ES Daily Plan | January 13, 2025

My preparations and expectations for the upcoming session.

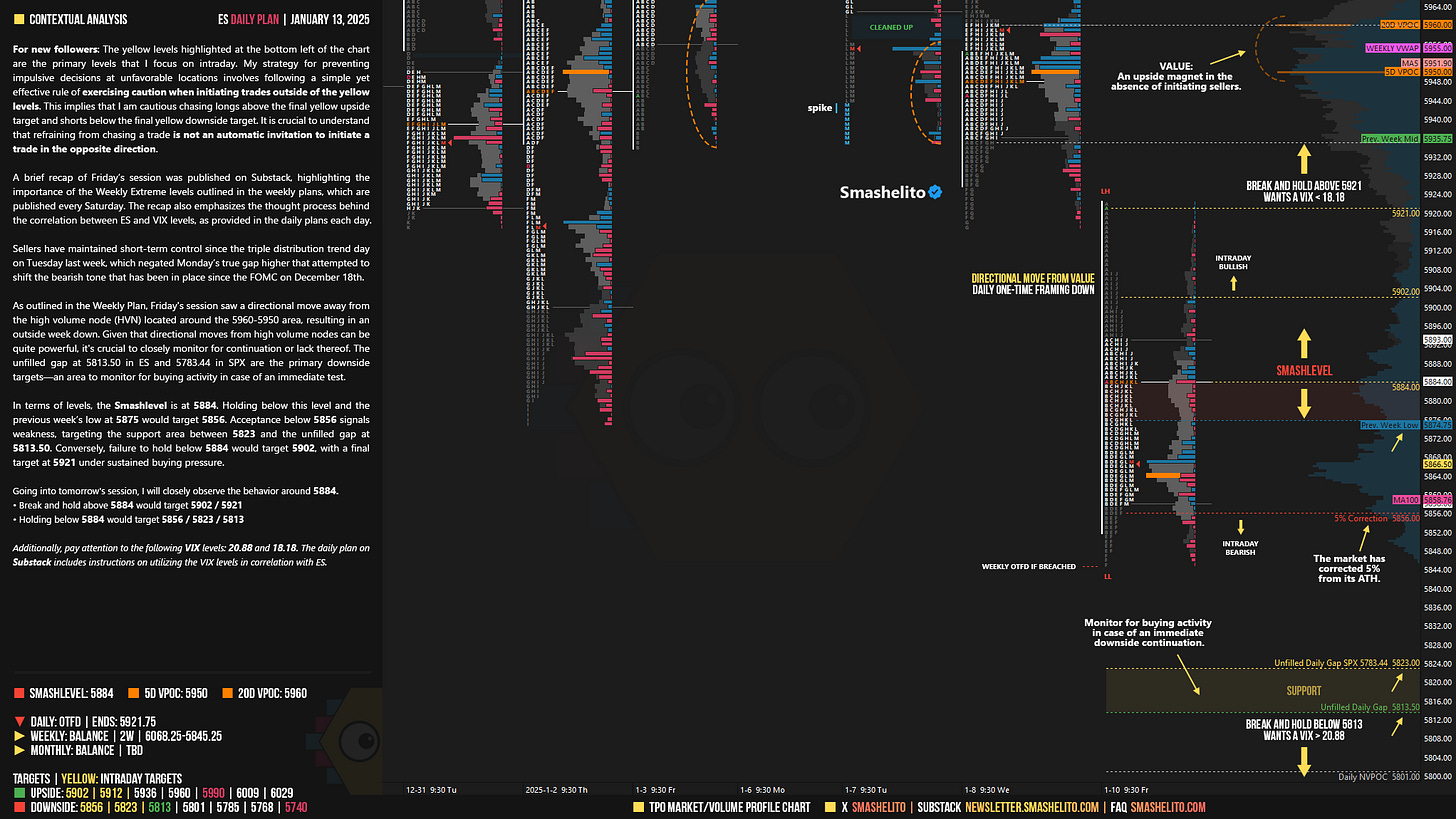

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

A brief recap of Friday’s session was published on Substack (link), highlighting the importance of the Weekly Extreme levels outlined in the weekly plans, which are published every Saturday. The recap also emphasizes the thought process behind the correlation between ES and VIX levels, as provided in the daily plans each day.

Sellers have maintained short-term control since the triple distribution trend day on Tuesday last week, which negated Monday’s true gap higher that attempted to shift the bearish tone that has been in place since the FOMC on December 18th.

As outlined in the Weekly Plan, Friday's session saw a directional move away from the high volume node (HVN) located around the 5960-5950 area, resulting in an outside week down. Given that directional moves from high volume nodes can be quite powerful, it's crucial to closely monitor for continuation or lack thereof. The unfilled gap at 5813.50 in ES and 5783.44 in SPX are the primary downside targets—an area to monitor for buying activity in case of an immediate test.

In terms of levels, the Smashlevel is at 5884. Holding below this level and the previous week’s low at 5875 would target 5856. Acceptance below 5856 signals weakness, targeting the support area between 5823 and the unfilled gap at 5813.50. Conversely, failure to hold below 5884 would target 5902, with a final target at 5921 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5884.

Break and hold above 5884 would target 5902 / 5921

Holding below 5884 would target 5856 / 5823 / 5813

Additionally, pay attention to the following VIX levels: 20.88 and 18.18. These levels can provide confirmation of strength or weakness.

Break and hold above 5921 with VIX below 18.18 would confirm strength.

Break and hold below 5813 with VIX above 20.88 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Superb, brother. The process continues… We stick to the plan to keep the odds in our favor.

Gap support area held today