ES Daily Plan | January 7, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

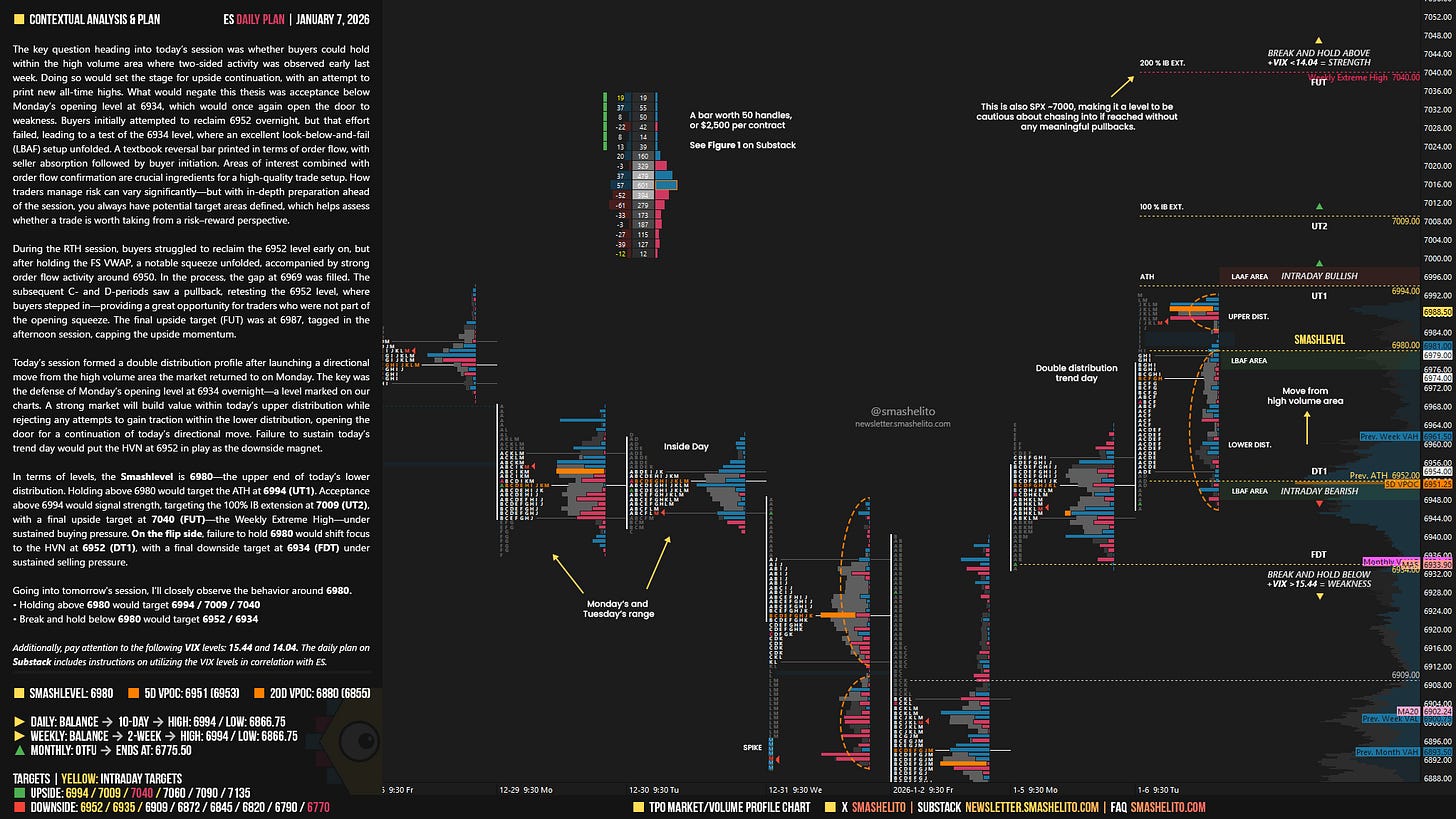

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

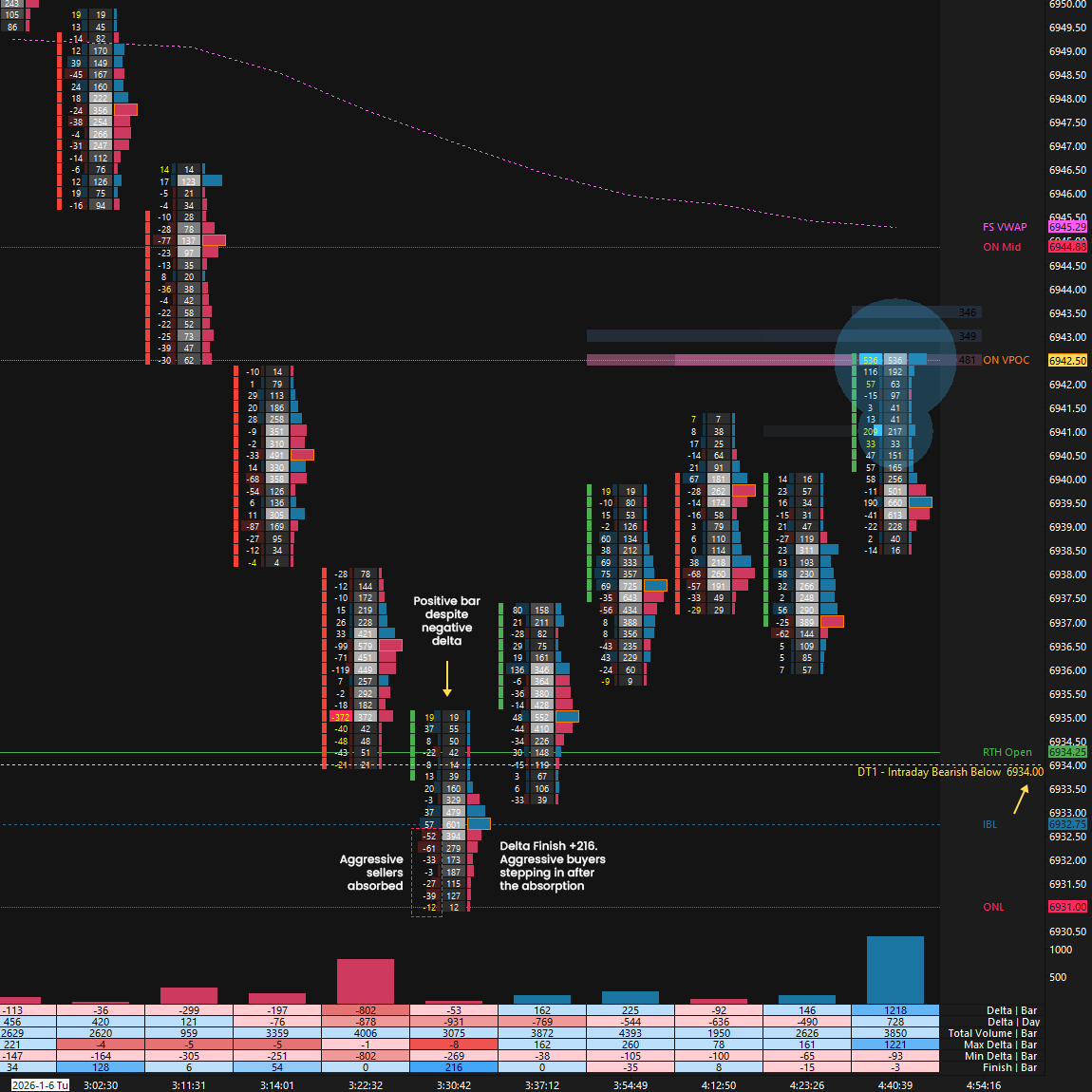

The key question heading into today’s session was whether buyers could hold within the high volume area where two-sided activity was observed early last week. Doing so would set the stage for upside continuation, with an attempt to print new all-time highs. What would negate this thesis was acceptance below Monday’s opening level at 6934, which would once again open the door to weakness.

Buyers initially attempted to reclaim 6952 overnight, but that effort failed, leading to a test of the 6934 level, where an excellent look-below-and-fail (LBAF) setup unfolded. A textbook reversal bar printed in terms of order flow, with seller absorption followed by buyer initiation. Areas of interest combined with order flow confirmation are crucial ingredients for a high-quality trade setup. How traders manage risk can vary significantly—but with in-depth preparation ahead of the session, you always have potential target areas defined, which helps assess whether a trade is worth taking from a risk–reward perspective.

During the RTH session, buyers struggled to reclaim the 6952 level early on, but after holding the FS VWAP, a notable squeeze unfolded, accompanied by strong order flow activity around 6950. In the process, the gap at 6969 was filled. The subsequent C- and D-periods saw a pullback, retesting the 6952 level, where buyers stepped in—providing a great opportunity for traders who were not part of the opening squeeze. The final upside target (FUT) was at 6987, tagged in the afternoon session, capping the upside momentum.

