ES Daily Plan | January 29, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

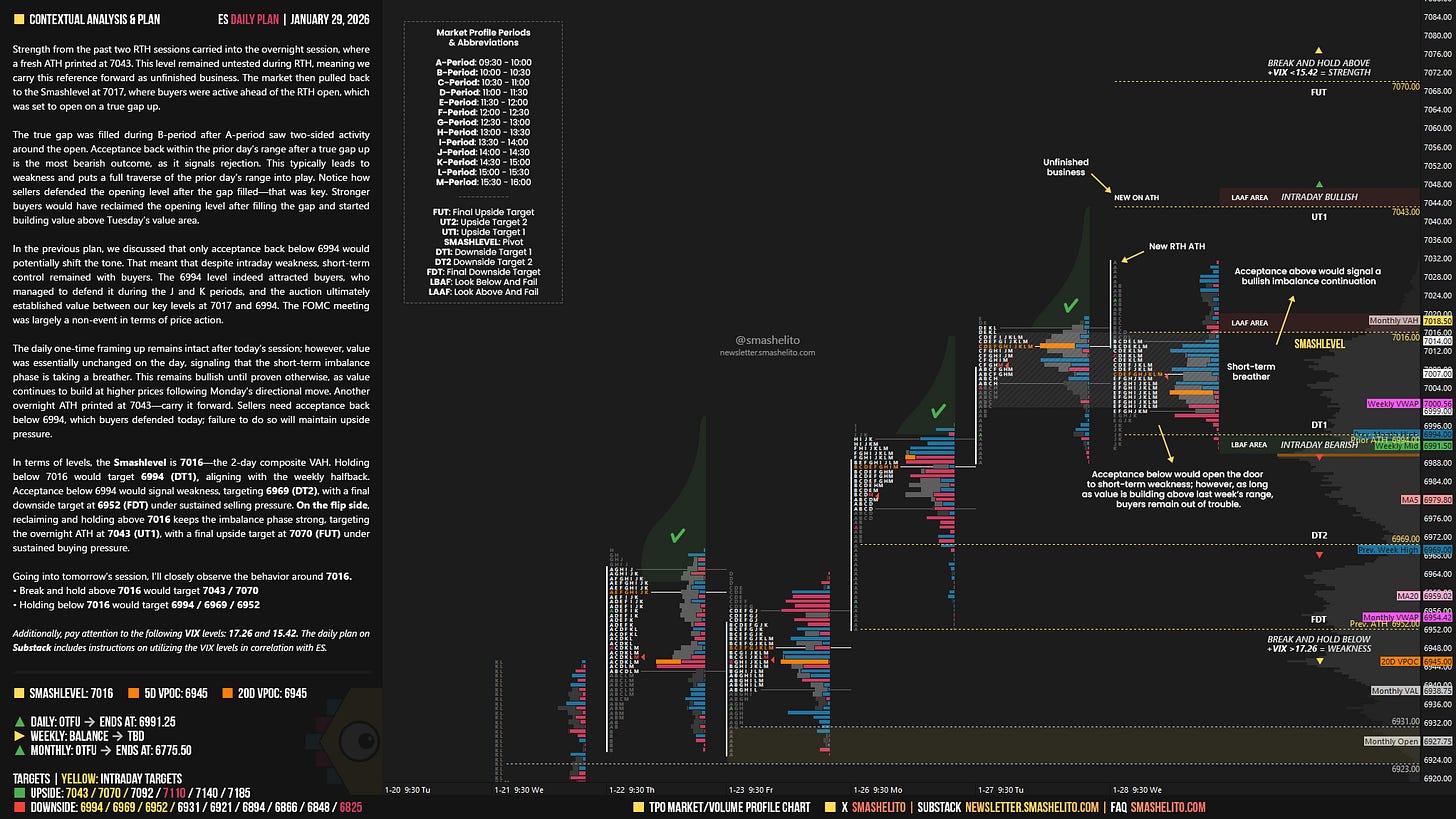

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

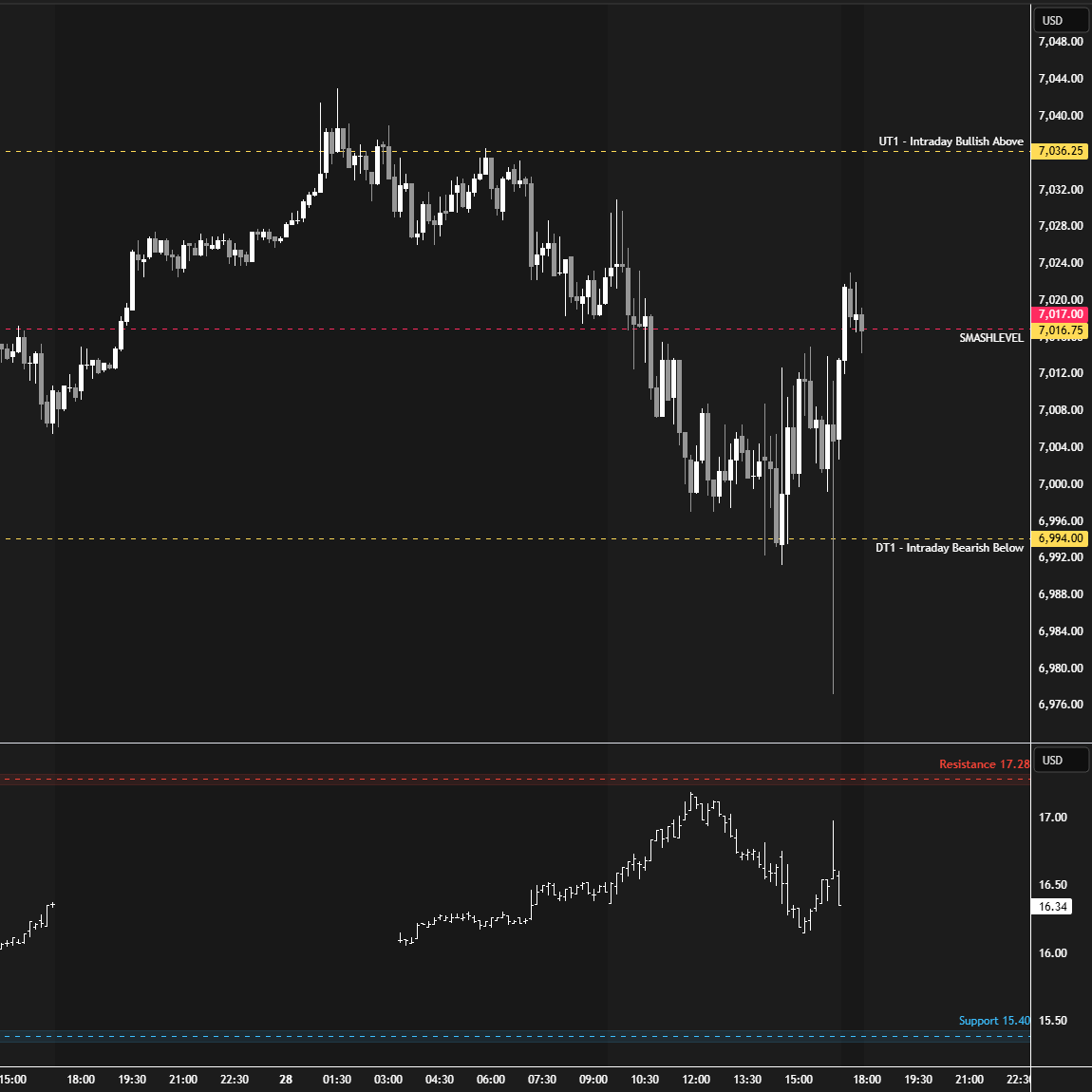

Strength from the past two RTH sessions carried into the overnight session, where a fresh ATH printed at 7043. This level remained untested during RTH, meaning we carry this reference forward as unfinished business. The market then pulled back to the Smashlevel at 7017, where buyers were active ahead of the RTH open, which was set to open on a true gap up.

The true gap was filled during B-period after A-period saw two-sided activity around the open. Acceptance back within the prior day’s range after a true gap up is the most bearish outcome, as it signals rejection. This typically leads to weakness and puts a full traverse of the prior day’s range into play. Notice how sellers defended the opening level after the gap filled—that was key. Stronger buyers would have reclaimed the opening level after filling the gap and started building value above Tuesday’s value area.

In the previous plan, we discussed that only acceptance back below 6994 would potentially shift the tone. That meant that despite intraday weakness, short-term control remained with buyers. The 6994 level indeed attracted buyers, who managed to defend it during the J and K periods, and the auction ultimately established value between our key levels at 7017 and 6994. The FOMC meeting was largely a non-event in terms of price action.

The daily one-time framing up remains intact after today’s session; however, value was essentially unchanged on the day, signaling that the short-term imbalance phase is taking a breather. This remains bullish until proven otherwise, as value continues to build at higher prices following Monday’s directional move.

Another overnight ATH printed at 7043—carry it forward. Sellers need acceptance back below 6994, which buyers defended today; failure to do so will maintain upside pressure.

