ES Daily Plan | July 26, 2023

Leading up to tomorrow's FOMC meeting, the market is in a 6-day balance.

As always, this event is expected to bring significant volatility and may act as a catalyst to resolve the current short-term balance. Stay nimble.

Contextual Analysis

The Asian session remained relatively uneventful. Just before the European session opened, the market pushed higher towards the Smashlevel of 4589. Although the price was initially rejected at this level, the buyers eventually managed to break through. At 4590, there was notable order flow activity, as passive sellers were reloading. This resulted in a decent drop before the opening of the regular trading hours (RTH).

In the RTH session, the market battled around the 4589 level for the first four periods. Subsequently, a range extension to the upside was established during the E-period. During the F-period, there was a pullback to the ON high, presenting a good opportunity to consider a continuation trade. This sequence was particularly interesting because the F-period failed to fill the single prints that were established during the E-period. The next upside level was the upper end of the multi-day balance at 4606, which was reached in K-period. The K-period fell two ticks short of the balance high, before reversing, making it a weak reference to carry forward.

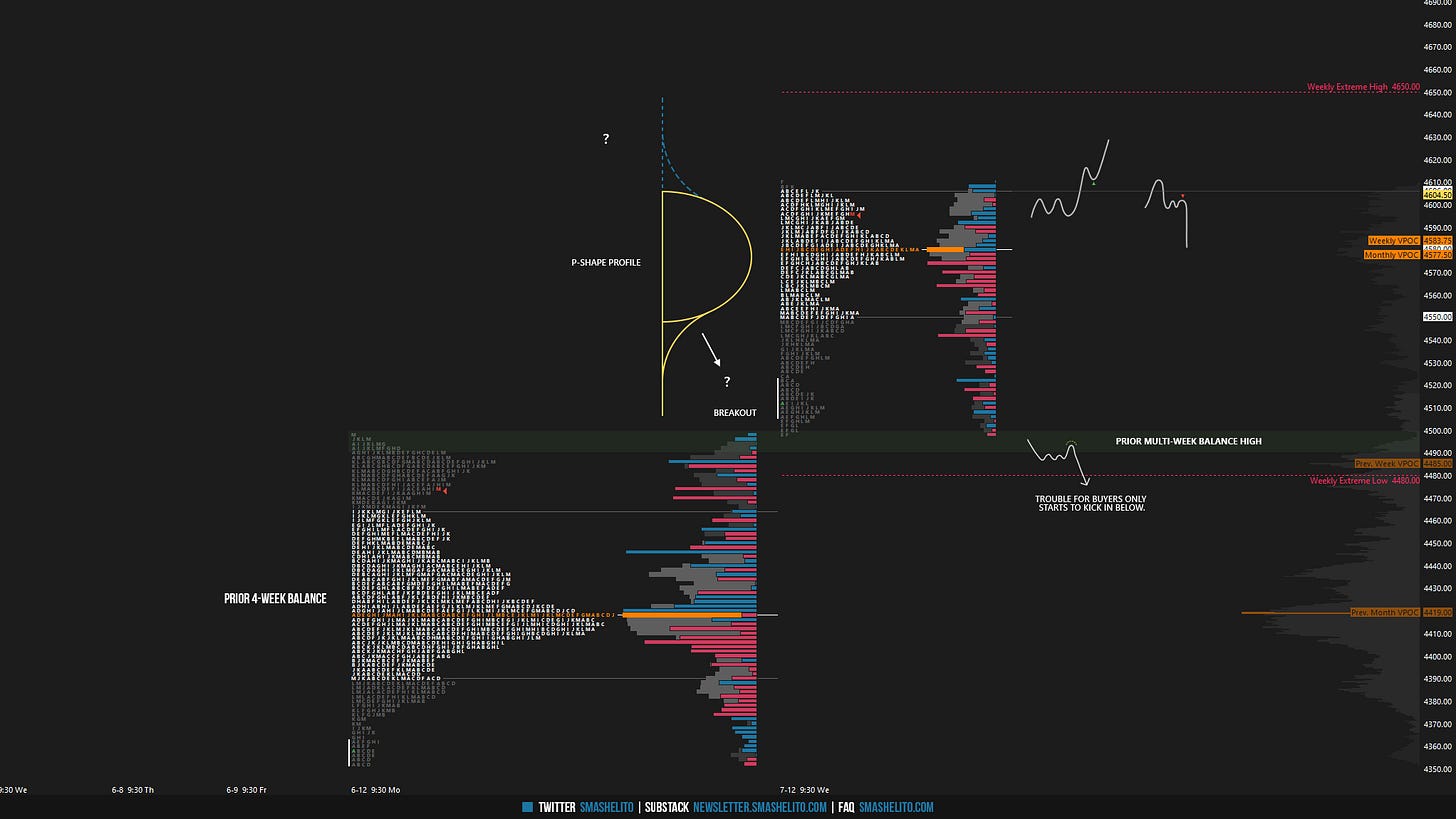

After Thursday's session, the main theme has been responsive activity as the daily returned to a state of balance. The daily is now in a 6-day balance, awaiting more market generated information. Remember that the longer a consolidation lasts, the more significant the move out of it tends to be. Tomorrow, we have the FOMC meeting, which, as always, is expected to bring significant volatility and potentially resolve this short-term balance area. FOMC events are known to have a considerable impact on the market, so it's advisable to stay nimble and consider going flat 30 minutes before the event. With plenty of opportunities likely to arise throughout the rest of the week, it's best to avoid getting caught up in the noise surrounding the FOMC announcement. Since the breakout from the multi-week balance area, the market has essentially formed a P-shape profile (in an uptrend), suggesting that the upward auction is not yet complete. I will provide a visual of this on Substack to highlight this point further.

For tomorrow, the Smashlevel (Pivot) is 4589, representing the level that put an end to the daily one-time framing up on Thursday of the previous week. Note the confluence with the Weekly VWAP. Holding above 4589 would target the upper end of the 6-day balance at 4606. Break and hold above 4606, indicating a successful breakout, would target 4620, as well as the last upside target of 4631. The Weekly Extreme High is located at 4650, in the case of continued strength. Break and hold below 4589 would target 4572, as well as the last downside target of 4558. In the event of further weakness, the 6-day balance low is located at 4545.

Going into tomorrow's session, I will observe 4589.

Holding above 4589 would target 4606 / 4620 / 4631

Break and hold below 4589 would target 4572 / 4558

Additionally, pay attention to the following VIX levels: 14.68 and 13.14. These levels can provide confirmation of strength or weakness.

Break and hold above 4631 with VIX below 13.14 would confirm strength.

Break and hold below 4558 with VIX above 14.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

As always, thank you!

Great plan. Thank you