ES Daily Plan | July 2, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | June 30 - July 4 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

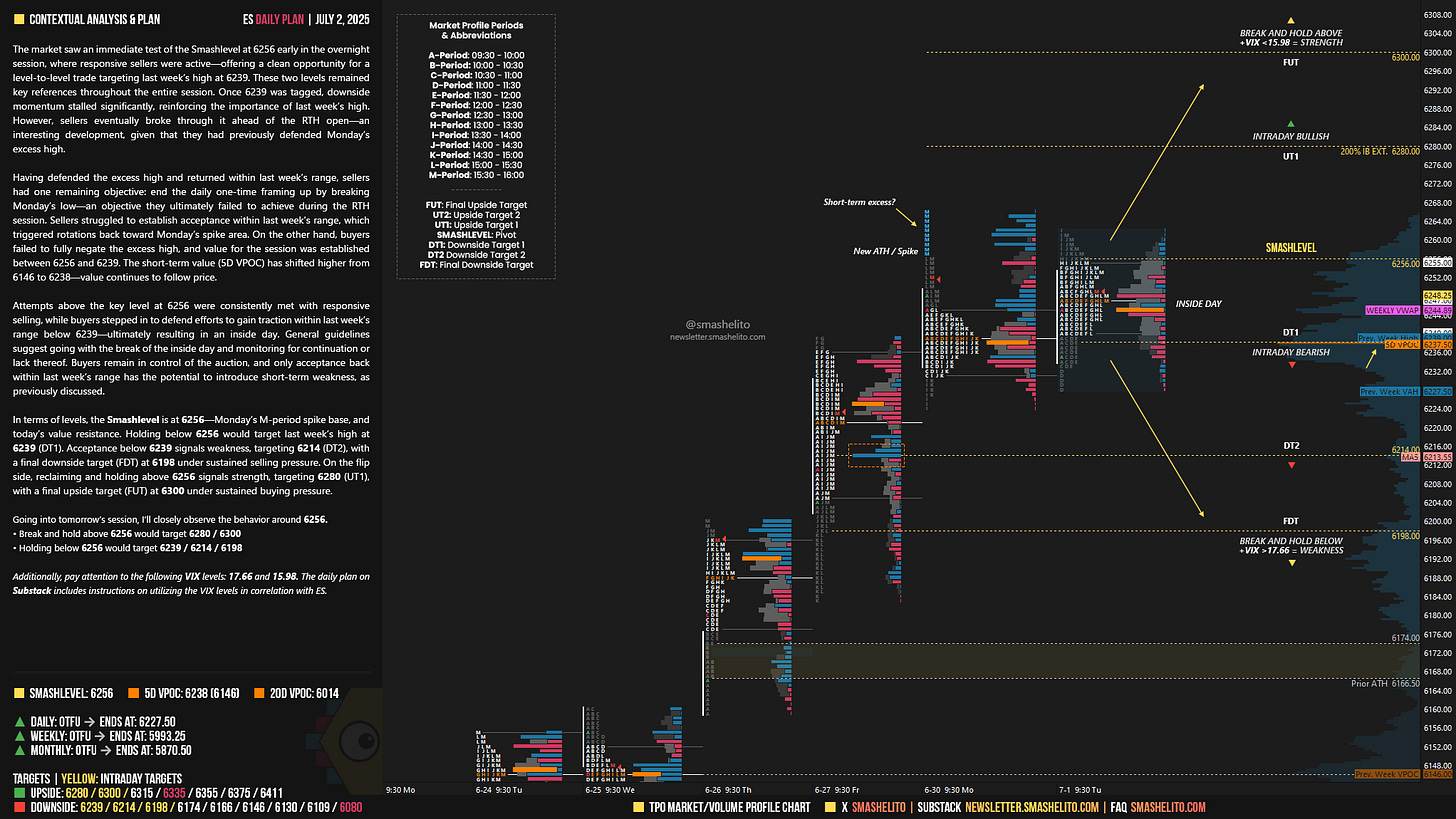

The market saw an immediate test of the Smashlevel at 6256 early in the overnight session, where responsive sellers were active—offering a clean opportunity for a level-to-level trade targeting last week’s high at 6239. These two levels remained key references throughout the entire session. Once 6239 was tagged, downside momentum stalled significantly, reinforcing the importance of last week’s high. However, sellers eventually broke through it ahead of the RTH open—an interesting development, given that they had previously defended Monday’s excess high.

Having defended the excess high and returned within last week’s range, sellers had one remaining objective: end the daily one-time framing up by breaking Monday’s low—an objective they ultimately failed to achieve during the RTH session. Sellers struggled to establish acceptance within last week’s range, which triggered rotations back toward Monday’s spike area. On the other hand, buyers failed to fully negate the excess high, and value for the session was established between 6256 and 6239. The short-term value (5D VPOC) has shifted higher from 6146 to 6238—value continues to follow price.

Attempts above the key level at 6256 were consistently met with responsive selling, while buyers stepped in to defend efforts to gain traction within last week’s range below 6239—ultimately resulting in an inside day. General guidelines suggest going with the break of the inside day and monitoring for continuation or lack thereof. Buyers remain in control of the auction, and only acceptance back within last week’s range has the potential to introduce short-term weakness, as previously discussed.

In terms of levels, the Smashlevel is at 6256—Monday’s M-period spike base, and today’s value resistance. Holding below 6256 would target last week’s high at 6239 (DT1). Acceptance below 6239 signals weakness, targeting 6214 (DT2), with a final downside target (FDT) at 6198 under sustained selling pressure.

On the flip side, reclaiming and holding above 6256 signals strength, targeting 6280 (UT1), with a final upside target (FUT) at 6300 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6256.

Break and hold above 6256 would target 6280 / 6300

Holding below 6256 would target 6239 / 6214 / 6198

Additionally, pay attention to the following VIX levels: 17.66 and 15.98. These levels can provide confirmation of strength or weakness.

Break and hold above 6300 with VIX below 15.98 would confirm strength.

Break and hold below 6198 with VIX above 17.66 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you!

Thank you very much!