Today’s session formed a double distribution profile after launching a directional move from the high volume area the market returned to on Monday. The key was the defense of Monday’s opening level at 6934 overnight—a level marked on our charts.

A strong market will build value within today’s upper distribution while rejecting any attempts to gain traction within the lower distribution, opening the door for a continuation of today’s directional move. Failure to sustain today’s trend day would put the HVN at 6952 in play as the downside magnet.

In terms of levels, the Smashlevel is 6980—the upper end of today’s lower distribution. Holding above 6980 would target the ATH at 6994 (UT1). Acceptance above 6994 would signal strength, targeting the 100% IB extension at 7009 (UT2), with a final upside target at 7040 (FUT)—the Weekly Extreme High—under sustained buying pressure.

On the flip side, failure to hold 6980 would shift focus to the HVN at 6952 (DT1), with a final downside target at 6934 (FDT) under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6980.

Holding above 6980 would target 6994 / 7009 / 7040

Break and hold below 6980 would target 6952 / 6934

Additionally, pay attention to the following VIX levels: 15.44 and 14.04. These levels can provide confirmation of strength or weakness.

Break and hold above 7040 with VIX below 14.04 would confirm strength.

Break and hold below 6934 with VIX above 15.44 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

This is awesome! Thank you Smash!

Thank you a lot again, and again small question about initial balance extension levels 😅 you use prev day IB extensions as target for next day ?