ES Daily Plan | February 27, 2025

Key Levels & Market Context for the Upcoming Session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

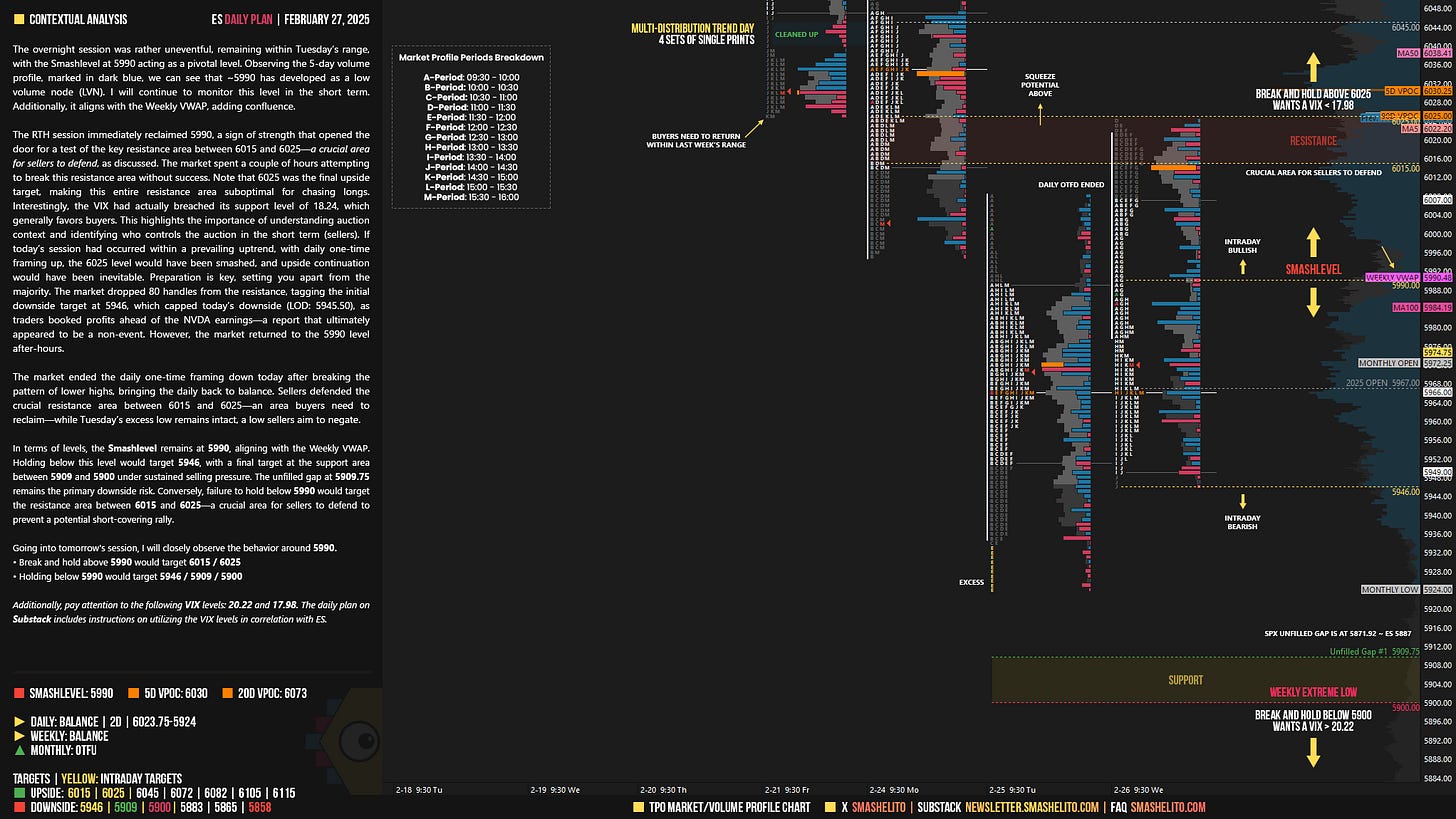

The overnight session was rather uneventful, remaining within Tuesday’s range, with the Smashlevel at 5990 acting as a pivotal level. Observing the 5-day volume profile, marked in dark blue, we can see that ~5990 has developed as a low volume node (LVN). I will continue to monitor this level in the short term. Additionally, it aligns with the Weekly VWAP, adding confluence.

The RTH session immediately reclaimed 5990, a sign of strength that opened the door for a test of the key resistance area between 6015 and 6025—a crucial area for sellers to defend, as discussed. The market spent a couple of hours attempting to break this resistance area without success. Note that 6025 was the final upside target, making this entire resistance area suboptimal for chasing longs. Interestingly, the VIX had actually breached its support level of 18.24, which generally favors buyers. This highlights the importance of understanding auction context and identifying who controls the auction in the short term (sellers). If today’s session had occurred within a prevailing uptrend, with daily one-time framing up, the 6025 level would have been smashed, and upside continuation would have been inevitable. Preparation is key, setting you apart from the majority. The market dropped 80 handles from the resistance, tagging the initial downside target at 5946, which capped today’s downside (LOD: 5945.50), as traders booked profits ahead of the NVDA earnings—a report that ultimately appeared to be a non-event. However, the market returned to the 5990 level after-hours.

The market ended the daily one-time framing down today after breaking the pattern of lower highs, bringing the daily back to balance. Sellers defended the crucial resistance area between 6015 and 6025—an area buyers need to reclaim—while Tuesday’s excess low remains intact, a low sellers aim to negate.

In terms of levels, the Smashlevel remains at 5990, aligning with the Weekly VWAP. Holding below this level would target 5946, with a final target at the support area between 5909 and 5900 under sustained selling pressure. The unfilled gap at 5909.75 remains the primary downside risk. Conversely, failure to hold below 5990 would target the resistance area between 6015 and 6025—a crucial area for sellers to defend to prevent a potential short-covering rally.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5990.

Break and hold above 5990 would target 6015 / 6025

Holding below 5990 would target 5946 / 5909 / 5900

Additionally, pay attention to the following VIX levels: 20.22 and 17.98. These levels can provide confirmation of strength or weakness.

Break and hold above 6025 with VIX below 17.98 would confirm strength.

Break and hold below 5900 with VIX above 20.22 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Thanks Smash!!

Thank you very much for sharing your analysis and reminding to us that "preparation is key". Victory loves preparation