ES Daily Plan | January 27, 2025

My preparations and expectations for the upcoming session.

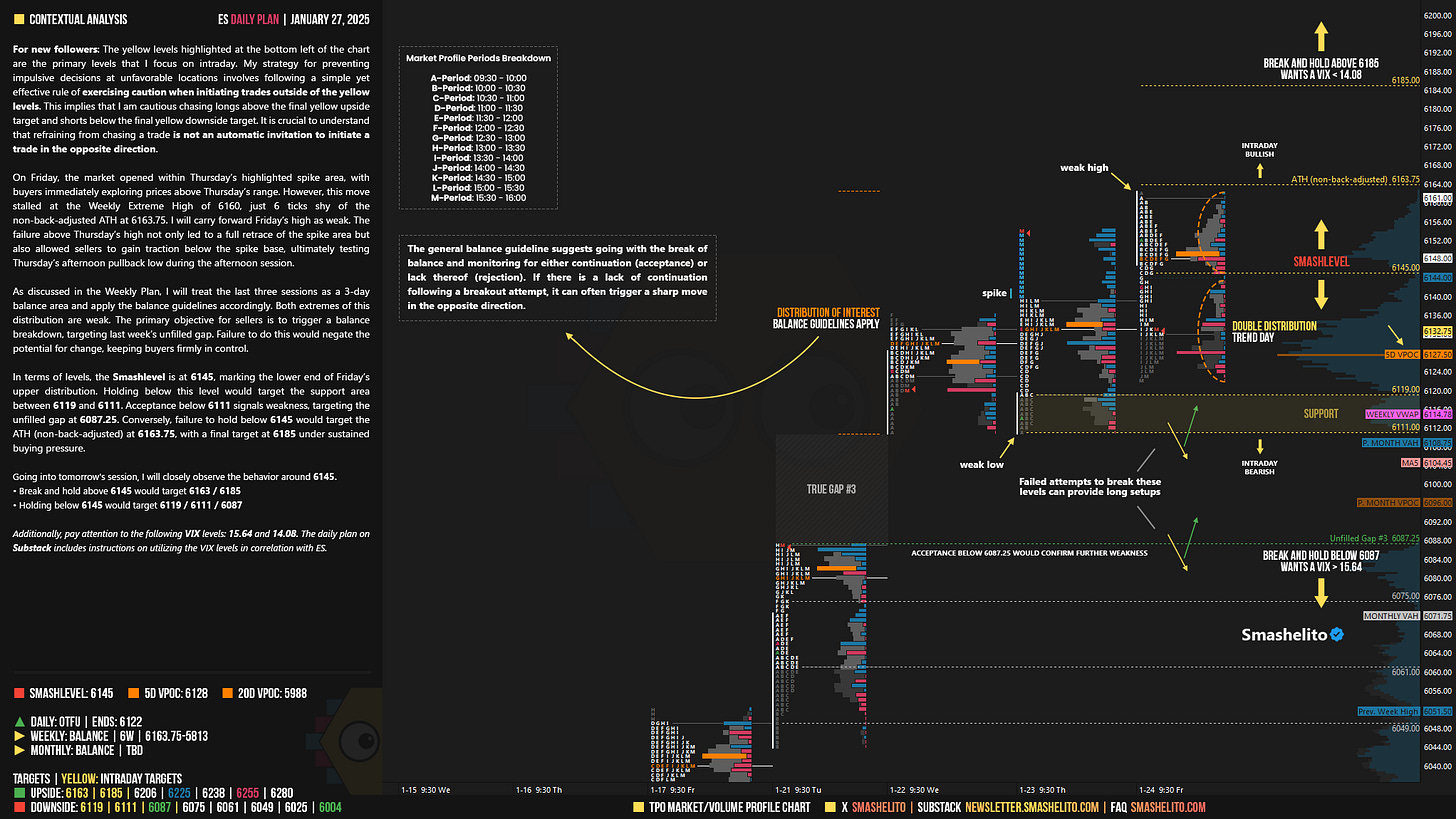

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

On Friday, the market opened within Thursday’s highlighted spike area, with buyers immediately exploring prices above Thursday’s range. However, this move stalled at the Weekly Extreme High of 6160, just 6 ticks shy of the non-back-adjusted ATH at 6163.75. I will carry forward Friday’s high as weak. The failure above Thursday’s high not only led to a full retrace of the spike area but also allowed sellers to gain traction below the spike base, ultimately testing Thursday’s afternoon pullback low during the afternoon session.

As discussed in the Weekly Plan, I will treat the last three sessions as a 3-day balance area and apply the balance guidelines accordingly. Both extremes of this distribution are weak. The primary objective for sellers is to trigger a balance breakdown, targeting last week’s unfilled gap. Failure to do this would negate the potential for change, keeping buyers firmly in control.

In terms of levels, the Smashlevel is at 6145, marking the lower end of Friday’s upper distribution. Holding below this level would target the support area between 6119 and 6111. Acceptance below 6111 signals weakness, targeting the unfilled gap at 6087.25. Conversely, failure to hold below 6145 would target the ATH (non-back-adjusted) at 6163.75, with a final target at 6185 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 6145.

Break and hold above 6145 would target 6163 / 6185

Holding below 6145 would target 6119 / 6111 / 6087

Additionally, pay attention to the following VIX levels: 15.64 and 14.08. These levels can provide confirmation of strength or weakness.

Break and hold above 6185 with VIX below 14.08 would confirm strength.

Break and hold below 6087 with VIX above 15.64 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Both targets nailed

Thank you!