ES Daily Plan | February 6, 2024

Contextually, little has changed as we continue to monitor where the market attempts to establish value.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

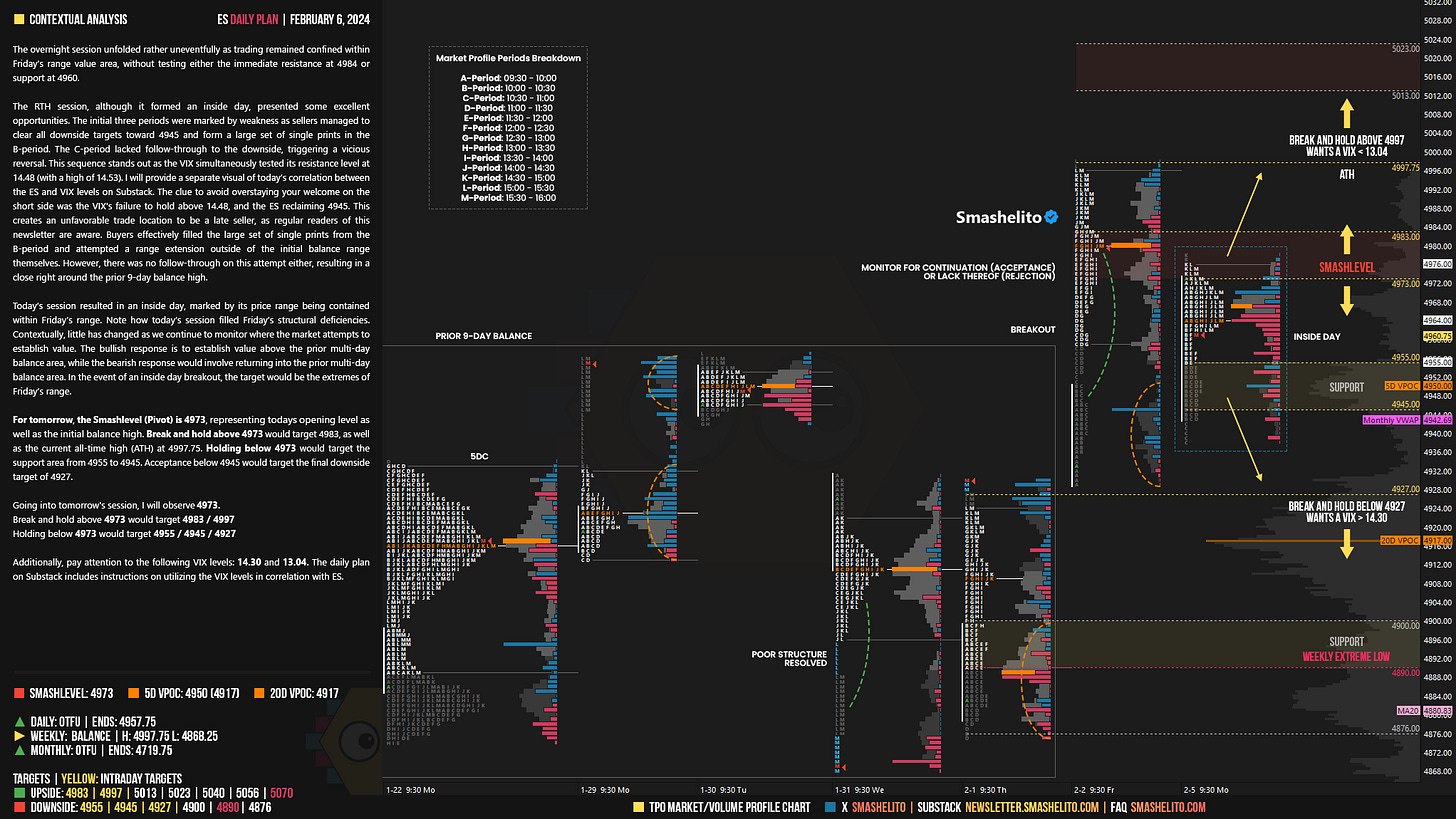

The overnight session unfolded rather uneventfully as trading remained confined within Friday's range value area, without testing either the immediate resistance at 4984 or support at 4960.

The RTH session, although it formed an inside day, presented some excellent opportunities. The initial three periods were marked by weakness as sellers managed to clear all downside targets toward 4945 and form a large set of single prints in the B-period. The C-period lacked follow-through to the downside, triggering a vicious reversal. This sequence stands out as the VIX simultaneously tested its resistance level at 14.48 (with a high of 14.53). I will provide a separate visual of today’s correlation between the ES and VIX levels on Substack. The clue to avoid overstaying your welcome on the short side was the VIX's failure to hold above 14.48, and the ES reclaiming 4945. This creates an unfavorable trade location to be a late seller, as regular readers of this newsletter are aware. Buyers effectively filled the large set of single prints from the B-period and attempted a range extension outside of the initial balance range themselves. However, there was no follow-through on this attempt either, resulting in a close right around the prior 9-day balance high.

Today’s session resulted in an inside day, marked by its price range being contained within Friday’s range. Note how today’s session filled Friday’s structural deficiencies. Contextually, little has changed as we continue to monitor where the market attempts to establish value. The bullish response is to establish value above the prior multi-day balance area, while the bearish response would involve returning into the prior multi-day balance area. In the event of an inside day breakout, the target would be the extremes of Friday’s range.

For tomorrow, the Smashlevel (Pivot) is 4973, representing todays opening level as well as the initial balance high. Break and hold above 4973 would target 4983, as well as the current all-time high (ATH) at 4997.75. Holding below 4973 would target the support area from 4955 to 4945. Acceptance below 4945 would target the final downside target of 4927.

Levels of Interest

Going into tomorrow's session, I will observe 4973.

Break and hold above 4973 would target 4983 / 4997

Holding below 4973 would target 4955 / 4945 / 4927

Additionally, pay attention to the following VIX levels: 14.30 and 13.04. These levels can provide confirmation of strength or weakness.

Break and hold above 4997 with VIX below 13.04 would confirm strength.

Break and hold below 4927 with VIX above 14.30 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Note: Computer issues are causing this plan to be released a bit later than usual.

This guy is incredible.

I’ve traded for over 20 years and he’s the best I’ve seen!

Not sure how the BIX numbers are computed and can’t seem to locate him on Substack….I’m computer ignorant outside of trading.

Thanks again