ES Daily Plan | July 3-4, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | June 30 - July 4 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

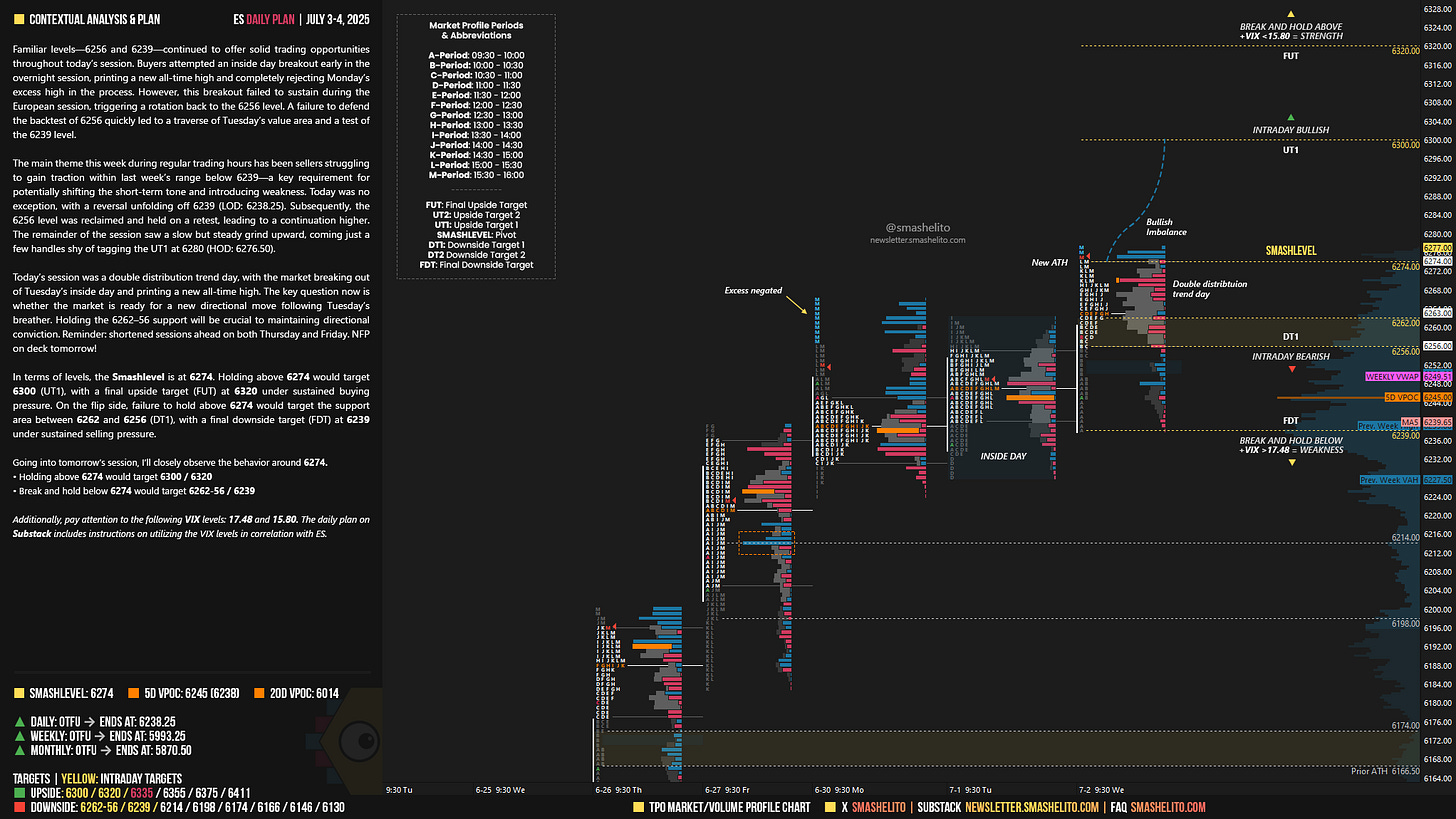

Familiar levels—6256 and 6239—continued to offer solid trading opportunities throughout today’s session. Buyers attempted an inside day breakout early in the overnight session, printing a new all-time high and completely rejecting Monday’s excess high in the process. However, this breakout failed to sustain during the European session, triggering a rotation back to the 6256 level. A failure to defend the backtest of 6256 quickly led to a traverse of Tuesday’s value area and a test of the 6239 level.

The main theme this week during regular trading hours has been sellers struggling to gain traction within last week’s range below 6239—a key requirement for potentially shifting the short-term tone and introducing weakness. Today was no exception, with a reversal unfolding off 6239 (LOD: 6238.25). Subsequently, the 6256 level was reclaimed and held on a retest, leading to a continuation higher. The remainder of the session saw a slow but steady grind upward, coming just a few handles shy of tagging the UT1 at 6280 (HOD: 6276.50).

Today’s session was a double distribution trend day, with the market breaking out of Tuesday’s inside day and printing a new all-time high. The key question now is whether the market is ready for a new directional move following Tuesday’s breather. Holding the 6262–56 support will be crucial to maintaining directional conviction. Reminder: shortened sessions ahead on both Thursday and Friday. NFP on deck tomorrow!

In terms of levels, the Smashlevel is at 6274. Holding above 6274 would target 6300 (UT1), with a final upside target (FUT) at 6320 under sustained buying pressure.

On the flip side, failure to hold above 6274 would target the support area between 6262 and 6256 (DT1), with a final downside target (FDT) at 6239 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6274.

Break and hold above 6274 would target 6300 / 6320

Holding below 6274 would target 6262-56 / 6239

Additionally, pay attention to the following VIX levels: 17.48 and 15.80. These levels can provide confirmation of strength or weakness.

Break and hold above 6320 with VIX below 15.80 would confirm strength.

Break and hold below 6239 with VIX above 17.48 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks :)

Thank you again