ES Daily Plan | July 16, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | July 14-18, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

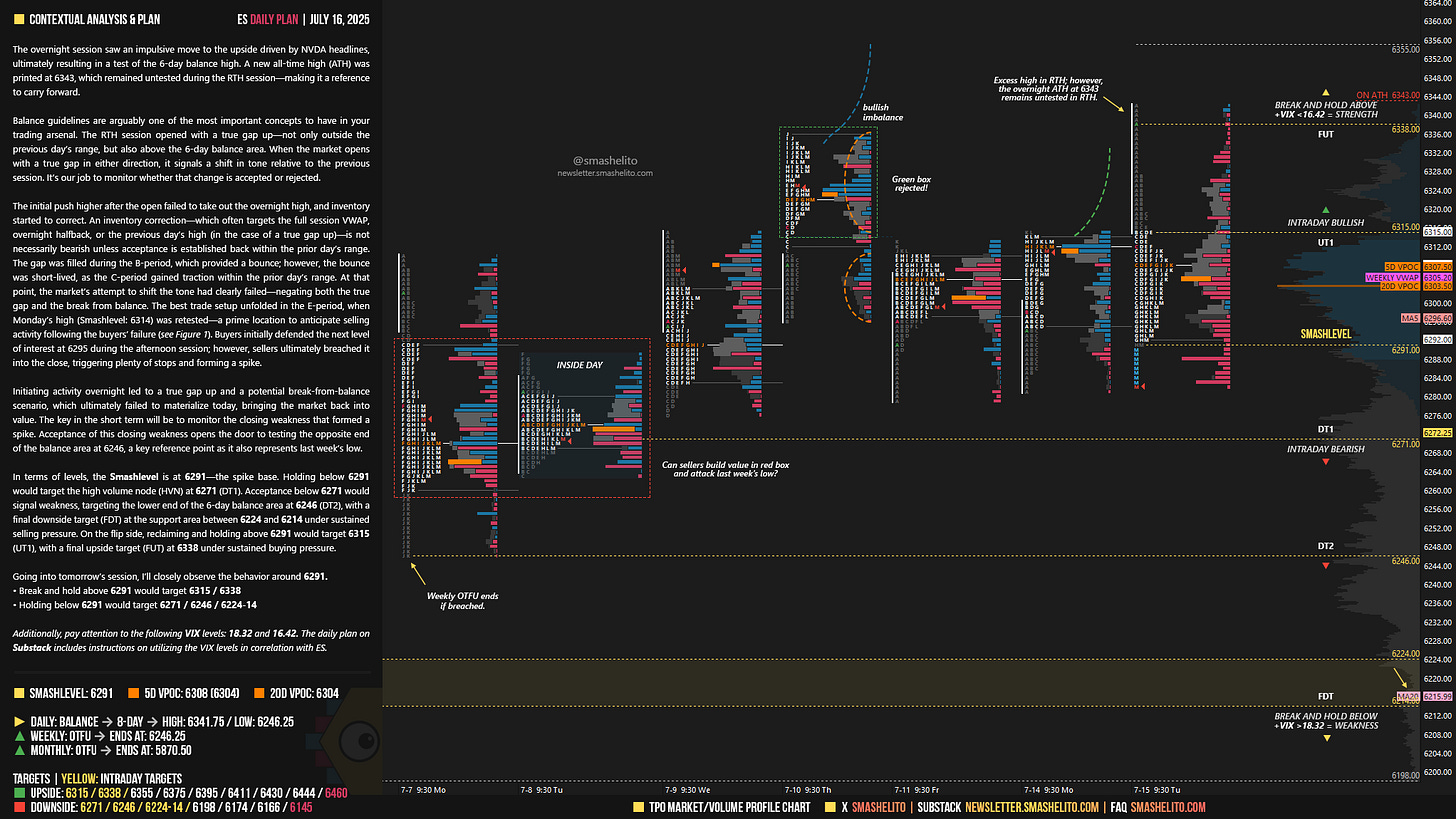

The overnight session saw an impulsive move to the upside driven by NVDA headlines, ultimately resulting in a test of the 6-day balance high. A new all-time high (ATH) was printed at 6343, which remained untested during the RTH session—making it a reference to carry forward.

Balance guidelines are arguably one of the most important concepts to have in your trading arsenal. The RTH session opened with a true gap up—not only outside the previous day’s range, but also above the 6-day balance area. When the market opens with a true gap in either direction, it signals a shift in tone relative to the previous session. It’s our job to monitor whether that change is accepted or rejected.

