ES Daily Plan | January 29, 2025

My preparations and expectations for the upcoming session.

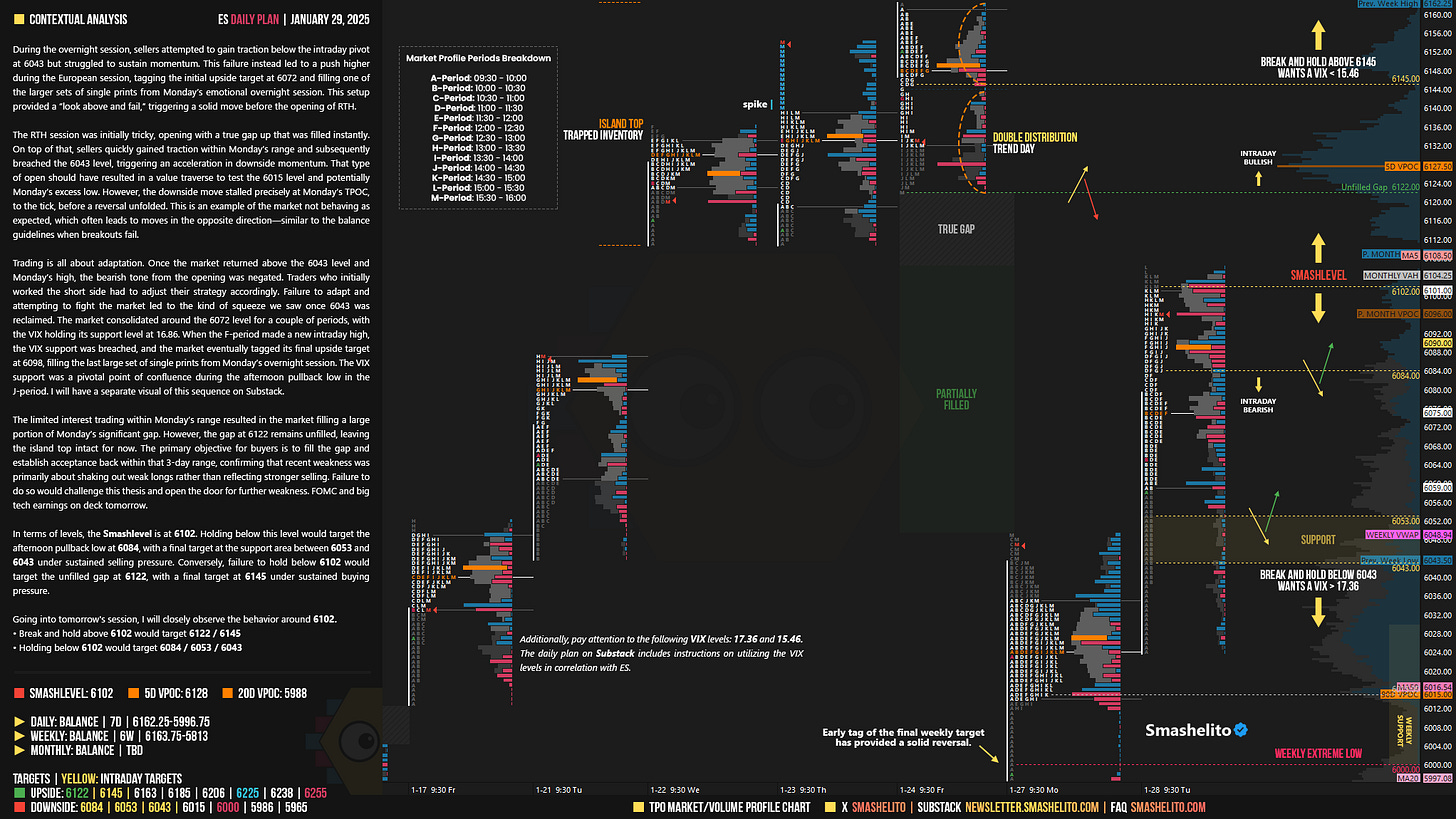

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

During the overnight session, sellers attempted to gain traction below the intraday pivot at 6043 but struggled to sustain momentum. This failure instead led to a push higher during the European session, tagging the initial upside target at 6072 and filling one of the larger sets of single prints from Monday’s emotional overnight session. This setup provided a “look above and fail,” triggering a solid move before the opening of RTH.

The RTH session was initially tricky, opening with a true gap up that was filled instantly. On top of that, sellers quickly gained traction within Monday’s range and subsequently breached the 6043 level, triggering an acceleration in downside momentum. That type of open should have resulted in a value traverse to test the 6015 level and potentially Monday’s excess low. However, the downside move stalled precisely at Monday’s TPOC, to the tick, before a reversal unfolded. This is an example of the market not behaving as expected, which often leads to moves in the opposite direction—similar to the balance guidelines when breakouts fail.

Trading is all about adaptation. Once the market returned above the 6043 level and Monday’s high, the bearish tone from the opening was negated. Traders who initially worked the short side had to adjust their strategy accordingly. Failure to adapt and attempting to fight the market led to the kind of squeeze we saw once 6043 was reclaimed. The market consolidated around the 6072 level for a couple of periods, with the VIX holding its support level at 16.86. When the F-period made a new intraday high, the VIX support was breached, and the market eventually tagged its final upside target at 6098, filling the last large set of single prints from Monday’s overnight session. The VIX support was a pivotal point of confluence during the afternoon pullback low in the J-period.

The limited interest trading within Monday’s range resulted in the market filling a large portion of Monday’s significant gap. However, the gap at 6122 remains unfilled, leaving the island top intact for now. The primary objective for buyers is to fill the gap and establish acceptance back within that 3-day range, confirming that recent weakness was primarily about shaking out weak longs rather than reflecting stronger selling. Failure to do so would challenge this thesis and open the door for further weakness. FOMC and big tech earnings on deck tomorrow.

In terms of levels, the Smashlevel is at 6102. Holding below this level would target the afternoon pullback low at 6084, with a final target at the support area between 6053 and 6043 under sustained selling pressure. Conversely, failure to hold below 6102 would target the unfilled gap at 6122, with a final target at 6145 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 6102.

Break and hold above 6102 would target 6122 / 6145

Holding below 6102 would target 6084 / 6053 / 6043

Additionally, pay attention to the following VIX levels: 17.36 and 15.46. These levels can provide confirmation of strength or weakness.

Break and hold above 6145 with VIX below 15.46 would confirm strength.

Break and hold below 6043 with VIX above 17.36 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Thanks Smash!

Thank you for the detailed review. Learning a lot!