In terms of levels, the Smashlevel is 7016—the 2-day composite VAH. Holding below 7016 would target 6994 (DT1), aligning with the weekly halfback. Acceptance below 6994 would signal weakness, targeting 6969 (DT2), with a final downside target at 6952 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 7016 keeps the imbalance phase strong, targeting the overnight ATH at 7043 (UT1), with a final upside target at 7070 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 7016.

Break and hold above 7016 would target 7043 / 7070

Holding below 7016 would target 6994 / 6969 / 6952

Additionally, pay attention to the following VIX levels: 17.26 and 15.42. These levels can provide confirmation of strength or weakness.

Break and hold above 7070 with VIX below 15.42 would confirm strength.

Break and hold below 6952 with VIX above 17.26 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

1. <<Acceptance back within the prior day’s range after a true gap up is the most bearish outcome, as it signals rejection.>>

2. <<The daily one-time framing up remains intact after today’s session; however, value was essentially unchanged on the day, signaling that the short-term imbalance phase is taking a breather. This remains bullish until proven otherwise, as value continues to build at higher prices following Monday’s directional move.>>

Hola, Smashelito!

I highlighted these two sentences because they really help me understand the directional bias for the session. Without the commentary in your daily plan, it would be much harder for me to judge whether the market is leaning bullish or not.

The levels alone are not enough—your explanations provide the context that day traders like me rely on.

Thank you for continuing to share your educational work. Some days your commentary clearly highlights the potential path of price, other days less so, but whenever you include these insights, they make a meaningful difference in how I prepare for the session.

Con aprecio, un cordial saludo desde Helsinki. Juan Lazaridis, el Greco.

Thanks Smash for helping me approach the sessions so calmly and clearly. As you say in your profile description, pre-market preparation allows for consistent work. Happy Session!