ES Daily Plan | June 10, 2025

Recap, Market Context & Key Levels for the Day Ahead

— For new subscribers

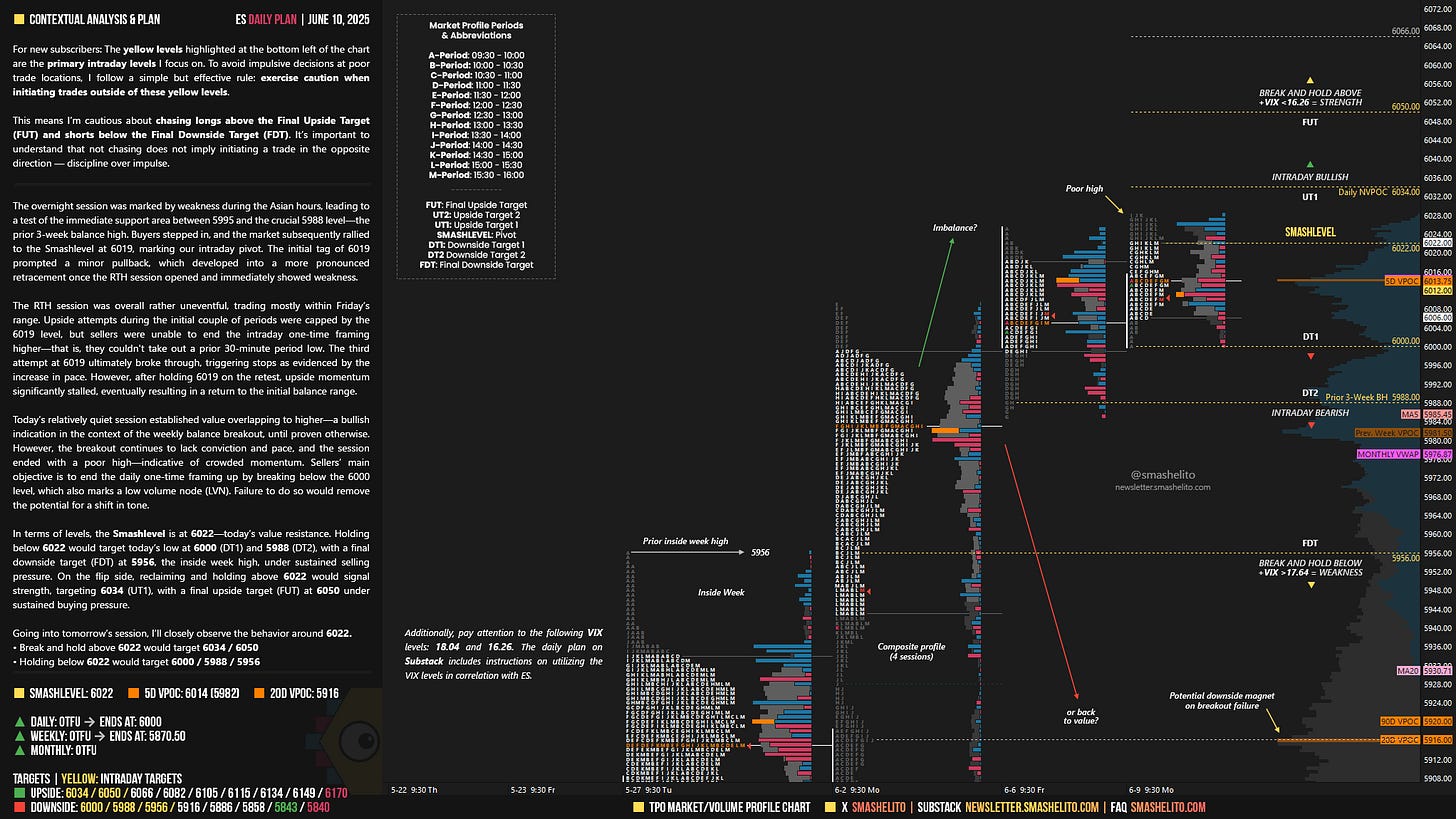

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | June 9-13, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

The overnight session was marked by weakness during the Asian hours, leading to a test of the immediate support area between 5995 and the crucial 5988 level—the prior 3-week balance high. Buyers stepped in, and the market subsequently rallied to the Smashlevel at 6019, marking our intraday pivot. The initial tag of 6019 prompted a minor pullback, which developed into a more pronounced retracement once the RTH session opened and immediately showed weakness.

The RTH session was overall rather uneventful, trading mostly within Friday’s range. Upside attempts during the initial couple of periods were capped by the 6019 level, but sellers were unable to end the intraday one-time framing higher—that is, they couldn't take out a prior 30-minute period low. The third attempt at 6019 ultimately broke through, triggering stops as evidenced by the increase in pace. However, after holding 6019 on the retest, upside momentum significantly stalled, eventually resulting in a return to the initial balance range.

Today’s relatively quiet session established value overlapping to higher—a bullish indication in the context of the weekly balance breakout, until proven otherwise. However, the breakout continues to lack conviction and pace, and the session ended with a poor high—indicative of crowded momentum. Sellers’ main objective is to end the daily one-time framing up by breaking below the 6000 level, which also marks a low volume node (LVN). Failure to do so would remove the potential for a shift in tone.

In terms of levels, the Smashlevel is at 6022—today’s value resistance. Holding below 6022 would target today’s low at 6000 (DT1) and 5988 (DT2), with a final downside target (FDT) at 5956, the inside week high, under sustained selling pressure. On the flip side, reclaiming and holding above 6022 would signal strength, targeting 6034 (UT1), with a final upside target (FUT) at 6050 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6022.

Break and hold above 6022 would target 6034 / 6050

Holding below 6022 would target 6000 / 5988 / 5956

Additionally, pay attention to the following VIX levels: 18.04 and 16.26. These levels can provide confirmation of strength or weakness.

Break and hold above 6050 with VIX below 16.26 would confirm strength.

Break and hold below 5956 with VIX above 18.04 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you Smash!

Hello Smash,

How much importance do you give to intraday one time framing, is it something that regularly shows you who is in control and which side to play. I always look at the one time frame on the daily chart but it might be useful to use it intraday also.

Thanks for the great analysis...