ES Daily Plan | January 16, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

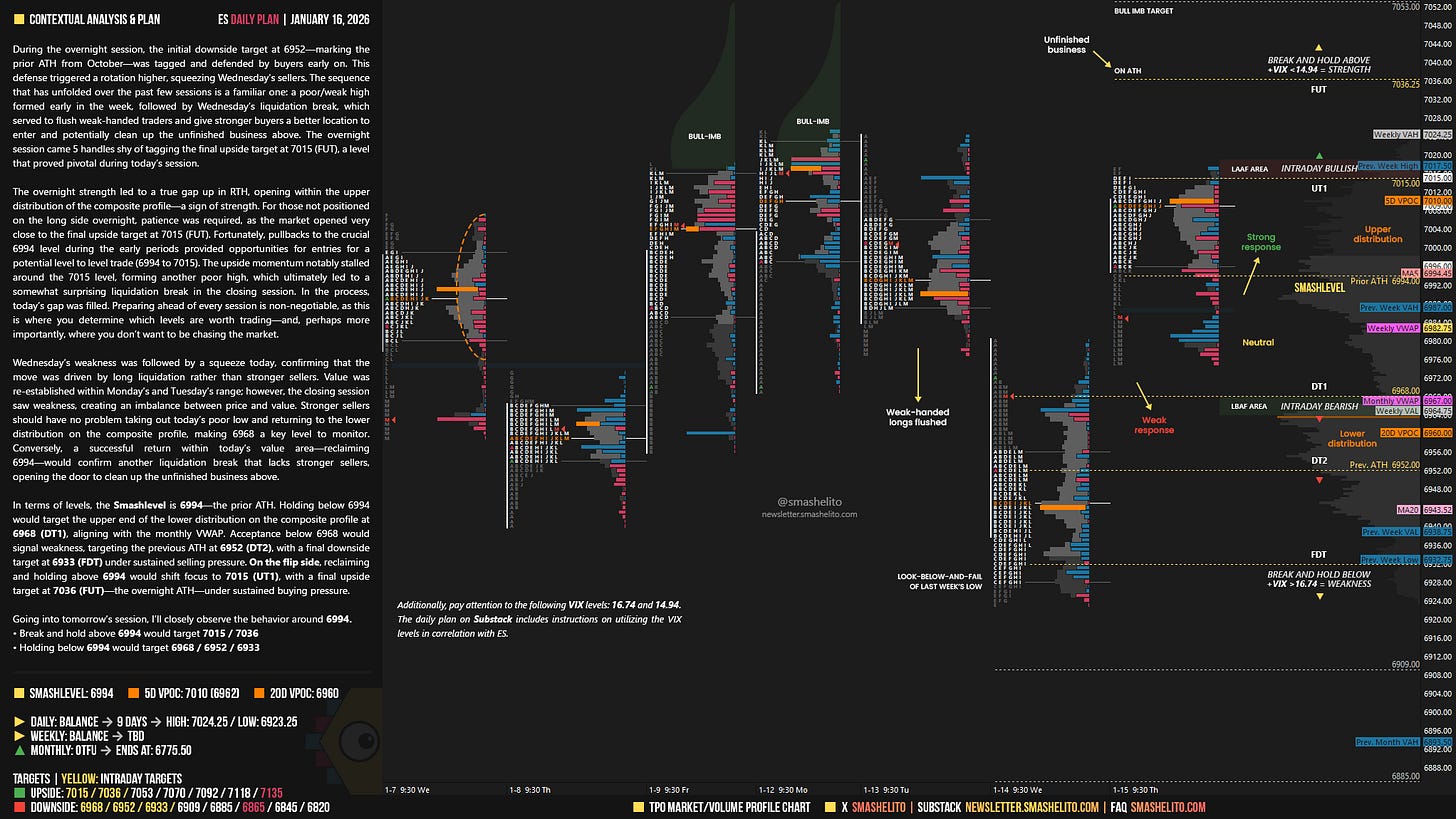

During the overnight session, the initial downside target at 6952—marking the prior ATH from October—was tagged and defended by buyers early on. This defense triggered a rotation higher, squeezing Wednesday’s sellers. The sequence that has unfolded over the past few sessions is a familiar one: a poor/weak high formed early in the week, followed by Wednesday’s liquidation break, which served to flush weak-handed traders and give stronger buyers a better location to enter and potentially clean up the unfinished business above. The overnight session came 5 handles shy of tagging the final upside target at 7015 (FUT), a level that proved pivotal during today’s session.

The overnight strength led to a true gap up in RTH, opening within the upper distribution of the composite profile—a sign of strength. For those not positioned on the long side overnight, patience was required, as the market opened very close to the final upside target at 7015 (FUT). Fortunately, pullbacks to the crucial 6994 level during the early periods provided opportunities for entries for a potential level to level trade (6994 to 7015). The upside momentum notably stalled around the 7015 level, forming another poor high, which ultimately led to a somewhat surprising liquidation break in the closing session. In the process, today’s gap was filled. Preparing ahead of every session is non-negotiable, as this is where you determine which levels are worth trading—and, perhaps more importantly, where you don’t want to be chasing the market.

Wednesday’s weakness was followed by a squeeze today, confirming that the move was driven by long liquidation rather than stronger sellers. Value was re-established within Monday’s and Tuesday’s range; however, the closing session saw weakness, creating an imbalance between price and value.

Stronger sellers should have no problem taking out today’s poor low and returning to the lower distribution on the composite profile, making 6968 a key level to monitor.

Conversely, a successful return within today’s value area—reclaiming 6994—would confirm another liquidation break that lacks stronger sellers, opening the door to clean up the unfinished business above.

In terms of levels, the Smashlevel is 6994—the prior ATH. Holding below 6994 would target the upper end of the lower distribution on the composite profile at 6968 (DT1), aligning with the monthly VWAP. Acceptance below 6968 would signal weakness, targeting the previous ATH at 6952 (DT2), with a final downside target at 6933 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6994 would shift focus to 7015 (UT1), with a final upside target at 7036 (FUT)—the overnight ATH—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6994.

Break and hold above 6994 would target 7015 / 7036

Holding below 6994 would target 6968 / 6952 / 6933

Additionally, pay attention to the following VIX levels: 16.74 and 14.94. These levels can provide confirmation of strength or weakness.

Break and hold above 7036 with VIX below 14.94 would confirm strength.

Break and hold below 6933 with VIX above 16.74 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you for all you do. Your levels have literally save me. May god continue to bless you

Thanks GOAT!