ES Weekly Plan | July 24-28, 2023

Below are my expectations for the week ahead.

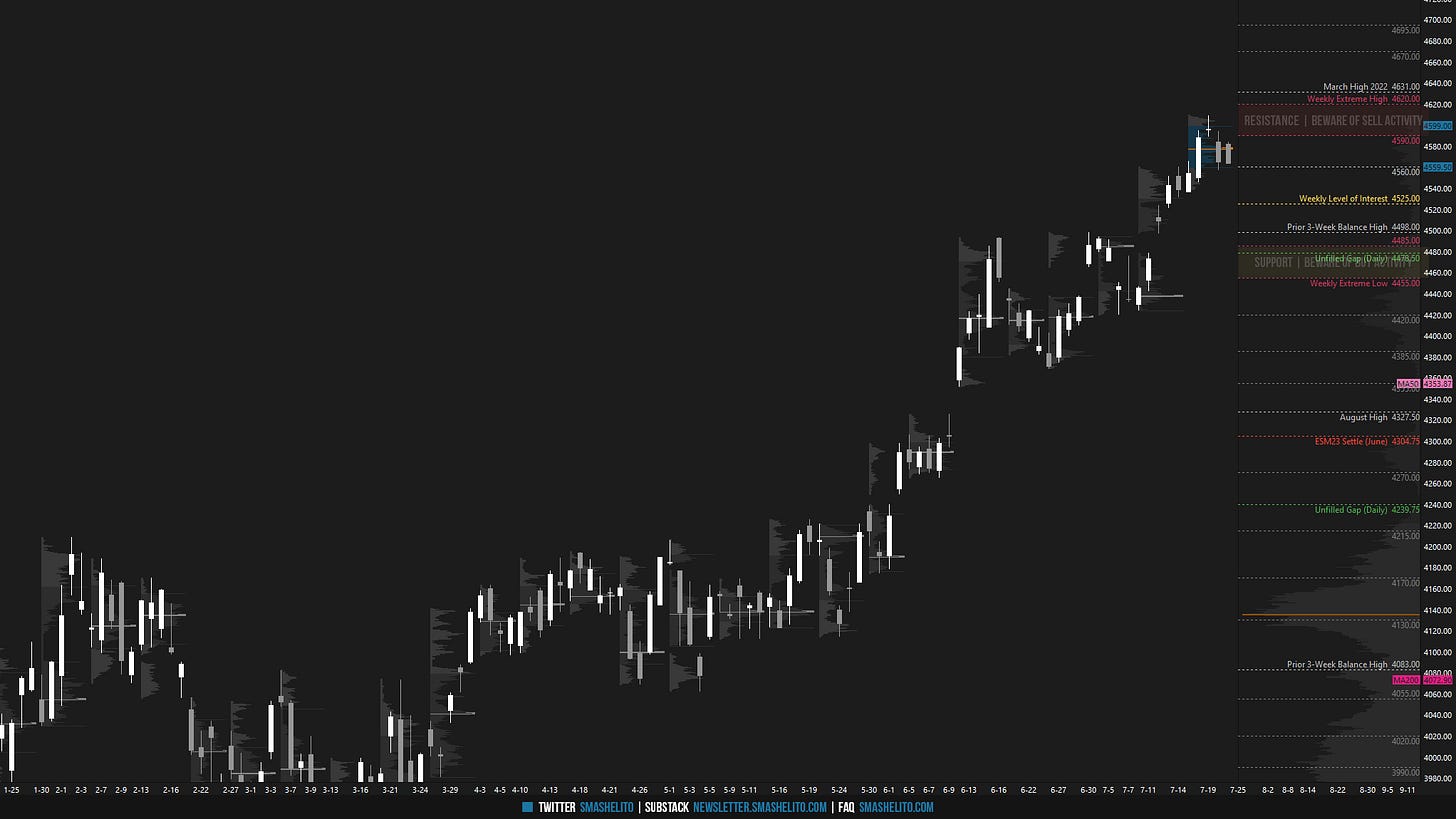

🟨 Daily: BALANCE | 4-Day | H: 4609.25 L: 4545.25

🟩 Weekly: OTFU | Ends: 4536.25

🟩 Monthly: OTFU | Ends: 4178

Weekly Extreme High: 4650

Weekly Extreme Low: 4480

As usual, a detailed daily plan will be published tomorrow.

During the previous week, the market showed continued strength in the first three days, with Tuesday standing out as a triple distribution trend day. This resulted in a test of the weekly resistance area, highlighted in the previous Weekly Plan. This resistance area encountered selling activity, leading to the daily returning to balance on Thursday, which aligned with the primary objective of the sellers. Consequently, two-sided activity was to be expected, and Friday's inside day served as confirmation of the market taking a short-term breather.

For this week, the main focus will be on the highlighted 4-day balance (4DB). Having successfully put an end to the daily one-time framing up on Thursday, the sellers are now aiming to break the 4-day balance to the downside. In such a scenario, where Tuesday's trend day would be effectively negated, there is potential for further weakness. However, as long as that doesn't happen, the buyers can remain fairly comfortable. The market continues to establish value at higher prices following the breakout from the 4-week balance area, which serves as a bullish indication in context of the recent directional upward move. As a result, both the short (5D) and medium-term (20D) value have shifted higher. Take note of the significant confluences present within this week's support and resistance areas, which we will discuss in more detail below. FOMC on Wednesday.

The weekly level of interest is 4584, which represents the high of Friday’s inside day. Break and hold above 4584 would target the resistance area from 4620 to the Weekly Extreme High of 4650, where selling activity can be expected. Take note of the March high from 2022 at 4631 and the 100% range extension from the prior 4-week balance at 4645. It’s also worth noting that the Monthly Extreme High of July is located at 4650, adding an additional layer of confluence to the resistance area.

Holding below 4584 would target the low of Tuesday’s triple distribution trend day at 4545, which is the 4-day balance low. Break and hold below 4545 would target the support area from 4510 to the Weekly Extreme Low of 4480, where buying activity can be expected. Take note of the unfilled daily gap at 4478.50, and how the support area coincides with the prior 4-week balance high. In other words, this area carries immense importance as it presents a substantial challenge for sellers to break and serves as a crucial area for buyers to defend. As I’ve mentioned since the month of April, for any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low, with a weekly close below it being preferred, which has yet to occur.

🟩 Upside: 4620 | 4631 | 4650 | 4670 | 4695

🟥 Downside: 4545 | 4510 | 4480 | 4455 | 4420

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.