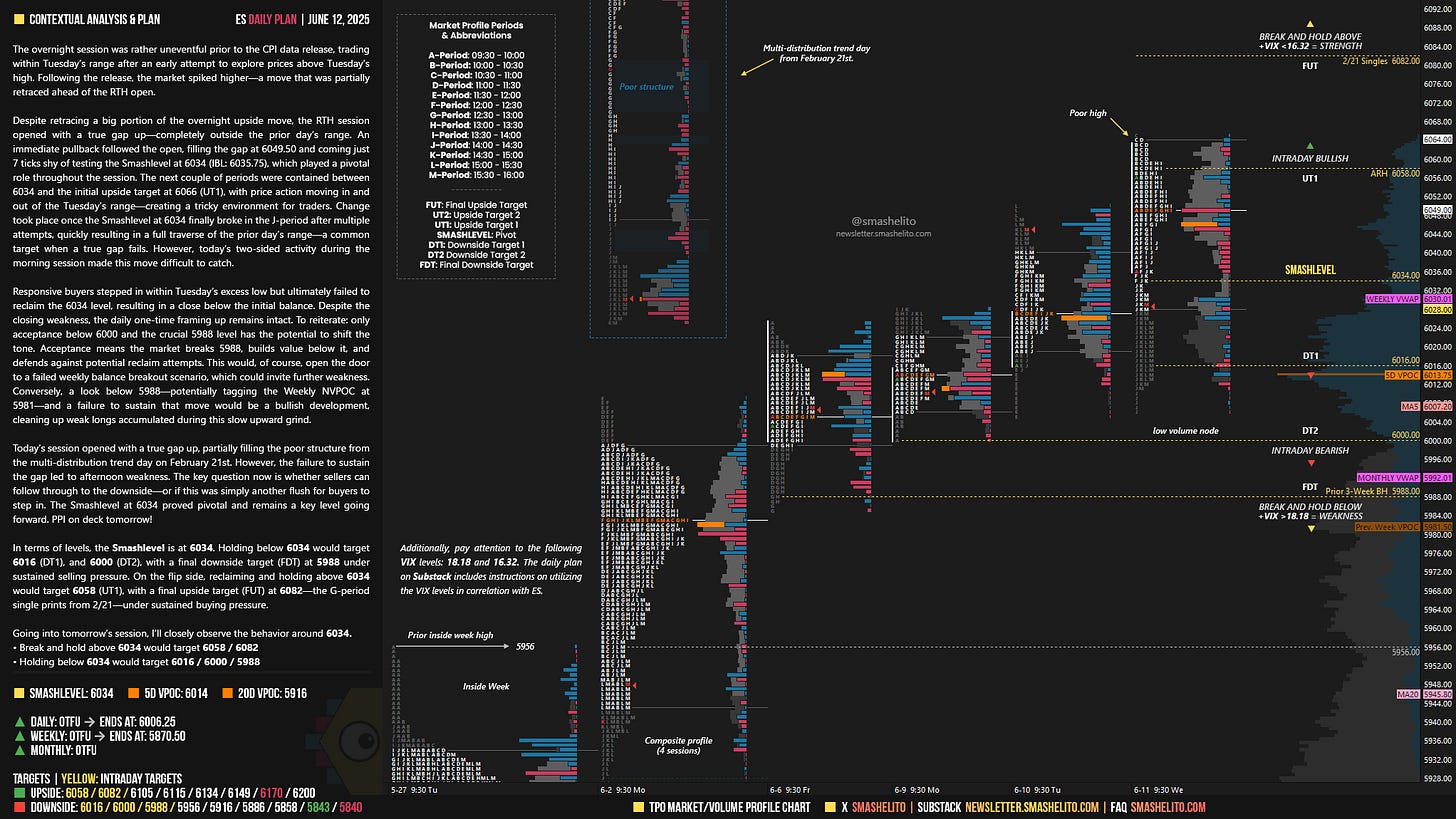

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | June 9-13, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

The overnight session was rather uneventful prior to the CPI data release, trading within Tuesday’s range after an early attempt to explore prices above Tuesday’s high. Following the release, the market spiked higher—a move that was partially retraced ahead of the RTH open.

Despite retracing a big portion of the overnight upside move, the RTH session opened with a true gap up—completely outside the prior day’s range. An immediate pullback followed the open, filling the gap at 6049.50 and coming just 7 ticks shy of testing the Smashlevel at 6034 (IBL: 6035.75), which played a pivotal role throughout the session. The next couple of periods were contained between 6034 and the initial upside target at 6066 (UT1), with price action moving in and out of the Tuesday’s range—creating a tricky environment for traders. Change took place once the Smashlevel at 6034 finally broke in the J-period after multiple attempts, quickly resulting in a full traverse of the prior day’s range—a common target when a true gap fails. However, today’s two-sided activity during the morning session made this move difficult to catch.

Responsive buyers stepped in within Tuesday’s excess low but ultimately failed to reclaim the 6034 level, resulting in a close below the initial balance. Despite the closing weakness, the daily one-time framing up remains intact. To reiterate: only acceptance below 6000 and the crucial 5988 level has the potential to shift the tone. Acceptance means the market breaks 5988, builds value below it, and defends against potential reclaim attempts. This would, of course, open the door to a failed weekly balance breakout scenario, which could invite further weakness. Conversely, a look below 5988—potentially tagging the Weekly NVPOC at 5981—and a failure to sustain that move would be a bullish development, cleaning up weak longs accumulated during this slow upward grind.

Today’s session opened with a true gap up, partially filling the poor structure from the multi-distribution trend day on February 21st. However, the failure to sustain the gap led to afternoon weakness. The key question now is whether sellers can follow through to the downside—or if this was simply another flush for buyers to step in. The Smashlevel at 6034 proved pivotal and remains a key level going forward. PPI on deck tomorrow!

In terms of levels, the Smashlevel is at 6034. Holding below 6034 would target 6016 (DT1), and 6000 (DT2), with a final downside target (FDT) at 5988 under sustained selling pressure.

On the flip side, reclaiming and holding above 6034 would target 6058 (UT1), with a final upside target (FUT) at 6082—the G-period single prints from 2/21—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6034.

Break and hold above 6034 would target 6058 / 6082

Holding below 6034 would target 6016 / 6000 / 5988

Additionally, pay attention to the following VIX levels: 18.18 and 16.32. These levels can provide confirmation of strength or weakness.

Break and hold above 6082 with VIX below 16.32 would confirm strength.

Break and hold below 5988 with VIX above 18.18 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

You're the man Smash!

Wonderful stuff Smash! When will you roll to Sep?