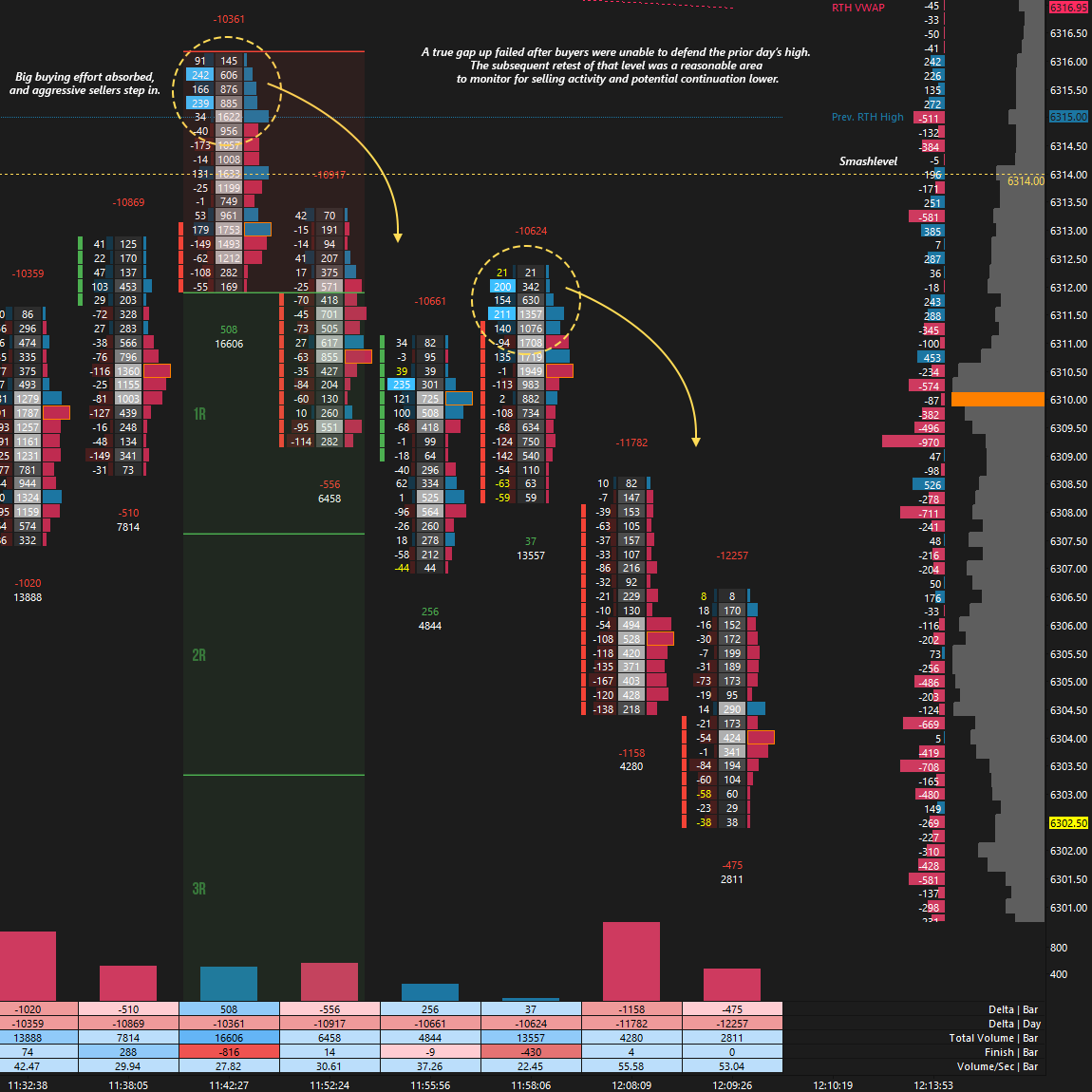

The initial push higher after the open failed to take out the overnight high, and inventory started to correct. An inventory correction—which often targets the full session VWAP, overnight halfback, or the previous day’s high (in the case of a true gap up)—is not necessarily bearish unless acceptance is established back within the prior day’s range. The gap was filled during the B-period, which provided a bounce; however, the bounce was short-lived, as the C-period gained traction within the prior day’s range. At that point, the market’s attempt to shift the tone had clearly failed—negating both the true gap and the break from balance. The best trade setup unfolded in the E-period, when Monday’s high (Smashlevel: 6314) was retested—a prime location to anticipate selling activity following the buyers’ failure (see Figure 1). Buyers initially defended the next level of interest at 6295 during the afternoon session; however, sellers ultimately breached it into the close, triggering plenty of stops and forming a spike.

Initiating activity overnight led to a true gap up and a potential break-from-balance scenario, which ultimately failed to materialize today, bringing the market back into value. The key in the short term will be to monitor the closing weakness that formed a spike. Acceptance of this closing weakness opens the door to testing the opposite end of the balance area at 6246, a key reference point as it also represents last week’s low.

In terms of levels, the Smashlevel is at 6291—the spike base. Holding below 6291 would target the high volume node (HVN) at 6271 (DT1). Acceptance below 6271 would signal weakness, targeting the lower end of the 6-day balance area at 6246 (DT2), with a final downside target (FDT) at the support area between 6224 and 6214 under sustained selling pressure.

On the flip side, reclaiming and holding above 6291 would target 6315 (UT1), with a final upside target (FUT) at 6338 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6291.

Break and hold above 6291 would target 6315 / 6338

Holding below 6291 would target 6271 / 6246 / 6224-14

Additionally, pay attention to the following VIX levels: 18.32 and 16.42. These levels can provide confirmation of strength or weakness.

Break and hold above 6338 with VIX below 16.42 would confirm strength.

Break and hold below 6214 with VIX above 18.32 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Hello smash brother what timeframe foot print do you use

Great stuff, thanks!