ES Daily Plan | January 6, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

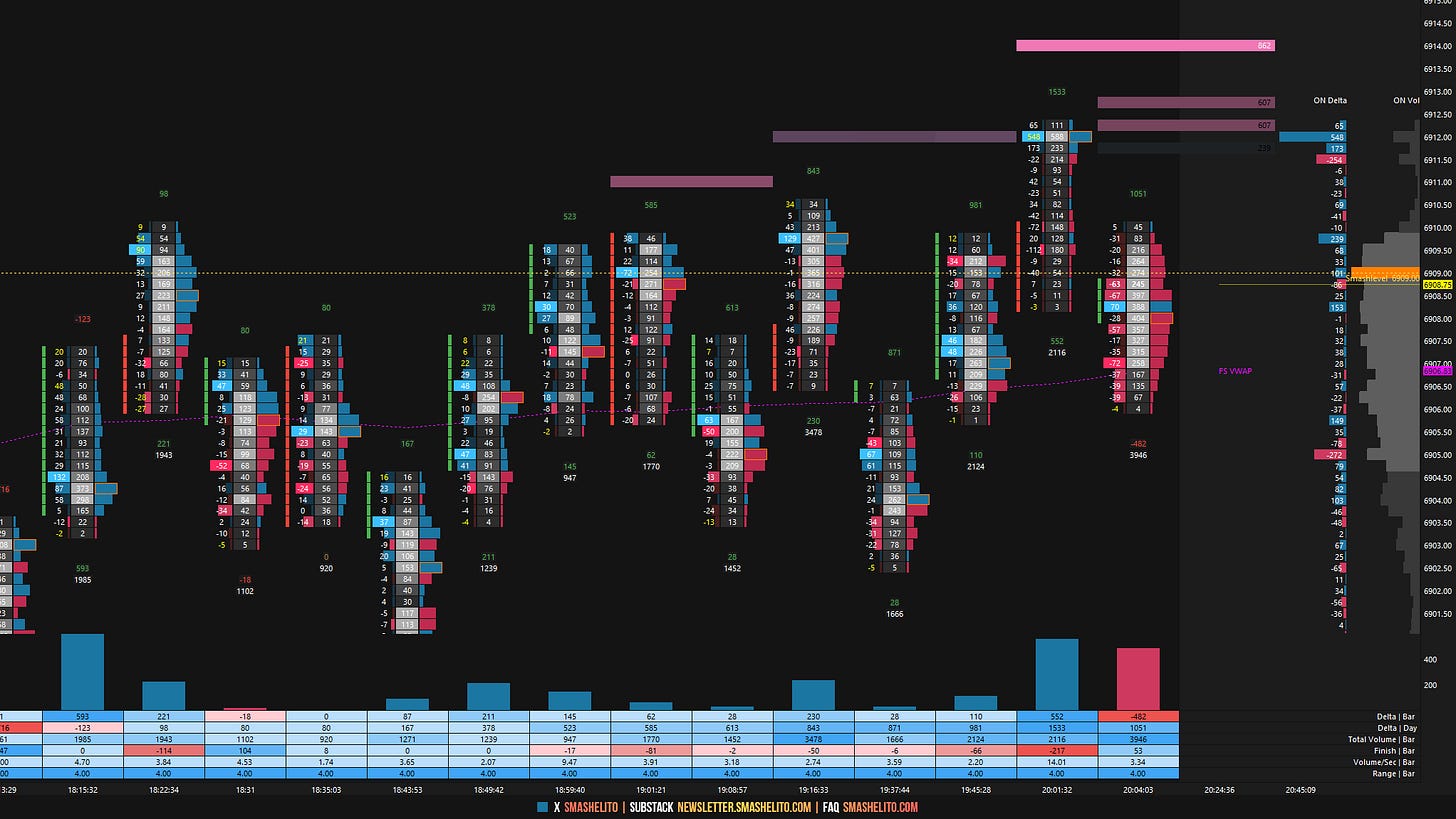

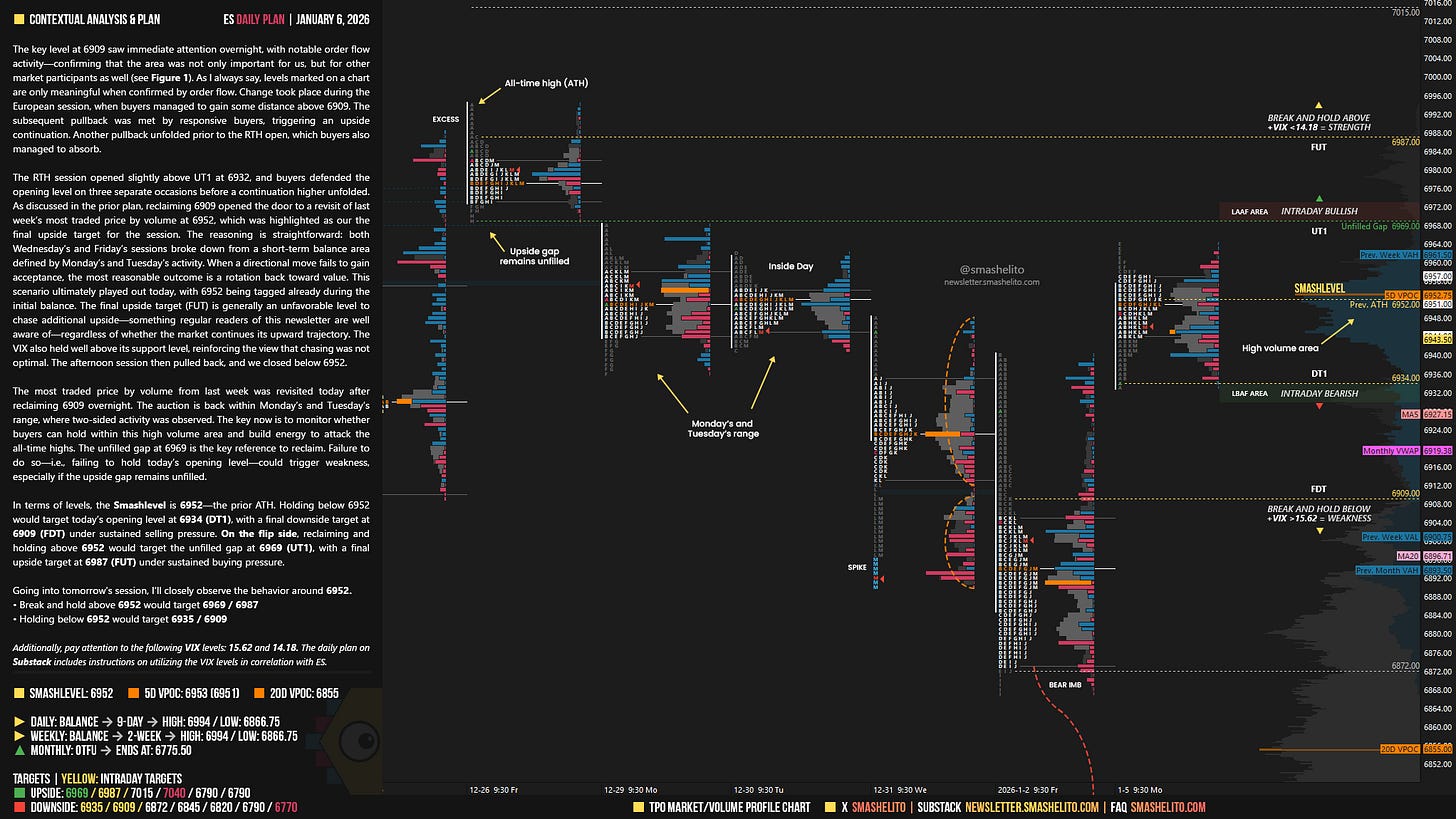

The key level at 6909 saw immediate attention overnight, with notable order flow activity—confirming that the area was not only important for us, but for other market participants as well (see Figure 1). As I always say, levels marked on a chart are only meaningful when confirmed by order flow. Change took place during the European session, when buyers managed to gain some distance above 6909. The subsequent pullback was met by responsive buyers, triggering an upside continuation. Another pullback unfolded prior to the RTH open, which buyers also managed to absorb.

The RTH session opened slightly above UT1 at 6932, and buyers defended the opening level on three separate occasions before a continuation higher unfolded. As discussed in the prior plan, reclaiming 6909 opened the door to a revisit of last week’s most traded price by volume at 6952, which was highlighted as our the final upside target for the session.

The reasoning is straightforward: both Wednesday’s and Friday’s sessions broke down from a short-term balance area defined by Monday’s and Tuesday’s activity. When a directional move fails to gain acceptance, the most reasonable outcome is a rotation back toward value. This scenario ultimately played out today, with 6952 being tagged already during the initial balance.

The final upside target (FUT) is generally an unfavorable level to chase additional upside—something regular readers of this newsletter are well aware of—regardless of whether the market continues its upward trajectory. The VIX also held well above its support level, reinforcing the view that chasing was not optimal. The afternoon session then pulled back, and we closed below 6952.

