ES Daily Plan | January 21, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

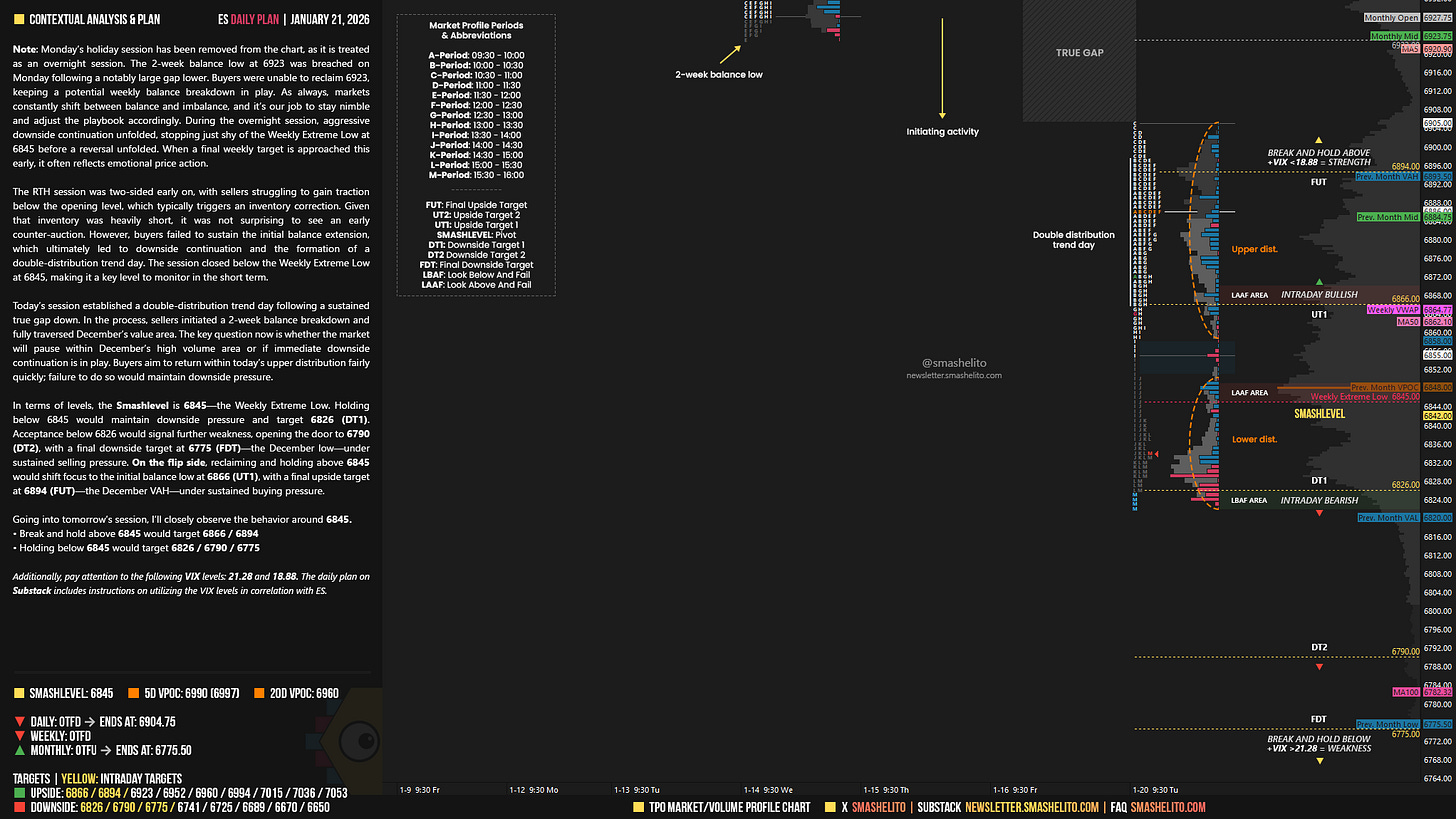

Note: Monday’s holiday session has been removed from the chart, as it is treated as an overnight session. The 2-week balance low at 6923 was breached on Monday following a notably large gap lower. Buyers were unable to reclaim 6923, keeping a potential weekly balance breakdown in play. As always, markets constantly shift between balance and imbalance, and it’s our job to stay nimble and adjust the playbook accordingly. During the overnight session, aggressive downside continuation unfolded, stopping just shy of the Weekly Extreme Low at 6845 before a reversal unfolded. When a final weekly target is approached this early, it often reflects emotional price action.

The RTH session was two-sided early on, with sellers struggling to gain traction below the opening level, which typically triggers an inventory correction. Given that inventory was heavily short, it was not surprising to see an early counter-auction. However, buyers failed to sustain the initial balance extension, which ultimately led to downside continuation and the formation of a double-distribution trend day. The session closed below the Weekly Extreme Low at 6845, making it a key level to monitor in the short term.

Today’s session established a double-distribution trend day following a sustained true gap down. In the process, sellers initiated a 2-week balance breakdown and fully traversed December’s value area. The key question now is whether the market will pause within December’s high volume area or if immediate downside continuation is in play. Buyers aim to return within today’s upper distribution fairly quickly; failure to do so would maintain downside pressure.

In terms of levels, the Smashlevel is 6845—the Weekly Extreme Low. Holding below 6845 would maintain downside pressure and target 6826 (DT1). Acceptance below 6826 would signal further weakness, opening the door to 6790 (DT2), with a final downside target at 6775 (FDT)—the December low—under sustained selling pressure.

On the flip side, reclaiming and holding above 6845 would shift focus to the initial balance low at 6866 (UT1), with a final upside target at 6894 (FUT)—the December VAH—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6845.

Break and hold above 6845 would target 6866 / 6894

Holding below 6845 would target 6826 / 6790 / 6775

Additionally, pay attention to the following VIX levels: 21.28 and 18.88. These levels can provide confirmation of strength or weakness.

Break and hold above 6894 with VIX below 18.88 would confirm strength.

Break and hold below 6775 with VIX above 21.28 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Oh my goodness, I really sat in my hands watching this very emotional session, thank you so much for your help

You said buyers failed to sustain the IB extension and that led to the double distribution trend day. When you're watching that happen live, what tells you the extension is actually failing vs just a normal pullback before it continues higher? Is this where Orderflow kicks in and you're verifying the move based on footprint, volume, etc? Also, any timeline on the private substack? Thanks Smash