ES Daily Plan | February 3, 2025

My preparations and expectations for the upcoming session.

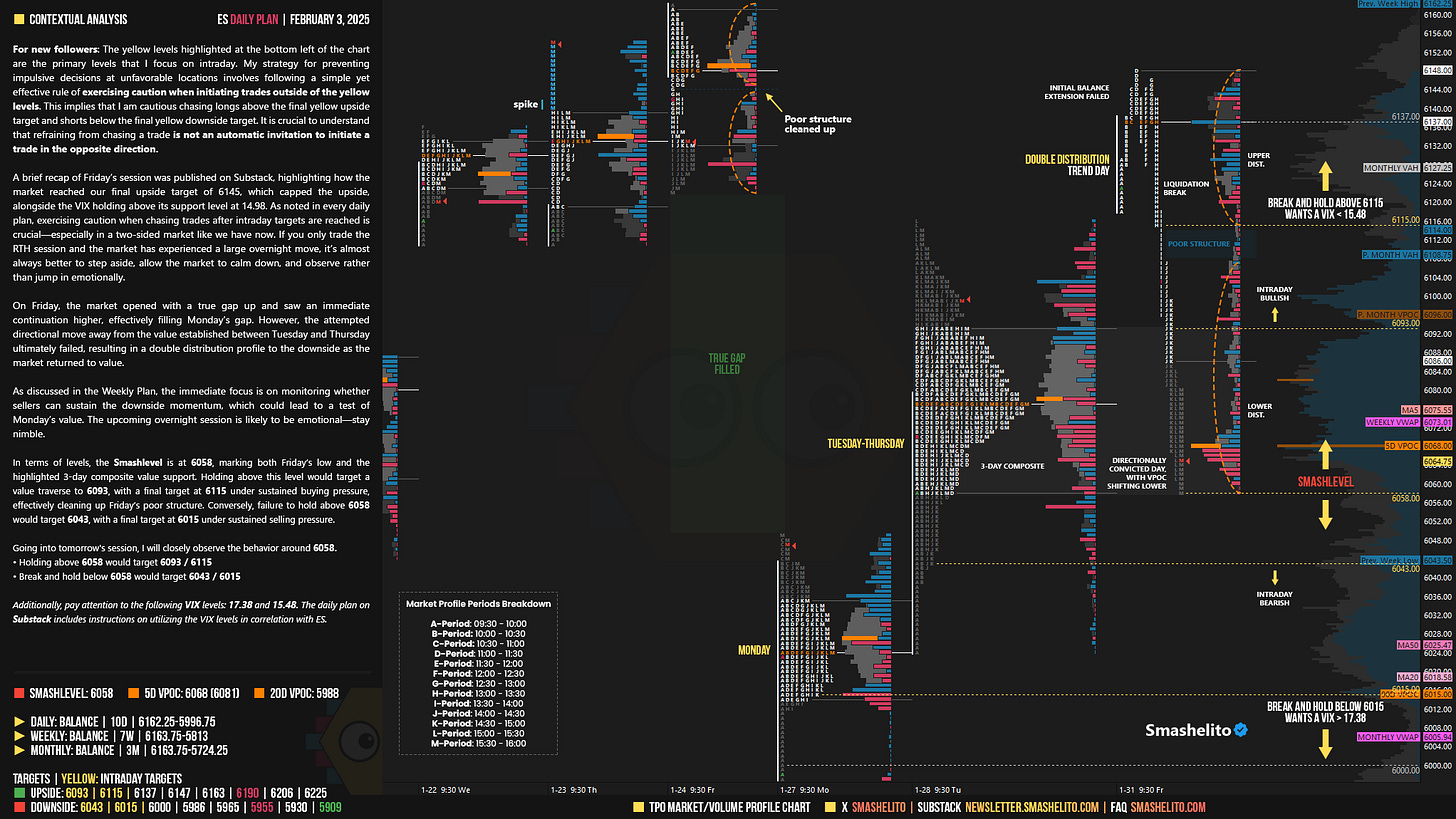

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

A brief recap of Friday’s session was published on Substack (link), highlighting how the market reached our final upside target of 6145, which capped the upside, alongside the VIX holding above its support level at 14.98. As noted in every daily plan, exercising caution when chasing trades after intraday targets are reached is crucial—especially in a two-sided market like we have now. If you only trade the RTH session and the market has experienced a large overnight move, it’s almost always better to step aside, allow the market to calm down, and observe rather than jump in emotionally.

On Friday, the market opened with a true gap up and saw an immediate continuation higher, effectively filling Monday’s gap. However, the attempted directional move away from the value established between Tuesday and Thursday ultimately failed, resulting in a double distribution profile to the downside as the market returned to value.

As discussed in the Weekly Plan, the immediate focus is on monitoring whether sellers can sustain the downside momentum, which could lead to a test of Monday’s value. The upcoming overnight session is likely to be emotional—stay nimble.

In terms of levels, the Smashlevel is at 6058, marking both Friday’s low and the highlighted 3-day composite value support. Holding above this level would target a value traverse to 6093, with a final target at 6115 under sustained buying pressure, effectively cleaning up Friday’s poor structure. Conversely, failure to hold above 6058 would target 6043, with a final target at 6015 under sustained selling pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 6058.

Holding above 6058 would target 6093 / 6115

Break and hold below 6058 would target 6043 / 6015

Additionally, pay attention to the following VIX levels: 17.38 and 15.48. These levels can provide confirmation of strength or weakness.

Break and hold above 6115 with VIX below 15.48 would confirm strength.

Break and hold below 6015 with VIX above 17.38 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Clearly, we’re seeing an extremely emotional overnight opening, much like last week, with the Weekly Extreme Low at 5955 already tagged. I’m simply observing for now—shorting is unfavorable, and longing is tricky in such an emotional environment.

Much appreciated, brother. Interesting times ahead 🔥🔥🔥🔥