The most traded price by volume from last week was revisited today after reclaiming 6909 overnight. The auction is back within Monday’s and Tuesday’s range, where two-sided activity was observed. The key now is to monitor whether buyers can hold within this high volume area and build energy to attack the all-time highs. The unfilled gap at 6969 is the key reference to reclaim. Failure to do so—i.e., failing to hold today’s opening level—could trigger weakness, especially if the upside gap remains unfilled.

In terms of levels, the Smashlevel is 6952—the prior ATH. Holding below 6952 would target today’s opening level at 6934 (DT1), with a final downside target at 6909 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6952 would target the unfilled gap at 6969 (UT1), with a final upside target at 6987 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6952.

Break and hold above 6952 would target 6969 / 6987

Holding below 6952 would target 6935 / 6909

Additionally, pay attention to the following VIX levels: 15.62 and 14.18. These levels can provide confirmation of strength or weakness.

Break and hold above 6987 with VIX below 14.18 would confirm strength.

Break and hold below 6909 with VIX above 15.62 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

I think you are turning me into a spy trader. I now understand why so many only trade spy. I refuse to do margin so I am somewhat limited.

This is a great learning opportunity for me at the market open today on January 6. I want a home in and focus my attention on why specifically the line in the sand was 6952. Thank you for everything you do.