ES Daily Plan | January 12, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

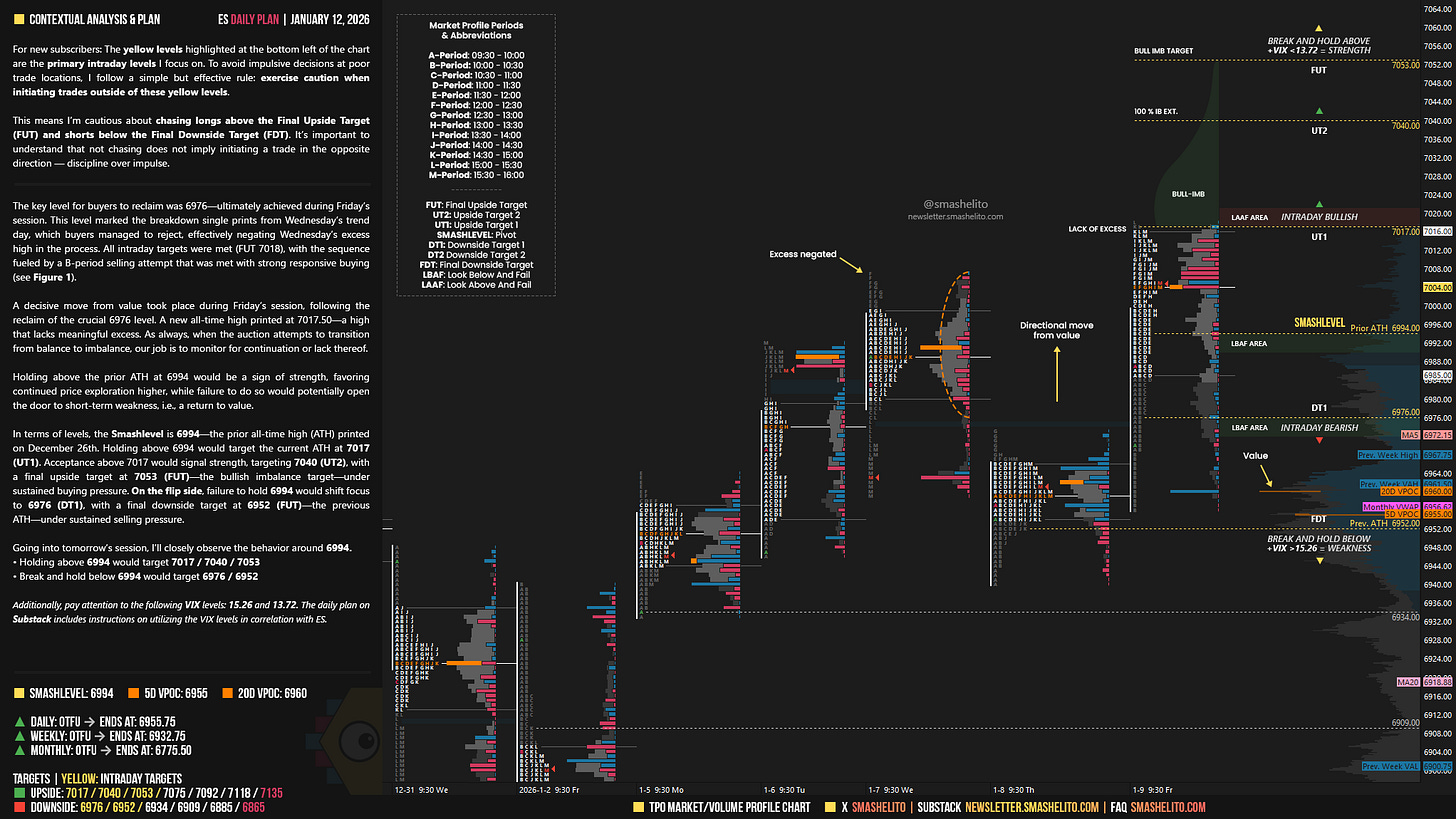

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

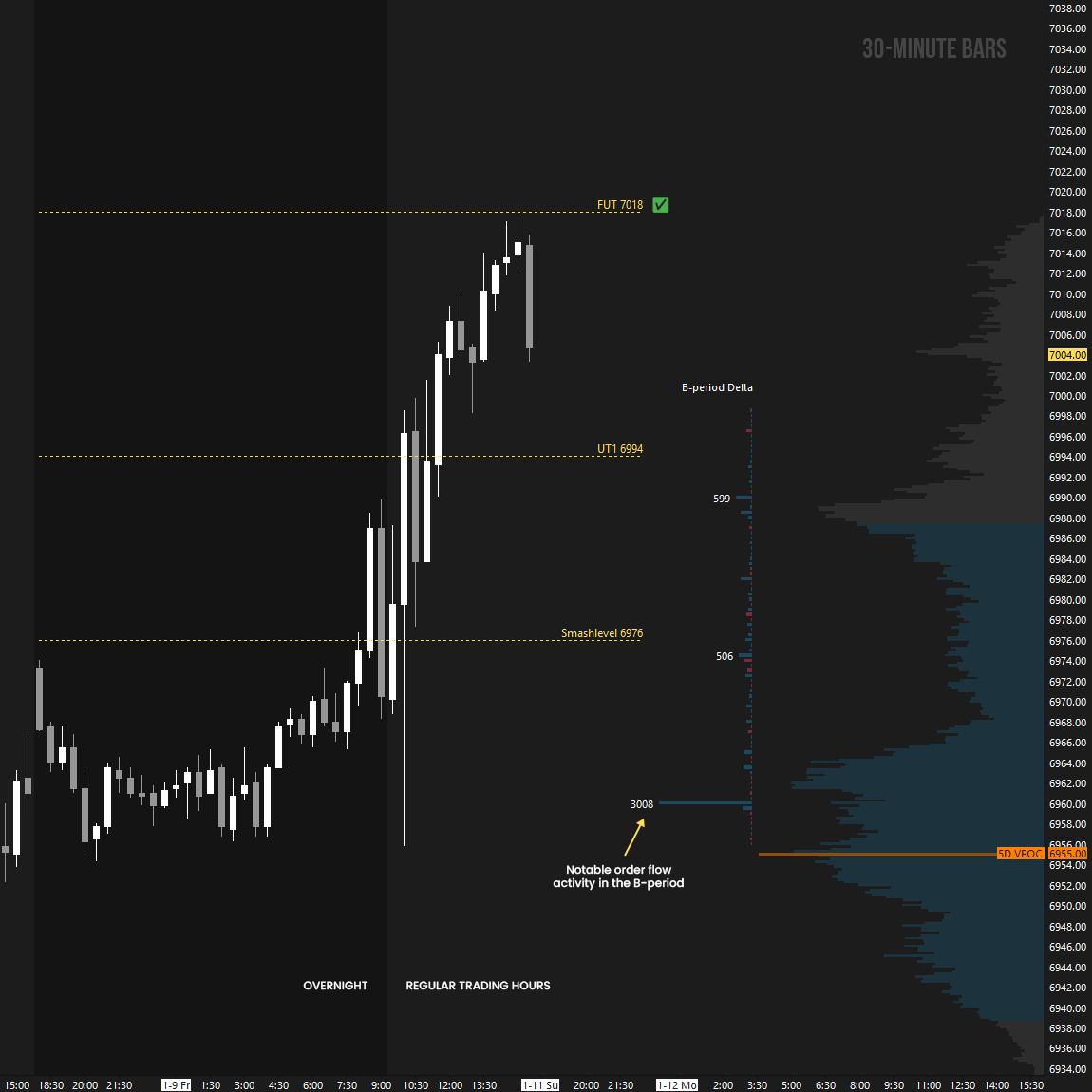

The key level for buyers to reclaim was 6976—ultimately achieved during Friday’s session. This level marked the breakdown single prints from Wednesday’s trend day, which buyers managed to reject, effectively negating Wednesday’s excess high in the process. All intraday targets were met (FUT 7018), with the sequence fueled by a B-period selling attempt that was met with strong responsive buying (see Figure 1).

A decisive move from value took place during Friday’s session, following the reclaim of the crucial 6976 level. A new all-time high printed at 7017.50—a high that lacks meaningful excess. As always, when the auction attempts to transition from balance to imbalance, our job is to monitor for continuation or lack thereof.

Holding above the prior ATH at 6994 would be a sign of strength, favoring continued price exploration higher, while failure to do so would potentially open the door to short-term weakness, i.e., a return to value.

In terms of levels, the Smashlevel is 6994—the prior all-time high (ATH) printed on December 26th. Holding above 6994 would target the current ATH at 7017 (UT1). Acceptance above 7017 would signal strength, targeting 7040 (UT2), with a final upside target at 7053 (FUT)—the bullish imbalance target—under sustained buying pressure.

On the flip side, failure to hold 6994 would shift focus to 6976 (DT1), with a final downside target at 6952 (FUT)—the previous ATH—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6994.

Holding above 6994 would target 7017 / 7040 / 7053

Break and hold below 6994 would target 6976 / 6952

Additionally, pay attention to the following VIX levels: 15.26 and 13.72. These levels can provide confirmation of strength or weakness.

Break and hold above 7053 with VIX below 13.72 would confirm strength.

Break and hold below 6952 with VIX above 15.26 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Can't tell you how much you've taught me over the years, it really is appreciated :) "bullish imbalance target" is a new one to me. Is this a fib or a measured move of some kind? Thanks again!

Thanks Smash! Great week ahead!